Inflation and stretched valuations shine light on precious metals

With inflation running at its highest level in decades and the global economy getting hotter than anticipated, investors are wondering what to do.

Bonds offer slim returns. As inflation has jolted higher, and central banks keep interest rates low, the real returns on bonds in rich countries have hovered below zero.

Shares seem little better. The valuations of major share market gauges around the world are above their long-term averages. In Australia, the trailing price-to-earnings ratio of the ASX 200 is at all-time highs. While the PE ratio of the S&P 500 in the US is re-approaching the heights of the dotcom era.

Stretched valuations and low yields suggest returns for conventional portfolios will be lower than in previous eras. AQR, the investment group, predicts that a traditional US portfolio made up 60/40 of shares and bonds could return as little as 1.4 per cent after adjusting for inflation in the coming years–significantly below the 5% average since 1900.

This challenging environment has sent investors looking for alternatives, which may offer higher returns and protection from inflation. One alternative that is gaining increasing traction is precious metals. These most famously include gold and silver, but also include lesser-known elements like platinum and palladium. As today’s environment challenges conventional portfolio-building techniques, precious metals are having their moment.

Precious metals outperform when inflation rises

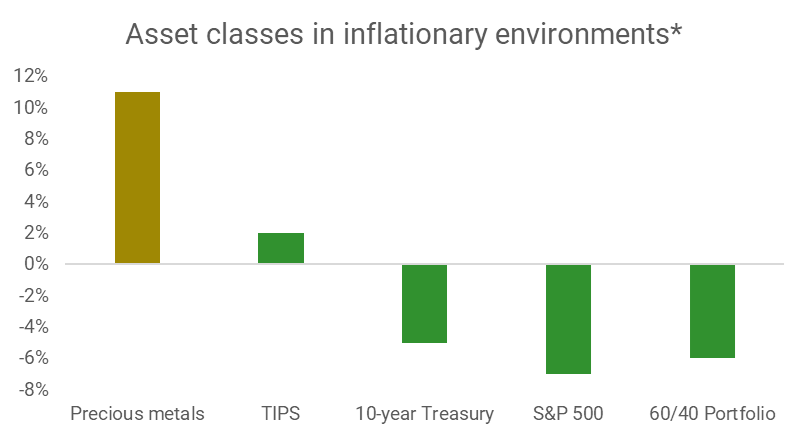

As a general rule, when inflation rises, most assets fare badly. A recent study led by Campbell Harvey, professor of finance at Duke University, found that the returns for most mainstream asset classes were negative when inflation spikes. Shares were especially precarious, with the S&P 500 almost unfailingly dropping when inflation shot up.

But the average returns for precious metals during periods of high inflation were in the double digits, the study found. Most interestingly the report found that gold, the foremost precious metal, did better than inflation-protected bonds (known as “TIPS”) when inflation rises. The reason seemed to be that precious metals can store real value in times of negative real rates. (When bonds and cash are guaranteed to lose real value). As such, the study concluded, precious metals may be appropriate as an inflation hedge.

Beyond their outperformance, rising inflation also challenges the traditional role of bonds in portfolios. And raises the question about whether precious metals can partly be taken in their place. For most investors, the core of a portfolio is made of shares, with bonds providing capital stability and thereby limiting drawdowns. Yet inflation undermines bonds’ ability to do this, as their value mechanically fall with rising inflation.

As precious metals have no internal rate of return their prices are not guaranteed to fall when inflation rises. Their prices are instead set by supply and demand, which vary greatly between metals.

Palladium has more than 80 per cent of its demand come from the car industry, where it is used as a catalyst. Platinum has broad industrial uses including: glass-making equipment, car catalysts and dental equipment. Gold demand comes mostly from investors, such as central banks, who regard it as a safe haven and in jewellery. While silver, the best conductor of electricity, is used mostly in industry, such as in solar panels.

The diversity and unpredictability of demand for precious metals can make them strong diversifiers, even when inflation is not a factor. Our own precious metals basket ETF (ASX Code: ETPMPM) has a correlation (beta) of just 0.18 to the ASX 200.

Conclusion

Precious metals have a lot to offer investors today. From their strong performance when inflation rises to the diversification they offer. ETF Securities provides Australia’s only precious metals basket ETF, the ETFS Physical Precious Metal Basket (ASX Code: ETPMPM). It provides physically backed access to a basket of gold, silver, platinum and palladium. All metal is held with an independent bank.

Disclaimer

ETFS Metal Securities Australia Limited (MSAL) is a Corporate Authorised Representative (CAR No: 001274650) under the ETFS Management (Aus) Limited AFSL. (AFSL No: 466778).

ETFS Metal Securities Australia Ltd is a member of the ETFS Capital Group and is the issuer of the Prospectus for the ETFS Physical PM Basket (ETPMPM). Before considering an investment in these products, investors should obtain a copy of the Prospectus from ETFS Management (Aus) Limited. Investments in any product issued by the ETFS Capital Group are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Neither ETFS, ETFS Capital Limited, ETFS Metal Securities Australia Ltd nor any other member of the ETFS Capital Group nor any of their respective directors, employees or agents guarantees the performance of any products issued by the ETFS Capital Group or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. Past performance is not a reliable indicator of future performance.