Here’s how private equity is conquering the ASX

Private equity is eating the ASX alive. Nearly every other month there is another billionaire dollar private equity approach of an ASX company. The latest is the $20 billion deal for Ramsay Health Care (ASX: RHC). Uniti Group, Vocus and Sydney Airport are recent other examples that the tyre kickers have poached from the ASX boards. It could be even said private equity is toying with its public counterparts. After six weeks of due diligence, CVC walked away from Brambles Limited (ASX: BXB) citing “market volatility”. While EML Payments (ASX: EML) offered Bain Capital a period of exclusivity without even getting an offer.

While shareholders get a quick sugar hit from the takeover speculation or bid, in the long run, losing these and other businesses will be to the detriment of public market investors.

One of the oldest plays in the private equity handbook is the balance sheet cleanout. Public markets are great at valuing profits in the P&L, but often fail to properly value assets such as buildings and land on the balance sheet. It’s not helped that management usually does a poor job of highlighting the value and accounting rules add complexity. Subsequently, a private equity player will look to monetise the latent assets while keeping the operating business largely unchanged.

KKR’s offer for Ramsay Healthcare will likely adopt this strategy. Ramsay’s hospital assets are stated at a lower book value of $2.5 billion. But according to analysts at Macquarie, the healthcare assets alone are worth $8.7 billion. Without doing anything to the core business, KKR could sell the assets, lease them back on long-dated agreements, and realise $6.2 billion of value overnight.

Another often underappreciated asset is equity interests. For example News Corporation (ASX: NWS) owns 61% of REA Group Limited. If News Corp were to distribute this shareholding, it would value the remainder of the business on an EBITDA multiple of just 5. Other companies in similar situations include Premier Investments Limited (ASX: PMV) and Link Administration (ASX: LNK).

The problem with equity interests is that it’s more difficult to convince management or the board to divest. Shrinking to greatness is not popular, given it will lower profits and therefore reduce executive remuneration. And in most cases, the equity interest is actually a better business than the parent company. But it’s clear boards need to do a better job of monetising latent assets or at least demonstrate more clearly the underlying value.

The next big issue plaguing public markets is its short term focus. Sydney Airport was arguably the best monopoly asset on the ASX with decades of stable recurring cash flows ahead of it. Yet the share price dropped over 35% during the pandemic as travel grounded to a halt. As a result, a group of long-term oriented pension funds came with an offer that a 50% premium to the prevailing price and snapped arguably the best infrastructure asset in Australia. On the surface level, the deal looked great, but in hindsight, the business was bought for just a slight premium to its pre-pandemic enterprise value.

This short term focus is not limited to established companies. The share price of Judo Capital (ASX: JDO), Temple & Webster (ASX: TPW) and Xero Limited (ASX: XRO) all sunk after recently announcing or reiterating long-term strategies to capture market share at the expense of near term profits. All three have a proven history of execution, high-quality management teams and large addressable markets. Yet the market has since sold off shares, further reinforcing the opinion that public markets fail to take a long-term view.

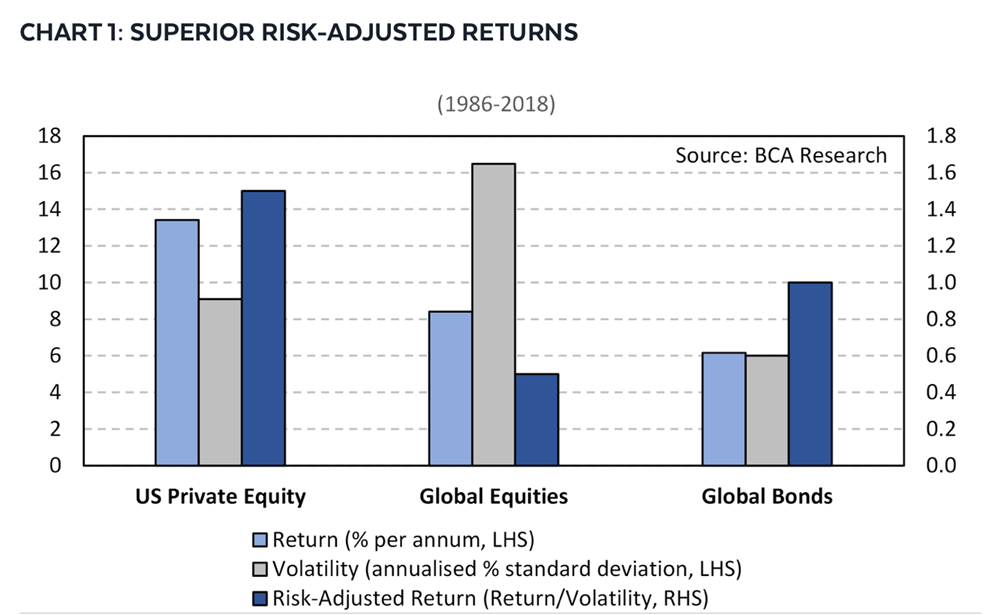

In contrast, private equity takes at least a 3-5 year investment horizon. It’s no surprise then that the asset class has outperformed public equities on both returns and volatility. As a result, the country’s largest superfund Australian Super expects to double its investment in private equity from $13 billion to $26 billion, ballooning the portfolio out to $50 billion within five years. It cited the long-term nature of private equity as a key reason why it upped its allocation.

It’s not all bad for ASX investors. The same pricing inefficiencies private equity is capitalising on can be identified by those willing to get into the weeds. Voting for directors with a capital management focus, a willingness to back credible management teams with long-term visions and pushing for better takeover premiums can also contribute to swinging the pendulum back in favour of public market investors.

If the ASX is to retain the best companies with the best investment return potential, it needs to be smarter about the way it values businesses. Otherwise, private equity is going to keep picking off the cream of the crop.

Information warning: The information in this article was published by The Rask Group Pty Ltd (ABN: 36 622 810 995) is limited to factual information or (at most) general financial advice only. That means, the information and advice does not take into account your objectives, financial situation or needs. It is not specific to you, your needs, goals or objectives. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product. Please read our Terms and Conditions and Financial Services Guide before using this website. The Rask Group Pty Ltd is a Corporate Authorised Representative (#1280930) of AFSL #383169