Global asset portfolios to deliver 5% a year: BCA

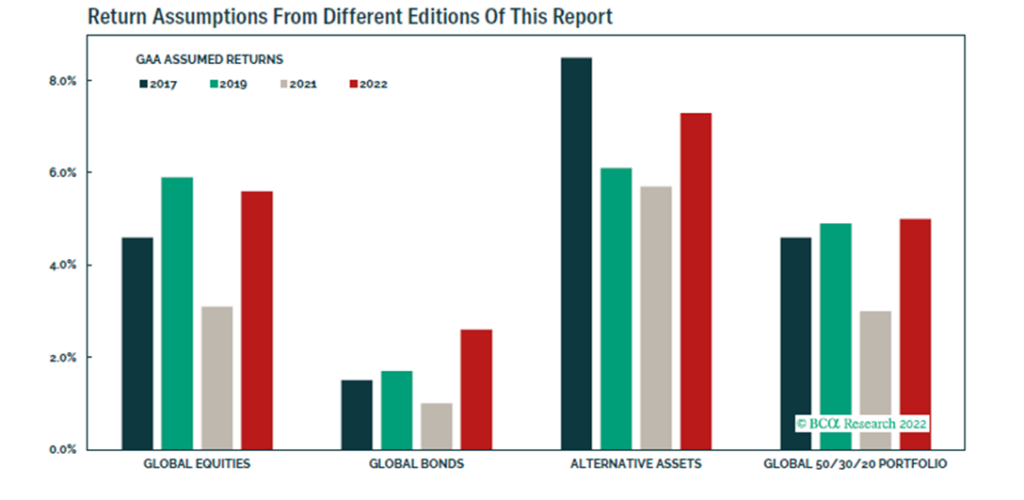

New research from BCA Consulting predicts Australian equities will outperform global equities over the next 10 to 15 years. The research house expects a global portfolio of 50 per cent equities, 30 per cent bonds, and 20 per cent alternatives to return 5.0 per cent a year in nominal terms over the next decade, lifting its forecast from 3.0 per cent in 2021.

While BCA has raised its forecasts for expected returns from a global portfolio, those returns will still sit lower than the gains of the past two decades of 6.6 per cent annualised gains. “The rise in risk-free rates (the building block of our assumptions) makes likely returns over the next decade slightly higher than we projected last year, but they are still below historical levels,” BCA said in a research note.

According to BCA, a US portfolio with the same composition is likely to return 5.3 per cent, compared to 7.3 per cent historically. Australian equities are expected to lead share market returns, in line with other analysts who see a boom to the local share market from its heavy weighting to commodities, with a nominal annual return of 7.4 per cent. Global equities are expected to return 5.6 per cent a year.

“These expected returns will continue to put pressure on funds to dial up risk appetite, or to revise their return assumptions lower,” said BCA.

“We reiterate our view that valuations are not a good timing tool for investors, but they are a very powerful indi¬cator of long-term returns, both for equities and fixed income.”

According to BCA’s prediction, gains from Australian shares are expected to even outstrip expected gains on emerging markets of 6.6 per cent over the next 10 to 15 years. Equities are expected to deliver a nominal annualised return of 5.2 per cent in the US, 7.0 per cent in the UK and just 5.1 per cent in the Euro area. Other forecasts for Australia include an expected 12-month forward price-earnings (P/E) ratio of an average of 14.5, up from a current level around 13.7.

Separate forecasts from global asset manager Research Affiliates also predicts relatively high real returns from Australian stocks over the next 10 years. The Australian share market is forecast to return 6.1 per cent in real (after inflation) annualised terms, compared to just 0.2 per cent for large cap US stocks and 3.3 per cent for US small cap stocks per annum. UK stocks are forecast to generate an anticipated real return of 5.2 per cent.

Shift to alternatives

According to BCA, alternative assets are expected to lead other asset class returns, as the graph above shows. They will likely benefit from increased flows as pension funds and other asset managers look for better returns outside public share markets. According to BCA, an equally weighted basket of 12 alternative asset classes is projected to return 7.3 per cent a year (up from 5.7 per cent in 2021). Returns are particularly high for private equity and direct real estate: 9.3 per cent and 10.5 per cent respectively.

According to BCA, Australian superannuation funds typically aim for returns of inflation or Libor plus 3 per cent or 4 per cent.

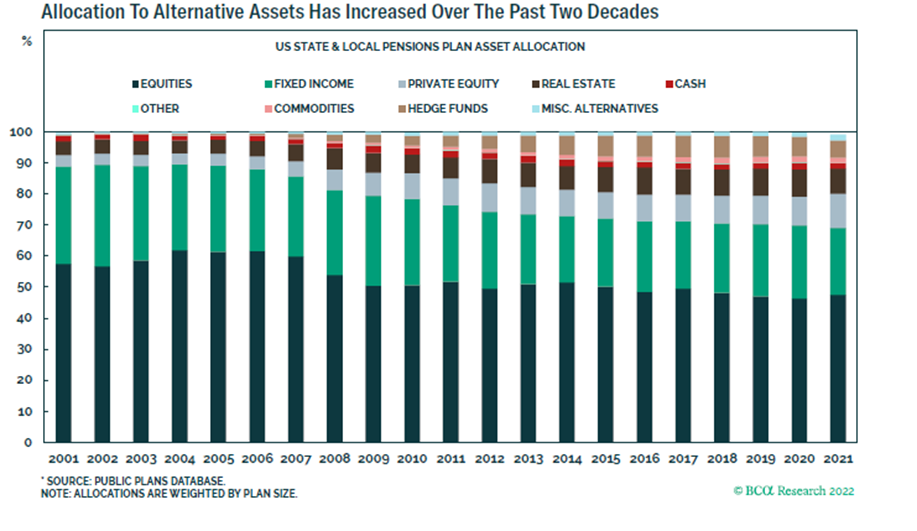

“Since these returns look hard to achieve, investors are likely to face further pressure to increase their weightings in riskier, less liquid, alternative assets – or to lower their return assumptions,” the research house said. “This has been observable in the data for public US pension funds which have increased their weights in alternative assets by almost 20 percentage points between 2001 and 2021 at the expense of public-market securities.”

Risk of stagflation

According to Research Affiliates, all of these estimates may be optimistic if stagflation eventuates. If the US Federal Reserve fails to tame inflation, Research Affiliates and recession results, predicts capital markets could behave as in the late 1970s and early 1980s.

“Interest rates will soar toward or above the the-then current rate of inflation. Equity prices will tank and P/E multiples will contract. In the last period of stagflation, Shiller’s cyclically adjusted price-to-earnings (CAPE) fell to below 10 in 1977, bottomed at 7 in 1982, and failed to rise back above 10 until 1985. With today’s CAPE well above 30, a fall even just to 10 implies a frightful decline in stock prices,” writers Chris Brightman, chief executive and chief investment officer, in this paper, Rising Risk of Stagflation.