Four straight winning days, consumer, property sectors outperform, Ramsay deal cut

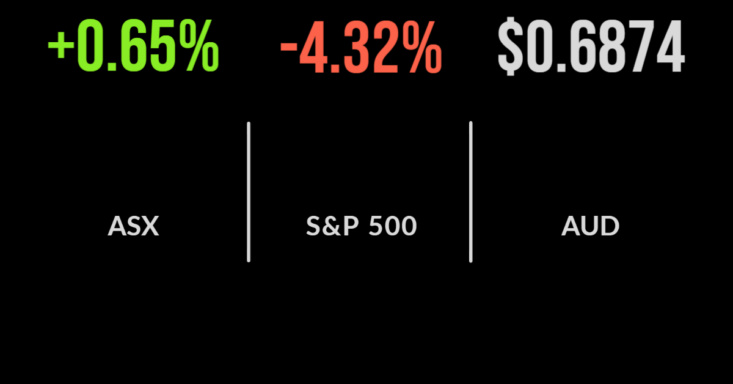

The local market managed a fourth straight day of gains, adding 0.6 per cent behind a strong performance from the property and consumer facing sectors.

Property finished 1.7 per cent higher ahead of what is expected to be a weaker US inflation reading while Star Entertainment (ASX:SGR) also gained 4.5 per cent.

The latter occurred despite the company being accused of ‘institutional arrogance’ and being found unfit to hold a casino license by the Bell inquiry in NSW.

The company is likely to face similar pressure to Crown in terms of greater regulation and oversight.

The lithium sector remained resilient with Pilbara (ASX:PLS) adding 3.7 per cent as the price of the commodity continues to surge.

Shares in Ramsay Healthcare (ASX:RHC) fell by more than 10 per cent after the company pulled out of merger negotiations with private equity suitor KKR.

The KKR-backed consortium indicated an unwillingness to increase their bid for the company from $88, which sent arbitrage seeking investors away from the stock despite improving operating performance.

Atlas to buy Chicago Skyway, Loy Yang shutdown again, Link tanks

Toll road owner Atlas Arteria (ASX:ALX) has gone against the strong advice of major shareholder IFM Investors, proceeding with a US$2 billion bid for the Chicago Skyway toll road.

The group entered a trading halt as they sought to raise fresh equity capital to fund the deal which will still require regulatory approvals.

Shares in Woolworths (ASX:WOW) finished slightly higher after the NSW Supreme Court approved their purchase of MyDeal.com.au in a continued expansion into e-commerce and logistics.

Energy player AGL Energy (ASX:AGL) gained 1.5 per cent, benefitting from a higher oil price, which overcame news that the Loy Yang A coal station will remain out of service for at least another month.

The biggest laggard, however, was Link Admin (ASX:LNK) which dropped by 20 per cent after the UK Regulator lodged a significant caveat on the deal.

They will force the acquirer, Dye & Durham, to hold an additional $518 million in capital to cover potential fines relating to their ill-fated UK custody business.

Inflation catches markets by surprise, tech sector sinks, worst day in two years

In what some described as a ‘nasty’ inflation print the US CPI unexpectedly increased 0.1 per cent, yes 0.1 per cent, in August.

Even though the year on year rate slowed to 8.3 from 8.5 per cent it was enough to send sharemarkets into a short-term tailspin.

The Dow Jones sank 4 per cent, the S&P500 4.3 and the Nasdaq was the hardest hit down 5.2 per cent on the news.

Every sector of the market finished lower with technology the biggest detractor as the 2-year bond yield jumped 0.18 per cent to 3.75 per cent.

Every major technology company fell by more than 4 per cent including Apple (NYSE:AAPLP), Amazon (NYSE:AMZN) and Alphabet (NYSE:GOOGL) which suggests it was likely technically driven given the limited impact on their business of a single inflation result.

Peloton (NYSE:PLTN) fell more than 10 per cent after both co-founders resigned from the company while the USD continues to push higher as investors flock for the safe haven.