Energy woes power local market

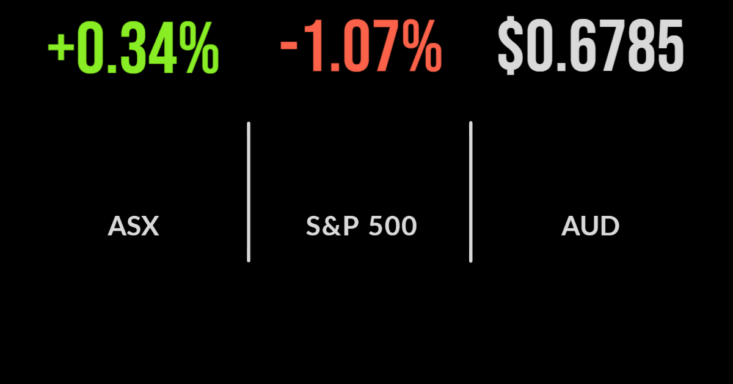

Energy powered the Australian market higher on Monday, with a 4 per cent rise in the S&P/ASX 200 Energy index at the heart of market sentiment, as oil, gas and coal prices rose. The energy action helped the benchmark S&P/ASX 200 advance 23.5 points, or 0.3 per cent, or to 6852.2, while the broader All Ordinaries index gained 8.2 points, or 0.3 per cent, to 7,074.5.

Among the energy stocks, Whitehaven Coal jumped 52 cents, or 6.5 per cent, to a fresh record close of $8.49; the stock has more than tripled in 2022. Most of the coal names followed suit, with Coronado Global Resources up 12 cents, or 7.5 per cent; to $1.73; Yancoal Australia surging 43 cents, or 7.3 per cent, to $6.31; New Hope adding 29 cents, or 5.7 per cent, to $5.39, TerraCom up 6 cents, or 6.5 per cent, to 99 cents; and Bowen Coking Coal firming 2 cents, or 5.1 per cent, to 41 cents.

Elsewhere, Woodside Energy advanced $1.43, or 4.3 per cent, to $35.08, while Beach Energy gained 8.5 cents, or 5.2 per cent, to $1.72, and Santos was up 24 cents, or 3.1 per cent, to $7.97.

The energy stocks are reacting to energy shortages around the world, particularly in Europe after Russia indefinitely shut down gas flows to Germany via the Nord Stream 1 pipeline. The uranium producers and hopefuls are also benefiting: Paladin Energy, which is restarting its Langer Heinrich Mine in Namibia was up 5 cents, or 6.4 per cent, to 84 cents; Boss Energy, which is poised to become Australia’s next uranium producer, at its Honeymoon project in South Australia, rose 8 cents, or 3.2 per cent, to $2.60; and Bannerman Energy, which is developing its Etango uranium project in Namibia, gained 7 cents, or 3.3 per cent, to $2.17.

Among the major miners, BHP added $1.17, or 3.2 per cent, to $37.91, Rio Tinto added $1.58, or 1.8 per cent, to $91.77, but Fortescue Metas slid 42 cents, or 2.6 per cent, to $16.41 as it traded ex-dividend, for the final dividend of $1.21 a share.

Rare earths miner Lynas was up 20 cents, or 2.4 per cent, to $8.50 after securing an investment deal with some of its key Japanese customers, who will take shares worth $US9 million ($13.3 million) to help fund further exploration at the company’s Mount Weld mine in Western Australia. Also, Lynas will no longer be restricted in paying dividends or share buybacks.

The big banks traded weaker ahead of the Reserve Bank’s meeting this afternoon, where it is widely expected to raise rates by another 50 basis points to 2.35 per cent. NAB fell by 20 cents, or 0.7 per cent, to $30.34; Westpac was down 5 cents, or 0.2 per cent, to $21.35; ANZ lost 12 cents, or 0.5 per cent, to $22.63;and CBA was also down by 0.5 per cent, easing 44 cents to $96.51. Investment bank Macquarie, however, advanced by $2.15, or 1.2 per cent, to $179.35.

The index giveth, the index taketh away

News that companies are being removed from indices is never welcome, and on Monday it was the turn of a group of stocks to feel the pain of exclusion, after it was announced that they will be removed from the S&P/ASX 200 index in a fortnight following S&P Dow Jones’ quarterly rebalance of the index. After exclusion, ETFs and other funds based on the index will no longer need to own these stocks. The pain was concentrated in bookmaker Pointsbet, which fell 15 cents, or 6.4 per cent, to $2.18, while buy-now-pay-later player Zip lost 3.5 cents, or 4 per cent, to 83 cents; and family safety app developer Life360 was down 25 cents, or 4.9 per cent, to $4.88.

But the stocks graduating into the S&P/ASX 200 index saw increased demand, led by fast-fashion jewellery retailer Lovisa, which was 88 cents, or 4 per cent, to $22.96; and Karoon Energy, which gained 6 cents, or 2.9 per cent, to $2.12.

US holidays while Europe frets

US markets were closed overnight for the Labor Day long weekend, so attention turned to Europe, where stocks slid and the euro fell, as the region’s worsening energy crisis added to the risks for a global economy already facing high inflation and monetary tightening.

The Stoxx Europe 50 Index dropped 1.5 per cent and the broader Stoxx Europe 600 fell 1.2 per cent, after Russia’s Gazprom decided not to restart gas flows to Europe via the Nord Stream 1 pipeline.

First, an oil leak was apparently discovered on Friday; now, Russia says certain sanctions — which it says affect the repairs — also must end before flows can resume. Heading into winter, markets do not like this energy uncertainty at all; Germany and other European nations are set for energy rationing. The euro slipped to a new 20-year low against the dollar in response to the shutdown.

Brent oil is up US$2.72, or 2.9 per cent, to US$95.74 a barrel, while West Texas Intermediate (WTI) is up US$2.23, or 2.6 per cent, to US$89.10 a barrel. Gold is trading US$3.53, or 0.2 per cent, higher at US$1,711.70 an ounce, and the Australian dollar is buying 68.08 US cents.