Economic data sparks Australian market

The Australian sharemarket had its biggest one-day rally in more than a year on Wednesday as traders raised their bets on the Reserve Bank cutting interest rates.

Weaker-than-expected GDP for third quarter boosted speculation the central bank could start lowering rates again in 2024. Australia’s economy grew just 0.2 per cent in the September quarter, failing to match forecasts of 0.4 per cent, and taking the annual pace to 2.1 per cent. That was barely changed from the previous quarter, but stronger than the 1.8 per cent expected.

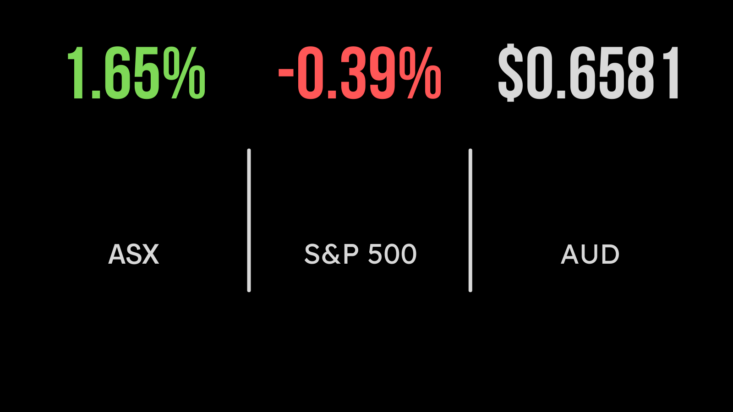

The benchmark S&P/ASX 200 index jumped 116.8 points, or 1.7 per cent, to 7178.4, with all the sectors in the green. The broader All Ordinaries added 116.9 points, or 1.6 per cent, to 7,386.

Interest-rate-sensitive real estate and bank stocks were among the best performers. The real estate sector added 3.1 per cent, led by Mirvac, which increased 9 cents, or 4.5 per cent, to $2.10; Dexus, which was up 21 cents, or 3 per cent, to $7.23; and Goodman Group, which gained 41 cents, or 1.8 per cent, to $23.48. The big banks all gained, with National Australia Bank up 55 cents, or 1.9 per cent, to $29.32; ANZ strengthening 31 cents, or 1.3 per cent, to $24.70; Westpac putting on 37 cents, or 1.7 per cent, to $21.79; and Commonwealth Bank lifting $1.63, or 1.6 per cent, to $106.34.

Pub and bottle shop owner Endeavour Group rose 12 cents, or 2.4 per cent, to $5.20 after saying it would grow hotel sales by more than $150 million over the next five years.

Financial services group Perpetual jumped $1.40, or 6.3 per cent, to $23.76 after the announcing a strategic review into separating its corporate trust and wealth management businesses to create a more focused asset management business. Later, after the market closed, listed investment conglomerate Washington H. Soul Pattinson tabled a $3 billion offer to acquire Perpetual and break the business up.

Also in financial services, Magellan Financial spiked 27 cents, or 3.6 per cent, to $7.83, after reporting that its total funds under management grew 2.6 per cent, to $35.2 billion, in November.

Biotech heavyweight CSL gained $4.35, or 1.7 per cent, to $267.47, and Telstra was up 7 cents, or 1.9 per cent, to $3.85

Meanwhile, one of Australia’s largest retailers, Chemist Warehouse is headed for the ASX, through a reverse listing in which it will take control of Sigma Healthcare, accompanied by a $350 million capital raising. Sigma CEO Vikesh Ramsunder will be head of the merged entity. Sigma went into a trading halt on Wednesday.

Resources mostly higher

The materials sector moved 1.2 per cent higher, on the back of a higher iron ore price. BHP rallied 71 cents, or 1.5 per cent, to $47.23; Rio Tinto rose 85 cents, or 0.7 per cent, to $126.45, despite raising the cost estimate of its Simandou iron ore project in Guinea to $US6.2 billion ($9.5 billion); and Fortescue added 1 cent, to $25.08.

Goldminer Evolution plunged 54 cents, or 13 per cent, to $3.60 as it completed a $525 million share placement to fund its acquisition of an 80 per cent stake in the Northparkes gold and copper mine in NSW.

A resurgent aluminium and alumina producer Alumina gained 5 cents, or 6.9 per cent, to 78 cents. Mine developer Chalice Mining jumped 16 cents, or 10.8 per cent, to $1.645; copper miner Sandfire Resources gained 21 cents, or 3.4 per cent, to $6.38; rare earths producer Lynas Rare Earths was up 19 cents, or 3.1 per cent, to $6.43; mineral sands producer Iluka added 15 cents, or 2.2 per cent, to $6.87; and diversified miner South32 lifted 6 cents, or 2 per cent, to $3.12.

Lithium producer Pilbara Minerals rose 18 cents, or 5.6 per cent, to $3.41; fellow producer Allkem surged 25 cents, or 3 per cent, to $8.55; IGO, which mines nickel as well as lithium, appreciated 33 cents, or 4.4 per cent, to $7.82; and Mineral Resources, which produces iron ore and lithium, gained $2.40, or 4.2 per cent, to $59.72. Lithium project developer Liontown Resources also recovered from Tuesday’s hammering, putting on 7.5 cents, or 6.1 per cent, to $1.31, while fellow developer Core Lithium surged 4 cents, or 17.4 per cent, to 27 cents, despite no news for the market.

In coal, Coronado Global Resources added 4 cents, or 2.3 per cent, to $1.78; Whitehaven Coal advanced 2 cents, to $7.09; but New Hope Corporation eased 4 cents, or 0.8 per cent, to $4.99.

Woodside Energy bounced back after sinking to its lowest level since May 2022 on Tuesday.

Australia’s largest oil and gas producer firmed 31 cents, or 1.1 per cent, to $29.84 after signing a 20-year agreement to sell 1.3 million tonnes of LNG a year to energy company Mexico Pacific.

Wall Street backs the Fed

Overnight in the US, the Dow Jones Industrial Average and the S&P 500 both retreated for a third straight day, as investors assessed data indicating falling inflation, which may show that the Federal Reserve’s anti-inflation treatment is working.

The 30-stock Dow Jones lost 70.13 points, or 0.2 per cent, to 36,054.43, while the broader S&P 500 eased 17.84 points, or 0.4 per cent, to 4,549.34. The tech-heavy Nasdaq Composite index also lost ground, down 83.2 points, or 0.6 per cent, to 14,146.71.

European stocks closed mostly higher, as Germany’s DAX index extended its record high.

In the bond market, the US 10-year yield lost 5.5 basis points, to 4.12 per cent, while the 2-year yield rose 4.5 basis points, to 4.603 per cent.

Gold is up US$8.16, or 0.4 per cent, to US$2,026.67 an ounce. Oil prices fell sharply, with the global benchmark Brent crude oil grade sinking US$2.92, or 3.8 per cent, to US$74.28 a barrel, and US West Texas Intermediate oil down US$3.02 lower, or 4.2 per cent, to US$69.30 a barrel.

The Australian dollar is buying 65.5 US cents this morning, down from 65.81 US cents at the ASX close on Wednesday.