Cup Day rate rise as Governor Bullock debuts

The Australian dollar and bond yields slid after the Reserve Bank of Australia lifted the cash rate by 0.25 per cent on Melbourne Cup Day, to 4.35 per cent. It was the first change to the official rate in five months – and the first under new governor Michele Bullock – coming after a run of stronger-than-expected inflation and retail sales reports appeared to force the RBA’s hand. But the central bank sounded more cautious about further tightening in its statement.

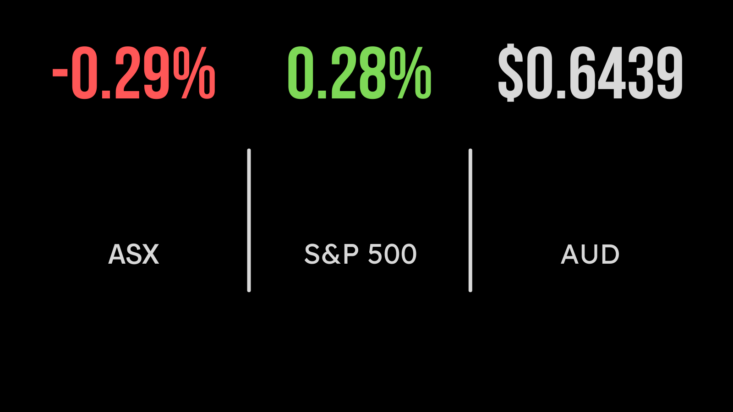

Somewhat counter-intuitively, the A$ fell against the US$ after the decision, down about one-quarter of a cent to US64.62 cents, along with the Australian sharemarket. The benchmark S&P/ASX 200 index fell 20.3 points, or 0.3 per cent, to 6977.1, at the closing bell, weighed down by financials and energy stocks. The All Ordinaries fell 0.2 per cent to 7176.6.

The financials sector was the worst performer on the ASX, with the sector index dropping 1 per cent. Westpac slid 59 cents, or 2.7 per cent, to $21.33, after reporting a 26 per cent rise in full-year cash profit on Monday. ANZ fell 27 cents, or 1.1 per cent, to $25.47; National Australia Bank lost 30 cents, or 1 per cent, to $29.04; and Commonwealth Bank eased 41 cents, or 0.4 per cent, to $100.01.

Origin Energy gained 10 cents, or 1.2 per cent, to $8.64 after proxy adviser Institutional Shareholder Services recommended that investors vote in favour of the Brookfield-led consortium’s $US10.5 billion ($20 billion) bid for the electricity generator.

Biotech Imugene surged 1.4 cents, or 26.9 per cent, to 6.6 cents following positive early resus from a clinical trial of its novel cancer-killing virus Vaxinia.

Big miners defy resources weakness

Among the bulk miners, BHP advanced 12 cents, or 0.3 per cent, to $45.56; Rio Tinto also gained 0.3 per cent, in its case 31 cents, to $121.81; and Fortescue Metals added 12 cents, or 0.6 per cent, to $23.36.

In energy, Woodside Energy slipped 21 cents, or 0.6 per cent, to $33.54, Santos lost 6 cents, or 0.8 per cent, to $7.33 and Brazilian-based producer Karoon Energy retreated 4 cents, or 1.6 per cent, to $2.40.

In coal, Whitehaven Coal slid 21 cents, or 3 per cent, to $6.80; New Hope Corporation lost 9 cents, or 1.7 per cent, to $5.24; Stanmore Resources was down 6 cents, or 1.6 per cent, to $3.73; and Yancoal Australia eased 6 cents, or 1.3 per cent, to $4.57.

Lithium producer Allkem gave up 42 cents, or 4.4 per cent, to $9.23; while fellow producer Pilbara Minerals weakened 14 cents, or 3.7 per cent, to $3.66. IGO, which mines nickel as well as lithium, was down 6 cents, or 0.6 per cent, to $9.59; and Mineral Resources, which produces iron ore and lithium, lost 60 cents, or 1 per cent, to $60.06.

Among the lithium project developers, Liontown Resources shed 6.5 cents, or 3.9 per cent, to $1.58; and US-based Piedmont Lithium lost 1.5 cents, or 3.4 per cent, to 43 cents; but Lake Resources jumped 1.5 cents, or 9.1 per cent, to 18 cents, despite no news.

Minerals explorer Chalice Mining sank 10.5 cents, or 5.5 per cent, to $1.805 after an update on its flagship Gonneville Project seemed to remind investors that production is still a long way off. The company said it had commenced the pre-feasibility study (PFS) for the project, and expects to complete the study in mid-2025.

Streaks continue for S&P 500, Nasdaq

Overnight on Wall Street, the broad S&P 500 index and the tech-heavy Nasdaq Composite Index both rose, marking their longest winning streaks in nearly two years. The S&P 500 added 12.4 points, or 0.3 per cent, to close at 4,378.38, while the Nasdaq Composite lifted 121.08 points, or 0.9 per cent, to end at 13,639.86. The blue-chip Dow Jones Industrial Average advanced 56.74 points, or 0.2 per cent, to 34,152.60.

The S&P 500 rose for a seventh consecutive day for the first time since its eight-day win streak reached in November 2021, while the Nasdaq posted eight days of wins for the first time since an 11-day streak ended in November 2021. The Dow rose for a seventh straight day, for its longest streak since July.

On the bond market, the US 10-year yield eased 8.3 basis points to 4.567 per cent, while the 2-year yield eked out a gain of 0.4 of a basis point, to 4.928 per cent.

Gold is down US$15.30, or 0.8 per cent, to US$1,982.40 an ounce, while the global benchmark Brent crude oil grade plunged US$3.73, or 4.4 per cent, to US$81.45 a barrel, and US West Texas Intermediate oil retreated US$3.68, or 4.6 per cent, to US$77.14 a barrel.

The Australian dollar is buying 63.72 US cents this morning, down from 64.33 US cents at Tuesday’s ASX close.