Consumer, business confidence sink as inflation bites

Tuesday provided a dour outlook for the Australian economy as inflation continues to dent consumer and business confidence.

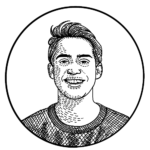

The Westpac Melbourne Institute Index of Consumer Sentiment continued its march lower, falling 3 per cent in June. The index has fallen every month in 2022 and is down 19 per cent since December.

Households are clearly feeling the impacts. Sentiment regarding family finances over the next twelve months is down 23 per cent, while confidence in the economic outlook has fallen 26 per cent.

Current sentiment levels have only occurred during periods of major economic upheaval. The most recent are the initial onset pandemic in 2020 and the Global Financial Crisis in 2008.

Households are also paying greater attention to movements in the economy. 60 per cent of consumers recall news of inflation compared to the long-run average of just 12 per cent.

Concern over interest rates is also accelerating. Reacting to the breathtaking speed of recent RBA rate rises, 72 per cent of respondents believe the cash rate will increase by more than 100 basis points in the next twelve months. Just one month ago the answer was 58 per cent. Subsequently, house price expectations have tumbled 33 per cent year on year.

Lacklustre consumer sentiment a gift for RBA

The RBA will likely be pleased with this outcome. In the past three months, the central bank has ramped-up its rhetoric around not letting inflation run away, explicitly stating it will do what is required to bring it under control.

The more the RBA can tame household demand via words rather than actions, the less pain the economy will need to incur.

Business falls below trend

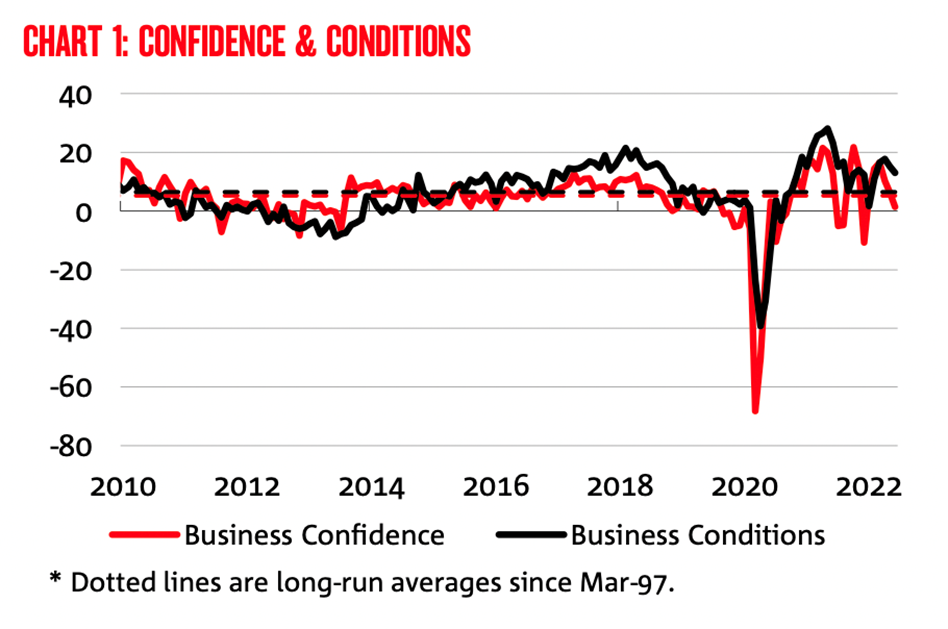

While confidence remains relatively higher, echoed much of what consumers had to say. Sentiment fell below its long-term trend with corporates noting record increases in the cost of goods and labour.

Business conditions retraced, however, remain above well above average. Trading, profitability and employment all fell on the prior month’s results.

Supply-side constraints continue to plague activity, with labour increasing 3.6 per cent and purchasing costs rising 4.8 per cent on the prior quarter. Households remain particularly upbeat around employment, which will maintain upward pressure on wages until immigration returns.

Positively, commodity prices have begun to fall and global supply chain constraints are easing. However, it will take some time for this flow to businesses.

Conditions across all sectors fell except for Finance. Retail confidence took a hammering, largely due to a drop-off in household spending intentions. When consumers were asked if it was time to buy a major household item, confidence fell 26 per cent year over year.

While households are reluctant to buy big-ticket items, conditions in Recreation and Personal Services have rebounded strongly. Consumers are eating out and travelling more as Australia emerges from two years of intermittent lockdowns.