Coin-toss on rates boosts local market

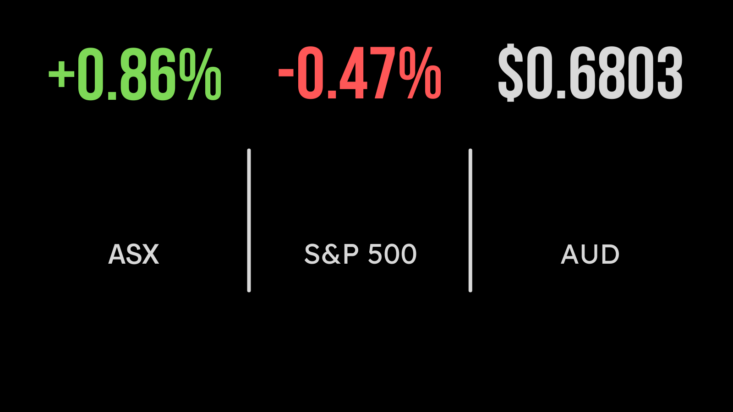

The Australian sharemarket sailed to a two-month high on Tuesday, after the minutes from the Reserve Bank of Australia’s June meeting showed that the bank’s policymakers were less hawkish than the market had expected.

Only healthcare of the 11 sectoral sub-indices went backwards, and that by only 0.02 per cent. The gains ranged as high as a 1.9 per cent rise for energy, on the back of higher natural gas prices.

The RBA minutes revealed that the central bank’s board almost didn’t lift interest rates earlier this month, with the arguments for and against a hike being “finely balanced.”

The major indices pushed higher, with the S&P/ASX 200 index up 62.9 points, or 0.9 per cent, to 7,357.8, and the broader All Ordinaries index gaining 59.3 points, or 0.8 per cent, to 7,548.5.

The energy sector was led by the heavyweights, with Woodside Energy rising 79 cents, or 2.2 per cent, to $36.31; and Santos finishing 17 cents higher, also up 2.2 per cent, to $7.74. Minnow White Energy surged 2 cents, or 20 per cent, to 12 cents, while Cooper Energy spiked 1 cent, or 7.1 per cent, to 15 cents.

In bulk mining, BHP gained 62 cents, or 1.4 per cent, to $46.72; Rio Tinto advanced 77 cents, or 0.7 per cent, to $117.40; and Fortescue Metals added 7 cents, or 0.3 per cent, to $22.40.

Gold minnow stars as production nears

Gold junior Brightstar Resources surged 0.3 cents, or 30 per cent, to 1.3 cents, after reporting that it was only a matter of weeks away from becoming Australia’s newest gold producer, as it works (in conjunction with unlisted partner BML Ventures) to restart the Menzies mine in Western Australia, which last operated in 1995.

Elsewhere in gold, Bellevue Gold was up 1.5 cents, or 1.2 per cent, to $1.27; but Northern Star gave up 7 cents, or 0.5 per cent, to $13.34; St Barbara eased one cent, or 1.9 per cent, to 52.5 cents; and Regis Resources lost 2.5 cents, or 1.3 per cent, to $1.945.

On planet coal, Whitehaven Coal rose 4 cents, or 0.6 per cent, to $6.78; and Coronado Global Resources advanced 4 cents, or 2.7 per cent, to $1.545; but New Hope Corporation eased one cent to $5.39; Stanmore Resources slipped 3 cents to $2.63; and Yancoal Australia lost 4 cents, or 0.9 per cent, to $4.54.

Lithium producer Allkem strengthened 24 cents, or 1.5 per cent, to $16.11, and fellow producer Pilbara Minerals accrued 12 cents, or 2.5 per cent, to $4.94; IGO, which mines nickel and lithium, added 33 cents, or 2.2 per cent, to $15.23; and Mineral Resources, which produces iron ore as well as lithium, put on 67 cents, or 0.9 per cent, to $74.06. Among the project developers, Lake Resources continued its slide, down a further 7.5 cents, or 19.7 per cent, to 30.5 cents; after losing 20 per cent yesterday on the back of a shock delay and cost blow-out at its Argentina Lithium project. Lake Resources has now lost 36 per cent in just two trading days.

Meanwhile, Core Lithium slid 1.5 cents, or 1.5 per cent, to 99 cents; but US-based developer Piedmont Lithium lifted 1.5 cents, or 1.7 per cent, to 91 cents.

Copper miner Sandfire Resources gained 9 cents, or 1.4 per cent, to $6.32, and rare earths producer Lynas lifted 7 cents, or 1 per cent, to $7.31.

The big banks all advanced. Commonwealth Bank gained $1.11, or 1.1 per cent, to $101.62; Westpac firmed 28 cents, or 1.3 per cent, to $21.43; ANZ was up 18 cents, or 0.8 per cent, to $23.80; and National Australia Bank added 44 cents, or 1.7 per cent, to $26.50. Macquarie Group advanced $1.17, or 0.6 per cent, to $185.20.

There was some eye-catching action in media, where Southern Cross Media spiked 15.5 cents, or 20.4 per cent, to 91.5 cents after KIIS FM owner ARN Media announced it had bought a 14.8 per cent stake in its radio rival.

In the US, it was a tepid return from the Juneteenth long weekend, as the surge that has pushed the market to levels not seen in more than a year took a breather.

Long weekend fails to energise US market

The 30-stock Dow Jones Industrial Average slid 245.25 points, or 0.7 per cent, to 34,053.87, while the broader S&P 500 index retreated 20.88 points, or 0.5 per cent, to 4,388.71, and the tech-heavy Nasdaq Composite index lost 22.28 points, or 0.2 per cent, to 13,667.29.

On the bond market, the US 10-year yield softened 4.6 basis points to 3.723 per cent, while the 2-year yield eased 2 basis points to 4.7 per cent.

Gold is down US$14.30, or 0.7 per cent, to $US1,938.02 an ounce, while the global benchmark Brent crude oil grade weakened 19 cents, or 0.2 per cent, to US$75.90 a barrel and US West Texas Intermediate oil fell US$1.28, or 1.8 per cent, to US$70.50 a barrel.

The Australian dollar is buying 67.87 US cents this morning, down from 68.1 US cents at the ASX Tuesday close.