China threat hits ASX, RBA says sorry, Frazis to leave BOQ

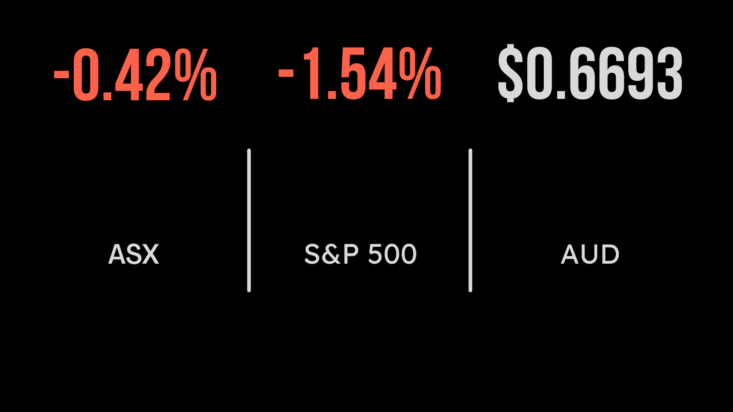

It was a tough start to the week in Australia, with little in the way of a US lead, all eyes were on growing unrest in China, which ultimately saw the S&P/ASX200 fall 0.4 per cent on Monday. Both the energy and materials sectors detracted, down 1.7 and 0.9 per cent as a surge in COVID-19 cases threatens to cut commodity demand and economic growth once again. BHP (ASX: BHP) fell 0.7 per cent and Rio Tinto (ASX: RIO) 1.4 per cent with the latter announcing the creation of a foundation for the destroyed Juukan Gorge. Shares in Bank of Queensland (ASX: BOQ) were rocked by news of the immediate departure of CEO George Frazis, who had lead the company through a significant restructure. Shares in BOQ fell more than 5 per cent with the company looking for a different skill set to guide it through the coming years. In a message too late for many, the Reserve Bank Governor apologised to those people who took out mortgages on the assumption that rates would remain near zero until 2023, the admission comes amid growing pressure on the policies implemented by the central bank.

Pilbara partners with Calix, Brambles in China JV, slowing COVID tests hit Healius

Shares in Brambles (ASX: BXB) outperformed, gaining 0.3 per cent, after the company announced an agreement between subsidiary CHEP China and Loscam for pallet pooling in the region. CHEP China will be sold for US$132 million, with shares in the joint entity issued as consideration, Brambles will own 20 per cent. Shares in Calix (ASX: CXL) fell 3 per cent despite announcing a partnership with lithium miner Pilbara (ASX: PLS) for the construction of a demonstration plant that seeks to produce quality lithium at lower carbon and energy intensity. Shares in Healius were hit by a downgrade in expectations, falling more than 10 per cent, after the company reported a drop in COVID-19 tests from 13,000 to just 3,000 per day. Revenue was down 31 per cent on the prior year, with earnings also falling 64 per cent as the company cycles an unprecedented testing blitz in 2021. Not unexpectedly, skincare producer BWX (ASX: BWX) has delayed the release of its financial statements with the company remaining in a trading halt, the CFO stepped down along with the announcements. Retail sales also fell for the first time in 2022, down 0.2 per cent in October.

S&P500 falls on China, rate hike warning, record Black Friday sales

All three US benchmarks finished more than 1 per cent lower, led by the Nasdaq, which was down 1.6 per cent. This despite Amazon (NYSE: AMZN) gaining 0.6 per cent after Black Friday sales broke the record set in 2021. More than US$9 billion in sales were achieved, up 2.3 per cent, with electronics leading the way, moving 221 per cent higher. Growing unrest in China didn’t impact local markets but had a significant impact on the US as the Dow Jones dropped 1.5 per cent and the S&P500 1.5 per cent amid a fall in the oil price that reversed all gains this year. This bodes well for inflation prints in the coming months. St Louis Fed President Bullard hinted towards more aggressive rate hikes, which flies in the face of a growing range of more challenging economic data. Issues in China have also impacted Apple iPhone production, with some 6 million phones impacted by shutdowns, lockdowns and strikes.