China optimism surge sparks miners

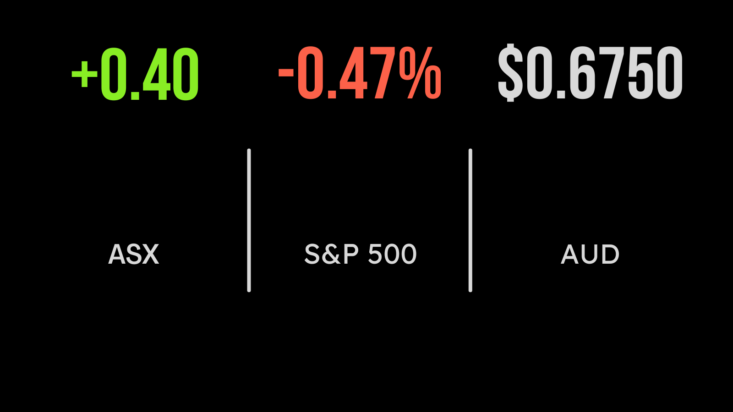

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1.

The bullishness for the miners came as data showed that China’s manufacturing activity grew at the fastest pace in more than a decade. Beijing’s manufacturing purchasing managers’ index (PMI) — considered a leading indicator of economic activity – surged to 52.6 from 50.1 in January: a reading above 50 signifies expansion, while a number below 50 points to contraction. The PMI figure embarrassed analysts’ consensus forecasts of 50.5 and was the strongest reading since April 2021, China’s National Bureau of Statistics said.

In other data released Wednesday, the Australian economy grew by 0.5 per cent in the December quarter, down from 0.7 per cent in the previous quarter, under forecasts of 0.8 per cent, according to the Australian Bureau of Statistics (ABS).

But the annual growth rate fell from 5.9 per cent to 2.7 per cent, and is predicted to slow further as the Reserve Bank’s interest rate tightening cycle effectively forces households to tighten their belts, and the tight labour market to cool.

The inflation figure, that is, the annual consumer price index (CPI) change, came in at 7.4 per cent for January, under forecasts, which expected about 8.1 per cent. The annual inflation rate softened from 8.4 per cent in December.

On the back of the Chinese data, iron ore futures in Singapore rose 2.2 per cent to $US126.05 a tonne, helping the local materials sector to a 2.3 per cent gain; BHP gained $1.02, or 2.3 per cent, to $46.22; Rio Tinto advanced $2.90, or 2.5 per cent, to $119.63; and Fortescue Metals Group rose 72 cents, or 3.4 per cent, to $22.12.

In the lithium field, Allkem advanced 52 cents, or 4.6 per cent, to $11.87, while fellow producer put on 4 cents, or 1 per cent, to $4.21. Mineral Resources, which produces iron ore as well as lithium, gained $3.44, or 4.2 per cent, to $86.00, and IGO, which mines nickel as well as lithium, lifted 44 cents, or 3.4 per cent, to $13.57. Among the lithium project developers, Core Lithium advanced 2.5 cents, or 2.7 per cent, to 96 cents, and Liontown Resources spiked 4.5 cents, or 3.3 per cent, to $1.40.

Rare earths producer Lynas Rare Earths gained 17 cents, or 2.1 per cent, to $8.37; diversified miner South32 rose 13 cents, or 3 per cent, to $4.47; but copper heavyweight Sandfire Resources slid 5 cents, or 0.9 per cent, to $5.83.

In coal, Yancoal Australia surged 30 cents, or 5.1 per cent, to $6.16; Whitehaven Coal eased one cent to $7.22; and New Hope Corporation advanced 2 cents to $5.45.

In energy, Woodside Energy gained 89 cents, or 2.5 per cent, to $36.80; Santos added 6 cents, or 0.9 per cent, to $7.06; Beach Energy put on 2 cents, or 1.4 per cent, to $1.44; but Brazilian-based producer Karoon Energy slipped 10 cents, or 4.3 per cent, to $2.24.

Engineering services company Downer EDI’s chief financial officer, Michael Ferguson, has resigned from the company two days after its stock plunged 24 per cent after its second profit downgrade in three months, and the company’s interim dividend was slashed by more than half. Although Downer EDI eked out a 2-cent gain on Wednesday, to $3.18, the stock has lost 19.3 per cent in the last five trading days and 13.8 per cent so far in 2023.

Westpac was down 46 cents, or 2 per cent, to $22.07; ANZ lost 28 cents, or 1.1 per cent, to $24.37; National Australia Bank retreated 62 cents, or 2.1 per cent, to $29.38; and Commonwealth Bank shed $1.64, or 1.6 per cent, to $99.05. Investment bank Macquarie Group was down 62 cents, or 0.3 per cent, to $188.90.

US bond yields heading higher

In the US overnight, stocks opened March with a gain of 5.14 points in the 30-stock Dow Jones Industrial Average, to 32,661.84, while the broad S&P 500 index eased 18.8 points, or 0.5 per cent, to 3,951.39, and the tech-heavy Nasdaq Composite Index lost 76.1 points, or 0.7 per cent, to close at 11,379.48.

Bond yields extended their February gains, with the benchmark 10-year yield briefly topping 4 per cent for the first time since November, and closing at 3.998 per cent, while the more rate-sensitive 2-year Treasury yield added 8.1 basis points, to 4.878 per cent.

On the commodities screens, gold gained US$11.17, or 0.6 per cent, to US$1,836.85 an ounce, while the global benchmark Brent crude oil grade rose 93 cents, or 1.1 per cent, to US$84.38 a barrel, and West Texas Intermediate advanced 67 cents, or 0.9 per cent, to US$77.72 a barrel.

The Australian dollar is buying 67.56 US cents this morning, steady on the 67.58 US cents at the local close on Wednesday.