CBA strength helps market over China woes

A post-result bounce in Commonwealth Bank helped lift the Australian share market on Wednesday, despite renewed worries about a softening Chinese economy, after the Middle Kingdom slipped into deflation.

Chinese data showed consumer prices fell 0.3 per cent in July from a year ago, the first decline since February 2021. Producer prices also retreated for a 10th consecutive month. Deflation is seen as dampening China’s demand for raw materials, and following disappointing Chinese trade figures a day earlier, the data posed queries for investors.

But while iron ore heavyweight Rio Tinto reacted predictably, dipping 61 cents, or 0.5 per cent, to $112.94; BHP Group gained 18 cents, or 0.4 per cent, to $45.50; and Fortescue Metals edged up 4 cents, or 0.2 per cent, to $21.18.

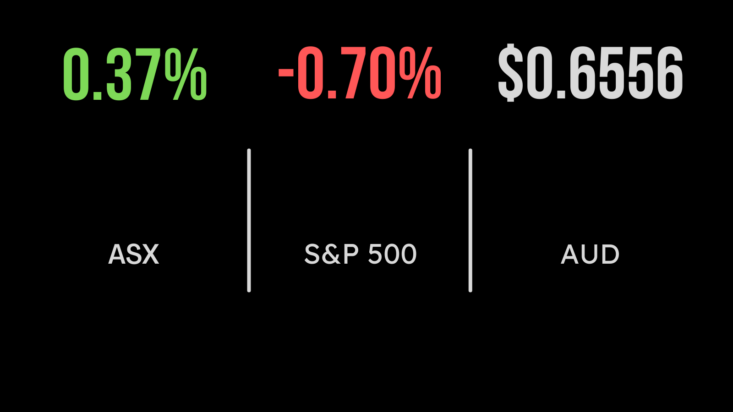

The benchmark S&P/ASX 200 finished up 26.9 points, or 0.4 per cent, to 7338, led by financials and tech stocks, with the broader All Ordinaries index adding 23.7 points, or 0.3 per cent, higher to 7543.4.

Commonwealth Bank gained $2.64, or 2.6 per cent, to $104.85, a day after reporting a record annual profit of $10.2 billion, largely on the back of higher interest rates, and lifted its dividend. The other major banks followed suit, with National Australia Bank up 61 cents, or 2.2 per cent, to $28.64; Westpac climbing 36 cents, or 1.7 per cent, to $22.07; and ANZ gaining 19 cents, or 0.8 per cent, to $25.43.

Elsewhere in financials, Suncorp disappointed investors with a lower-than-expected dividend. The stock lost 21 cents, or 1.7 per cent, to $13.50. The insurer declared a fully franked final dividend of 27 cents a share, sharply lower than the 40 cents expected by analysts’ consensus. Insurance Australia Group shed 3 cents, or 0.5 per cent, to $5.95; and QBE Insurance lost 28 cents, or 1.8 per cent, to $15.60.

In other company news, Australia’s biggest funerals business, InvoCare, jumped 70 cents, or 5.9 per cent, to $12.48 after its board backed a lower takeover offer worth $1.8 billion, made by private equity TPG Capital, at $12.70 a share.

Coal producer Coronado Global Resources partially bounced back from its 11.6 per cent loss on Tuesday, gaining 7 cents, or 4.8 per cent, to $1.525. Elsewhere in coal, Whitehaven Coal added 16 cents, or 2.3 per cent, to $7.14; New Hope Corporation lifted 12 cents, or 2.2 per cent, to $5.56; Terracom put on 1.5 cents, or 3.8 per cent, to 41 cents; and Bowen Coking Coal surged 0.9 cents, or 10.7 per cent, to 9.3 cents.

In lithium, producer Pilbara Minerals eased 3 cents, or 0.6 per cent, to $5.29; fellow producer Allkem lost 12 cents, or 0.8 per cent, to $14.22; IGO, which mines nickel as well as lithium, added 2 cents to $13.31; and Mineral Resources, which produces iron ore and nickel, gained 40 cents, or 0.6 per cent, to $69.44.

Department store chain Myer was also starting on the comeback trail after losing 14.1 per cent yesterday: the stock advanced 2.5 cents, or 4.1 per cent, to 63.5 cents. Jewellery retailer Lovisa was among the largest decliners, down 92 cents, or 4.3 per cent, to $20.26 after broking firm Macquarie downgraded the shares to ‘neutral’ from ‘outperform,’ and slashed its price target by 38 per cent, to $22.

In energy, Woodside Energy retreated 11 cents, or 0.3 per cent, to $38.29; and Santos slipped one cent to $7.85; but Brazilian-based producer Karoon Energy gained 3 cents, or 1.4 per cent, to $2.23.

Inflation wait pressures US stocks

In the US, the market’s poor August continued, ahead of tonight’s inflation readout, with the blue-chip Dow Jones Industrial Average sliding 191.13 points, or 0.5 per cent, to finish at 35,123.36. The broader S&P 500 lost 31.67 points, or 0.7 per cent, to 4,467.71, and the tech-heavy Nasdaq Composite index slipped 162.31 points, or 1.2 per cent, to 13,722.02.

Tonight our time, the closely watched consumer price index (CPI) figure is forecast to show a monthly increase of 0.2 per cent for July, and a 12-month rate of just 3.3 per cent.

On the bond market, the key US 10-year Treasury yield retreated 1.9 basis points, to 4.014 per cent, while the 2-year yield gained 4.6 basis points, to 4.804 per cent.

Gold is trading US$9.63, or 0.5 per cent, lower at US$1,915.94 an ounce, while the global benchmark Brent crude oil grade surged US$1.38, or 1.6 per cent, to US$87.55 a barrel, and US West Texas Intermediate oil eased 20 cents, or 0.2 per cent, to US$84.20 a barrel.

The Australian dollar is buying 65.30 US cents this morning, down from 65.69 US cents at the ASX close on Wednesday.