-

Sort By

-

Newest

-

Newest

-

Oldest

After a stronger-than-expected US inflation figure for August, the Australian August job report blew expectations out of the water, with a 64,900 jobs created in the month, well above the 23,000 anticipated by economists. The unemployment rate stayed at 3.7 per cent in August. The data was viewed as boosting the case for the Reserve…

A tech slide dragged the ASX indices lower on Wednesday, ahead of the US inflation data coming in overnight. Consensus expectations were for the US headline consumer price index (CPI) to show core inflation at 3.6 per cent for the year to August, up from 3.2 per cent a month ago – a significant rise….

The Australian share market moved higher on Tuesday, as investors assessed conflicting data releases, one showing weakening consumer sentiment but the other indicating business conditions improving. The benchmark S&P/ASX200 index managed to finish 14.6 points, or 0.2 per cent, higher at 7206.9, with the broader All Ordinaries index tracking that rise in percentage terms, adding…

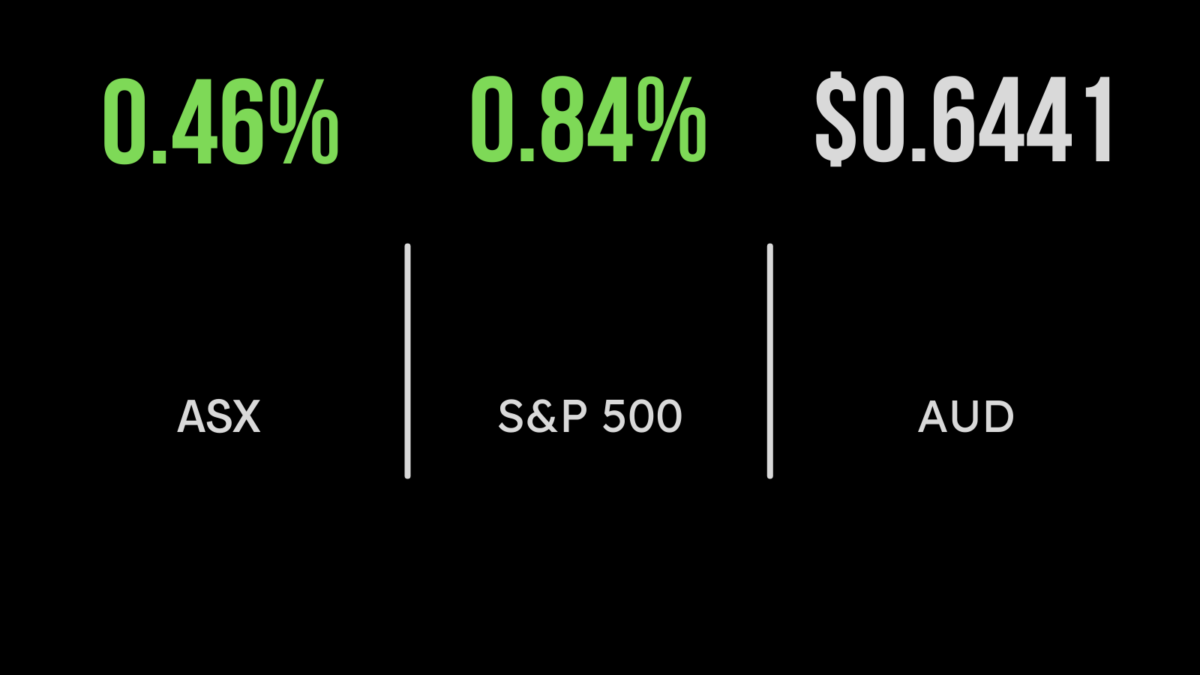

The S&P/ASX 200 finished the day higher, up 0.5 percent after initially falling by 0.2 percent earlier in the trading session. The broader All Ordinaries also rose by 0.4 percent. On Monday, the Australian stock market rebounded from earlier losses, breaking a four-day losing streak. This recovery was attributed in part to a strong performance by iron ore mining…

Both benchmarks weakened into the close, as both the S&P/ASX200 (ASX:XJO) and All Ordinaries (ASX:XAO) fell 0.2 per cent on Friday. The weakness was driven by the materials sector, which fell 1 per cent, driven lower by BHP (ASX:BHP) and Fortescue (ASX:FMG), down 1.2 and 2.4 per cent. The highlight was the utilities sector…

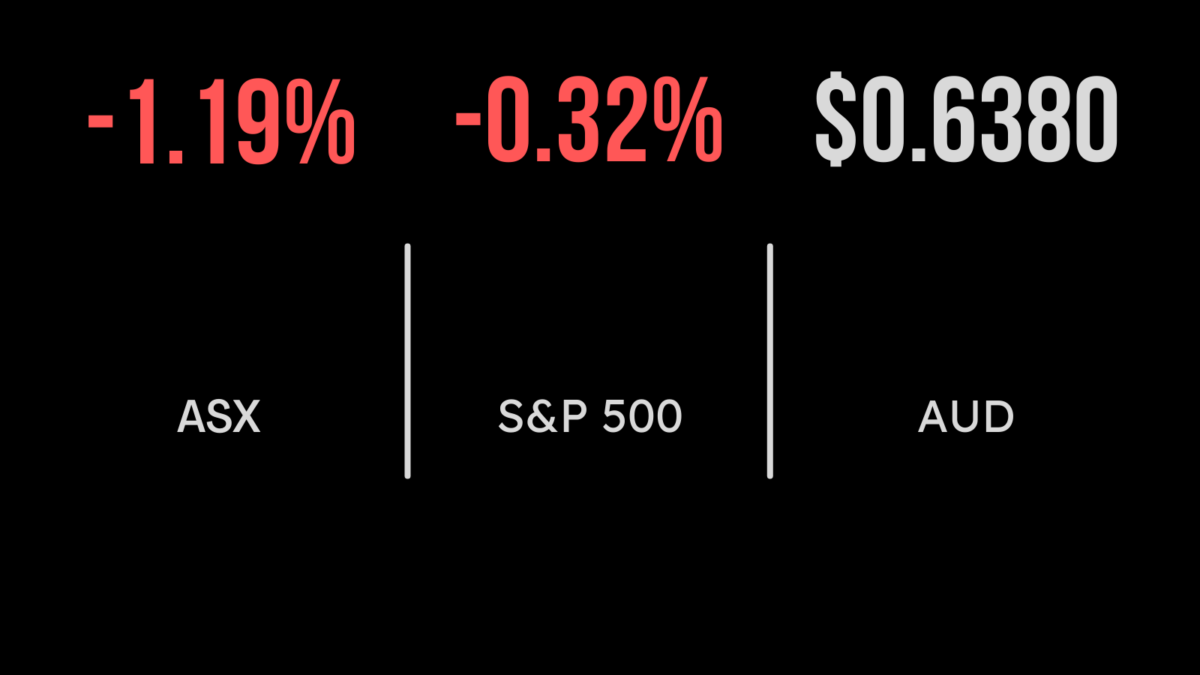

Both local benchmarks, including the S&P/ASX200 fell 1.2 per cent on Thursday, as pressure continues to build from poor global economic data. A surge in bond yields in the US, on the back of higher oil prices, has hit valuation and growth hopes once again, while further signs of slowing growth in China, hit the…

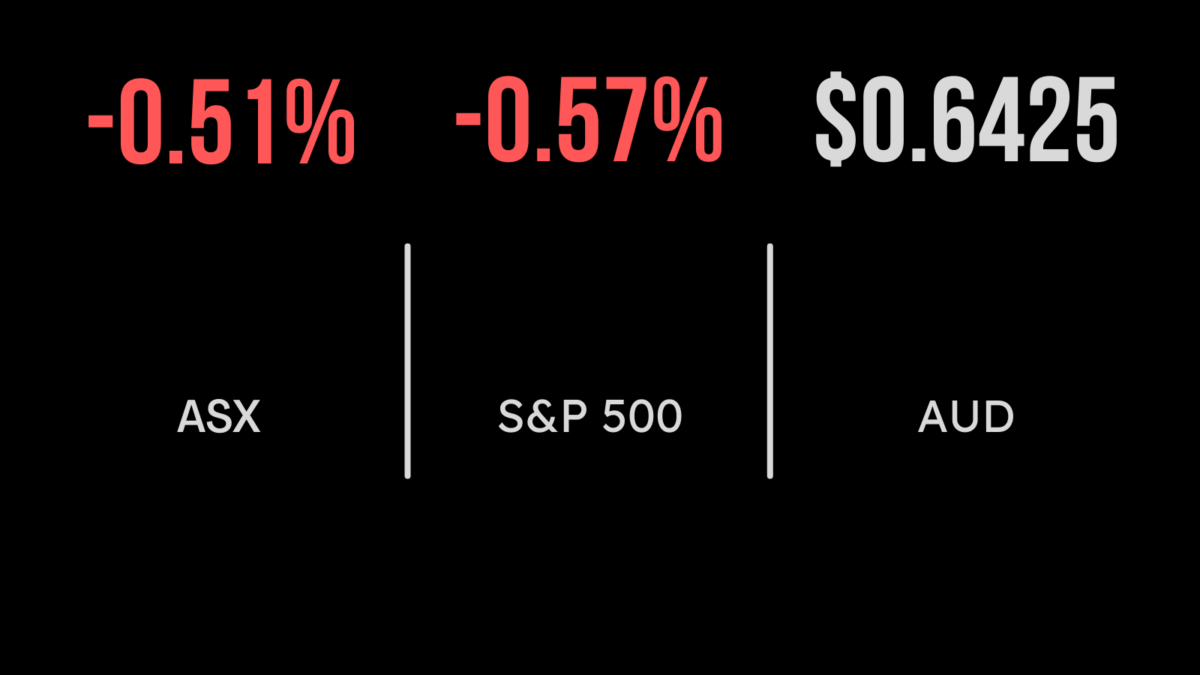

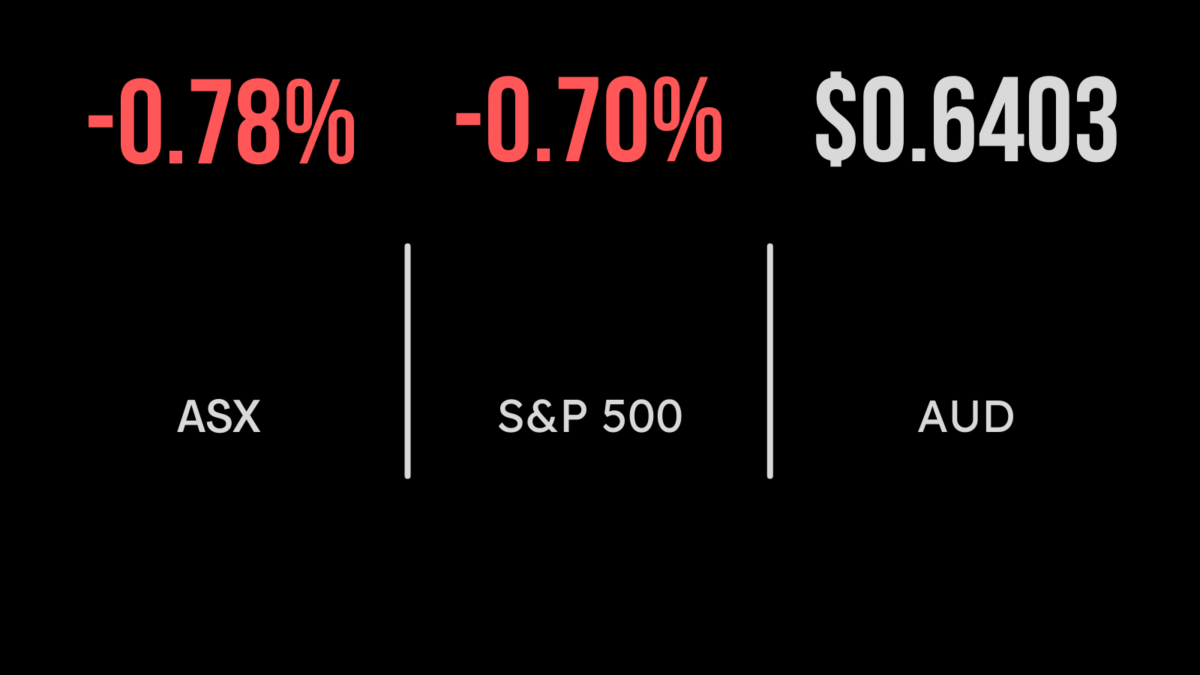

The local share market weakened again on Wednesday, with the All Ordinaries down 0.7 and the S&P/ASX 200 (ASX:XJO) falling 0.8 per cert as seven sectors fell by more than 1 per cent. The rare highlight was the energy sector, which gained 1 per cent on the back of the oil price surging above US$90…

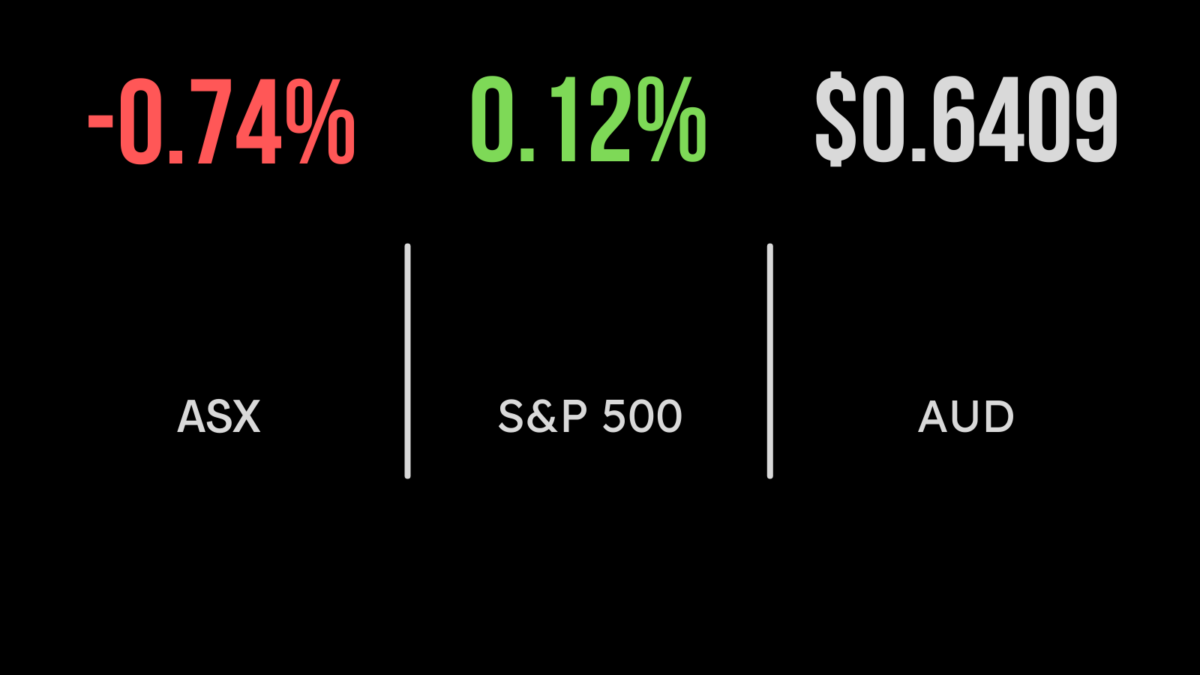

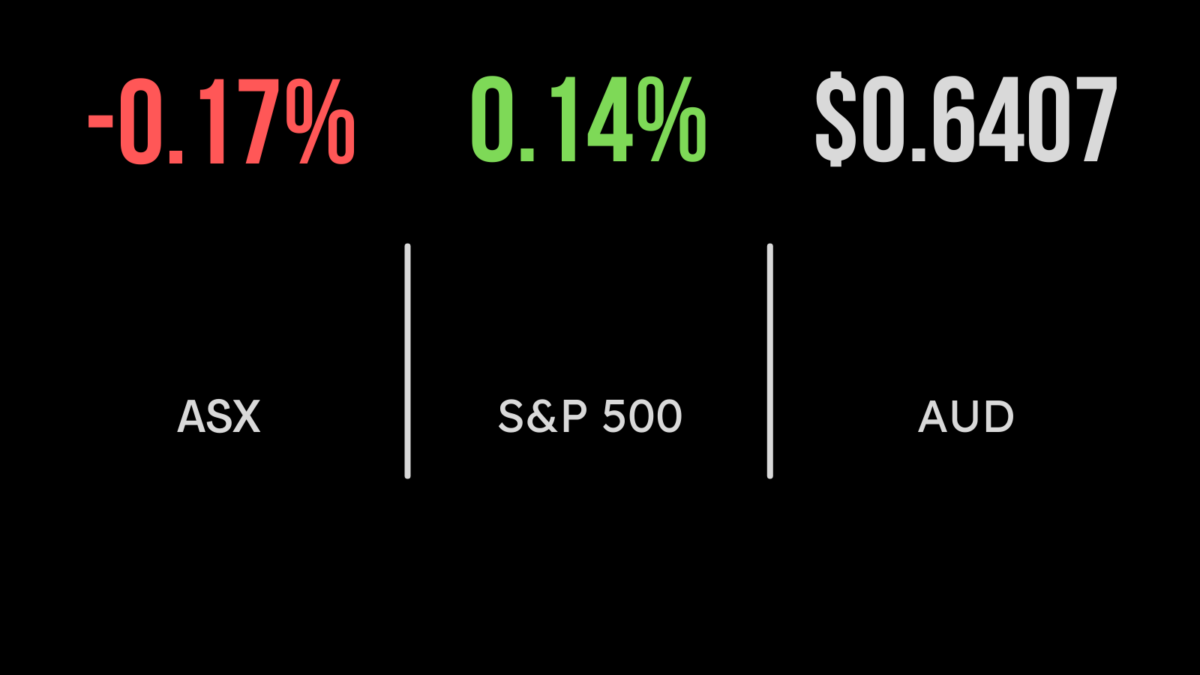

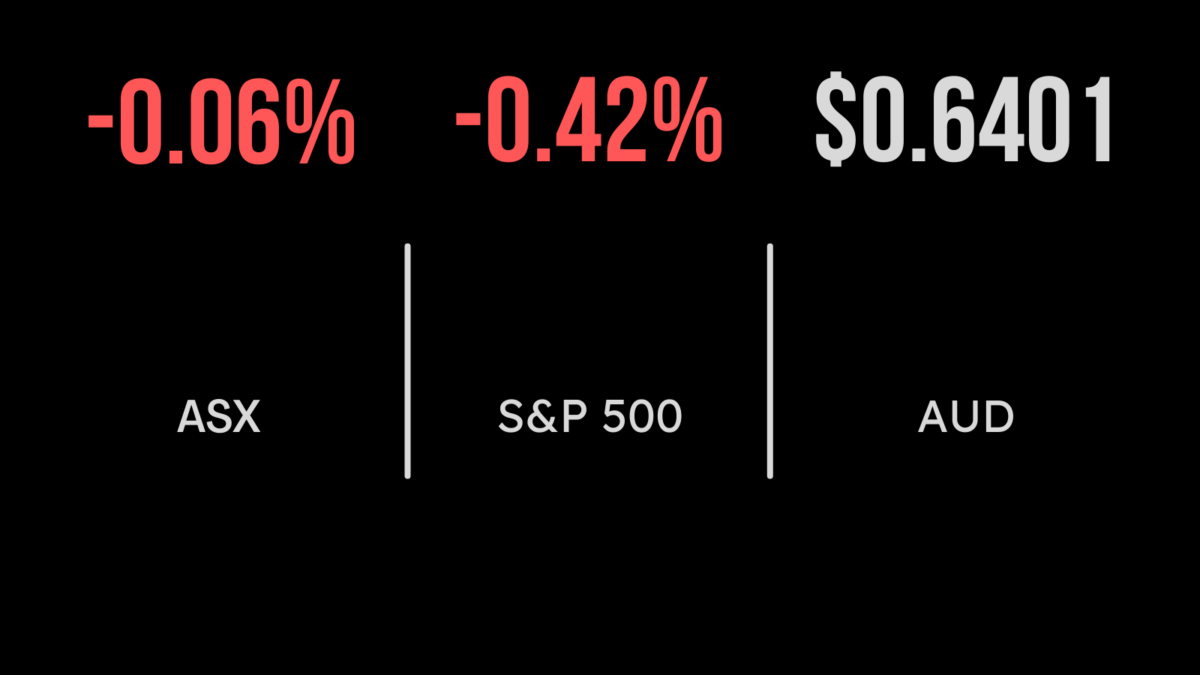

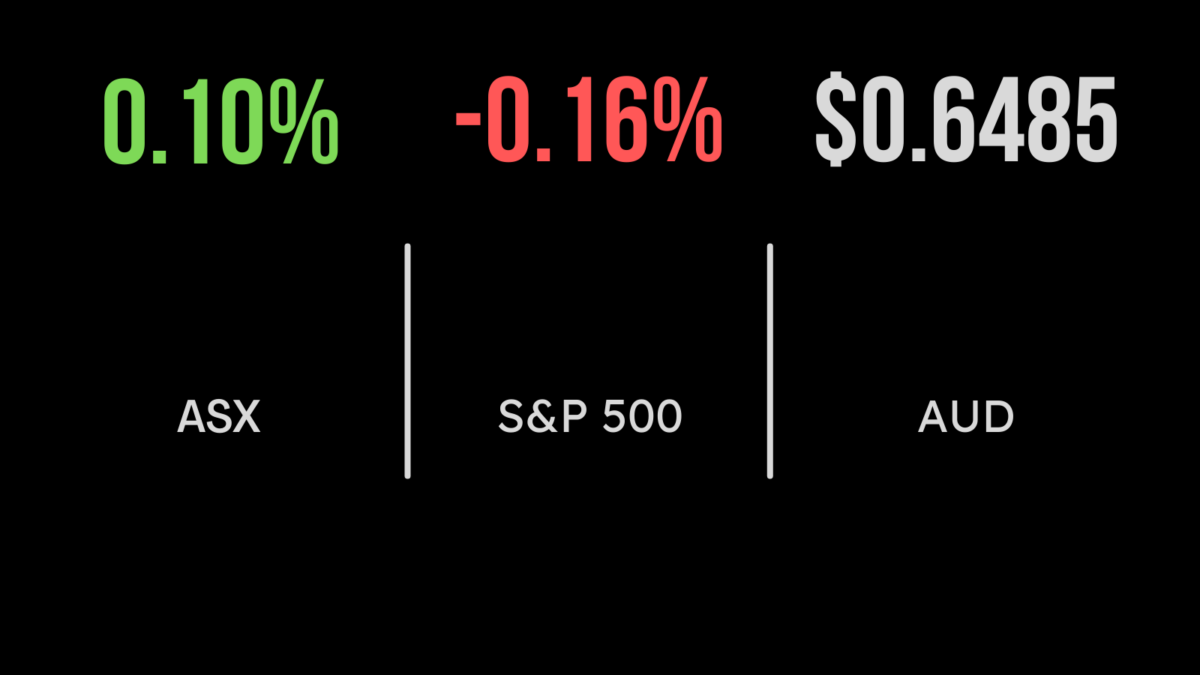

The local share market closed broadly flat on Tuesday, with both the S&P/ASX200 (ASX:XJO) and All Ordinaries falling 5 and 9 points respectively. The primary culprit was a weakening utilities sector which fell 1.2 per cent behind a 2.9 per cent selloff in Origin Energy (ASX:ORG). The weakness came despite news that the NSW Government…

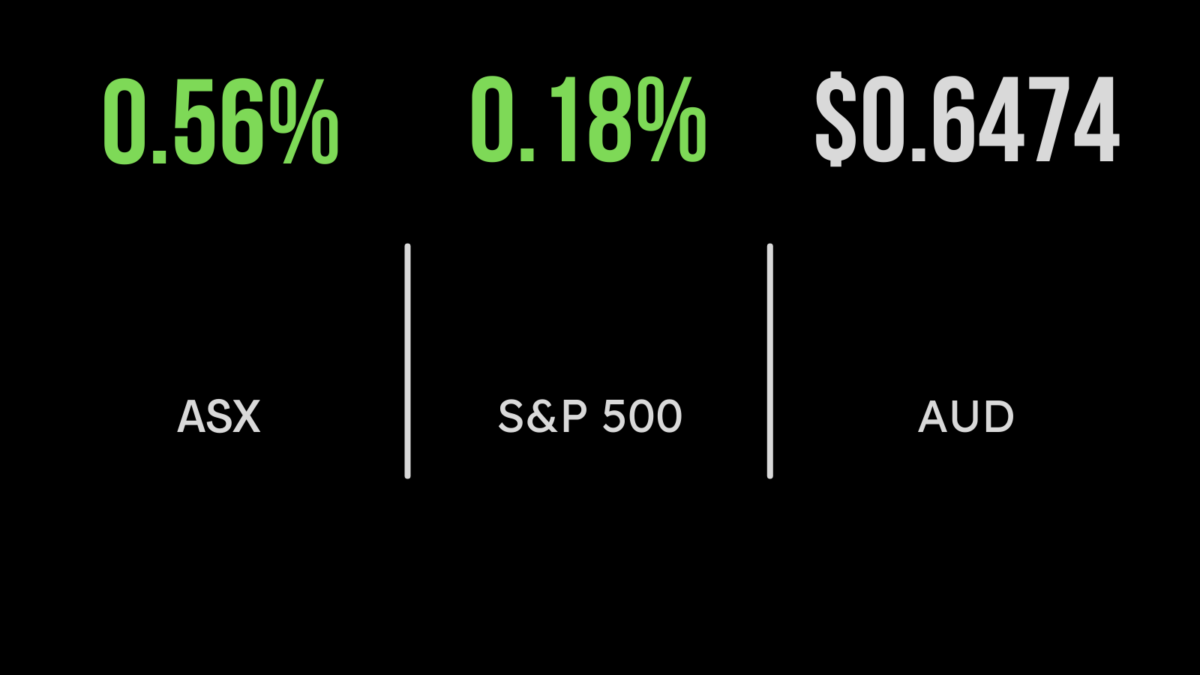

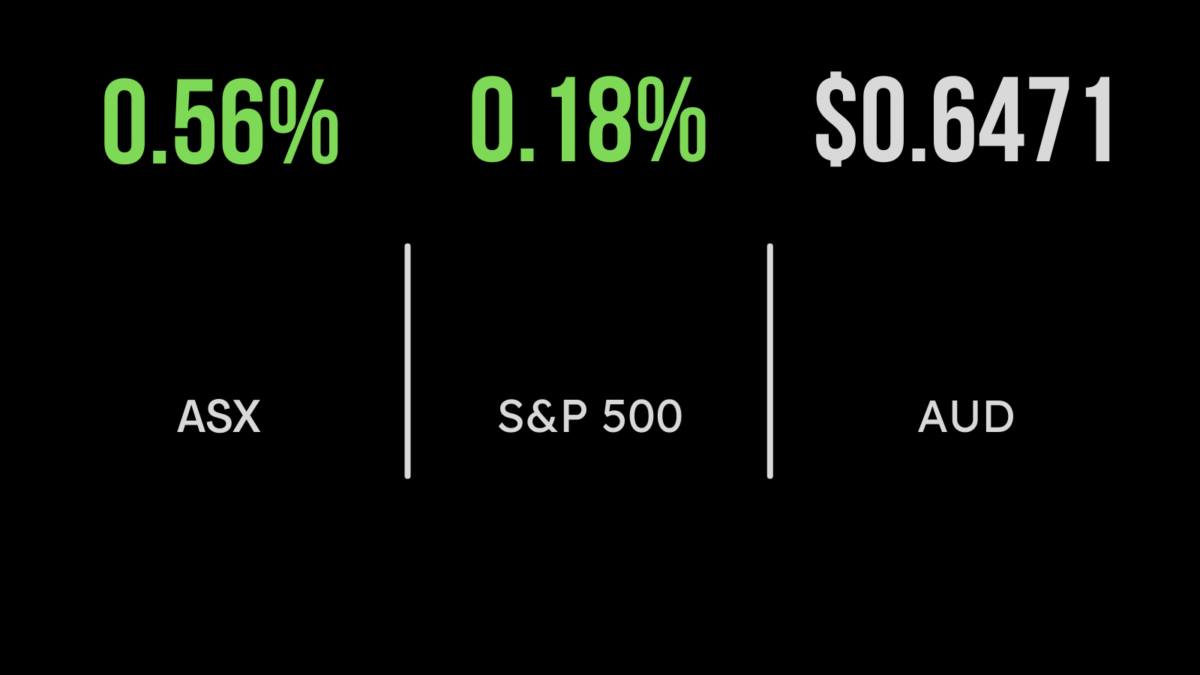

The local sharemarket started the week strongly, with the All Ordinaries (ASX:XAO) managing a 0.5 per cent gain, and the S&P/ASX200 (ASX:XJO) up 0.6 per cent. The move was driven by positive sentiment in the materials and energy sectors, up 2 and 1.6 per cent, as acquisition activity continues to grow. This time it was…

Both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) fell 0.4 per cent on Friday, but still managed to deliver a 2.3 per cent gain for the week. The mining and retailing sectors remain under significant pressure, despite news of stimulus from the Chinese banking sector. Shares in Fortescue (ASX:FMG) fell another 5.3 per cent after…

The S&P/ASX 200 index concluded up 0.1 percent and the All-Ordinaries index performed even better, edging up by 0.15 percent. The energy sector displayed the weakest performance, with Whitehaven Coal dropping 9 percent, and Woodside dropping4.1 percent, as both companies went ex-dividend on Thursday. On the other hand, the communication services sector emerged as the top performer, with Telstra, TPG Telecom, and Carsales all recording gains of…

The S&P/ASX 200 concluded up 1.2 percent, and the All Ordinaries also rose by 1.2 percent. Australia’s monthly consumer price indicator yielded an unexpected outcome on Wednesday, fuelling the share market to achieve its most robust single-day surge in over six weeks. The inflation gauge for July exhibited a drop to 4.9 percent from June’s 5.4 percent, catching numerous…