Blackmore Capital puts ESG in action

Environmental (E), Social (S), and Governance (G) analyses consider a multitude of issues within the E, S, G pillars. For example, MSCI, one of the mainstream ESG data and rating providers, scores companies using ten themes and 37 different factors across E, S, and G categories. However, while these scores can provide useful information about companies’ overall ESG credentials, they offer little insight into which factors could have a material impact on companies’ financial returns.

Historically, materiality has primarily been viewed as an accounting principle defining which issues and information are “decision-useful” from a financial and operational perspective. Companies have been considering both the materiality of sustainability issues and the materiality of financial information for several years. However, they have only started to link these two concepts and their application, leading to a perspective of dual or double materiality. This new perspective recognises that issues or information that are material to environmental and social objectives may develop to have financial consequences over time.

At the same time, investors are demanding more clarity on how to determine materiality, which helps them understand a company in the context of its management strategy and its governance regimes.

The Sustainability Accounting Standards Board (SASB), a not-for-profit organization with a mission to help businesses around the world report on sustainability, defines materiality in the following way: “financially material issues are those reasonably likely to impact the financial condition or operating performance of a company and therefore are the most important to investors.” As the financial relevance of ESG factors varies within different sectors and industries, SASB developed the SASB Materiality Map, a display of the potential materiality of 26 sustainability-related business issues grouped across five categories: environment, social capital, human capital, business model and innovation, as well as leadership and governance.

One of the key elements of the SASB materiality map is its specificity. SASB’s approach is to identify the industry-specific sustainability topics most relevant to business and investment outcomes. For example GHG emissions (one of the factors within the Environment category) is considered material for companies running large fleets of trucks, airlines, or ones that are in energy-intensive industries. For a company relying on a low paid labour force, the impact of the rising minimum wage would be a material factor. Hence, Compensation and Benefits (one of the factors within the Human capital category) needs to be carefully considered.

The SASB framework is undoubtedly useful for ESG risk analyses and for helping companies decide which information is most helpful in making financially related decisions and what information companies should disclose. However, in our view, the definition used by Unilever, one of the highest-ranking companies on ESG metrics, is more constructive to inform how companies and investors should be thinking about materiality: “An issue is material to Unilever if it meets two conditions. Firstly, it impacts our business significantly in terms of growth, cost, or risk. And secondly, it is important to our stakeholders – such as investors, society (citizens, NGOs, governments), consumers, customers (retailers), suppliers, and our employees – and they expect us to take action on the issue. In determining if an issue is material, we consider our impacts across the value chain”.

The above definition focuses on business-critical matters for management and the Board, and recognises that companies do not exist in isolation. As Eliza Moscolin, Head of Sustainability & CSR at Santander, says, “The very purpose of sustainability, ESG, and also materiality is making sure they (companies) take account of their impact on the ecosystem within which they operate, and how that system impacts them. Only with this long-term view they succeed – they won’t be short-sighted or surprised by impact they hadn’t foreseen”.

Implicitly, the Uniliver definition also recognises the dynamic nature of materiality. The basic idea of dynamic materiality is that investors’ consideration of what is a material ESG issue changes over time. This change can happen very slowly, as with gender diversity,or suddenly, when something universally catastrophic happens. A case in point is the COVID-19 crisis. Employee Health & Safety, Labor Practices, Access and Affordability, Product Quality and Safety, and Supply Chain Management, essentially all of which are social and human capital dimensions, have emerged as material issues for all companies during the COVID-19 crisis and have dominated all other ESG issues.

The bottom line is that the concept of materiality is malleable and is evolving; there is no one size fits all approach. Though, one thing is certain: materiality needs to go beyond reporting and as an investor-oriented concept needs to be viewed through the lens of value creation.

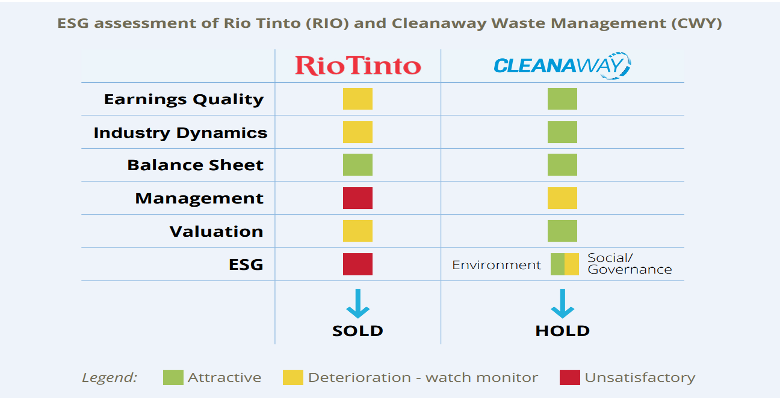

A good example of how this could be done is a materiality assessment of the actions by Rio Tinto (RIO) and Cleanaway Waste Management (CWY), carried out by Blackmore Capital. Blackmore Capital is an Aussie equity fund manager who seeks to allocate capital to companies that can sustainably create economic value over the longer term. The manager adopts an unaware benchmark approach based on comprehensive research and fundamental company and industry analysis. Their ESG analysis focuses on identifying environmental, social & governance factors relevant to a business that can have a meaningful impact at a company and industry level.

Blackmore sold their position in RIO following a review of its decision to destroy a 46,000-year-old indigenous rock shelter at the Juukan Gorge mine in the Pilbara. In the manager’s view, RIO not only damaged its reputation and its social license to operate, but its actions have led to increased environmental and regulatory costs for its business and the industry. Hence, RIO’s earnings quality, industry dynamics and valuation have become less attractive while the management and the overall ESG assessment changed to unsatisfactory. By contrast, while the misconduct of the CEO of CWY was extremely disappointing, it has not irrevocably damaged CWY’s business franchise. Hence, Blackmore has marked down the assessment on CWY’s management and ESG but has decided to maintain its holding.

The table below summarises the manager’s ESG evaluation of the two businesses incorporating the impact of their actions on the companies’ investment thesis:

While the above approach is somewhat subjective, it provides more transparency to investors regarding the process of defining materiality from a perspective of companies’ ability to create value over time.