Banks boost local bourse

A strong performance by the banking sector led the Australian share market on Tuesday, as traders and investors cast a wary eye ahead of the monthly US inflation readout overnight.

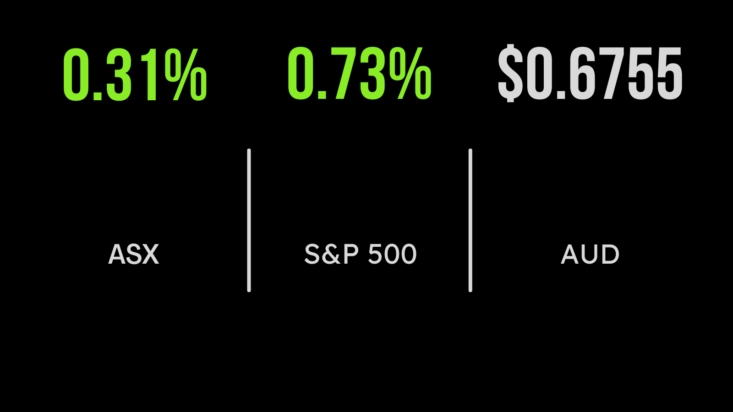

The benchmark S&P/ASX200 index gained 22.5 points, or 0.3 per cent, to 7203.3, while the broader All Ordinaries gained 18.6 points, or 0.2 per cent, to 7389.2.

The banks were inspired by a trading update from Bendigo and Adelaide Bank, in which the country’s fifth-largest retail bank announced its unaudited cash earnings were up 22 per cent to $245 million in the five months to November 30, compared to the same period in 2021, amid a decline in lending and a boost in deposits. Bendigo & Adelaide Bank surged 62 cents, or 6.9 per cent, to an almost four-month high of $9.66. Following suit, ANZ advanced 56 cents, or 2.4 per cent, to $24.10; National Australia Bank put on 60 cents, or 2 per cent, to $30.79; Westpac rose 30 cents, or 1.3 per cent to $23.66; and CBA was up $1.05, or 1 per cent, to $106.44. Investment bank Macquarie Group added $1.36, or 0.8 per cent, to $172.86.

CSL dipped $1.13, or 0.4 per cent, to $297.04 after announcing that chief executive Paul Perreault will step down from his role in March after a decade leading the biotech giant, handing over to chief operating officer Paul McKenzie. When Mr Perreault took over as CEO, the share price was $63.28 and the market capitalisation was 32.8 billion, meaning that CSL has grown 4.3 times in market value on his watch.

Energy fight only warming up

In the energy sector, Woodside Energy gained 4 cents to $35.14 after releasing a strong statement saying the Albanese government’s proposed intervention in the gas market “threatens power supply, investment and jobs.” Woodside and Shell have suspended talks with buyers to supply new gas into Australia’s east coast market, blaming the Albanese government’s intervention into energy markets and warning the move could lead to shortages and gas rationing.

Woodside, which supplies 20 per cent of east coast domestic demand from Victoria’s Bass Strait, followed Shell’s dramatic move to freeze sales to customers by also pausing its own process to supply into the market. Elsewhere, Santos eased 1 cent, to $7.10; while in the utilities, Origin Energy gained 9 cents, or 1.3 per cent, to $7.28 and AGL Energy was up 10 cents, also 1.3 per cent, to $7.89.

Big Mining struggled, with Fortescue Metals sinking 89 cents, or 4.2 per cent, to $20.23;

BHP losing 71 cents, or 1.5 per cent, to $46.08; and Rio Tinto shedding $2.25, or 1.9 per cent, to $114.10.

In coal, Whitehaven Coal was up 9 cents, or 1 per cent, to $9.59, New Hope Corporation added 3 cents, to $5.74 and Yancoal Australia spiked 20 cents, or 3.5 per cent, to $5.97; while in lithium, producer Pilbara Minerals eased 1 cent to $4.52, and fellow producer Allkem also retreated 1 cent to $13.03.

Among the lithium project developers, Core Lithium retreated 2.5 cents, or 2.2 per cent, to $1.14, Lake Resources weakened 3 cents, or 3.2 per cent, to 90 cents, Liontown Resources slid 4.5 cents, or 2.6 per cent, to $1.70, but Piedmont Lithium, which has agreements to supply Tesla, eked out a 1.5 cent gain, or 1.8 per cent, to 84 cents.

The tech sub-index was the strongest performer, climbing 2.1 per cent as small-business accounting software player Xero gained $2.35, or 3.3 per cent, to $72.98; while global logistics software leader WiseTech Global added $1.07, or 2 per cent, to $54.65. Afterpay’s owner Block, Inc. advanced $2.94, or 3.1 per cent, to $96.45, but fellow buy-now, pay-later pioneer Zip Co was hammered 7.5 cents, or 10.5 per cent, lower to 64 cents.

Tyro Payments added 17 cents, or 14.6 per cent, to $1.375 on hopes that buyout firm Potentia Capital might return to the EFTPOS machine provider with a higher takeover offer.

US markets on wait-and-see watch for Fed meeting

In the US, stocks were tepidly higher after the US inflation report showed an increase of just 0.1 per cent in November, for an annual rate of 7.1 per cent: economists’ consensus had been expecting a 0.3 per cent monthly increase and a 7.3 per cent annual rise. Investors are anticipating the Federal Reserve’s next rate-hiking decision at the conclusion of its two-day policy meeting on Wednesday in the US, and the markets expect a 0.5 percentage-point rise.

The benchmark S&P 500 index gained 29.1 points, or 0.7 per cent, to 4,019.6, while the 30-stock Dow Jones Industrial Average added 103.6 points, or 0.3 per cent, to 34,108.6 and the tech-laden Nasdaq Composite index advanced 113.1 points, or 1 per cent, to 11,256.8. The 10-year Treasury yield moved in five basis points to 3.513 per cent, while the more policy-sensitive 2-year yield came in 18 basis points, to 4.22 per cent.

On the commodity front, gold rose US$27.84, or 1.6 per cent, to US$1,809.94 an ounce, the global benchmark Brent crude oil grade surged US$2.64, or 3.4 per cent, to US$80.63 a barrel and West Texas Intermediate crude gained US$2.22, or 3 per cent, to US$75.39 a barrel. The Australian dollar is buying 68.54 US cents, up strongly from 67.62 US cents at the local close on Tuesday.