Australian market turns red for 2023

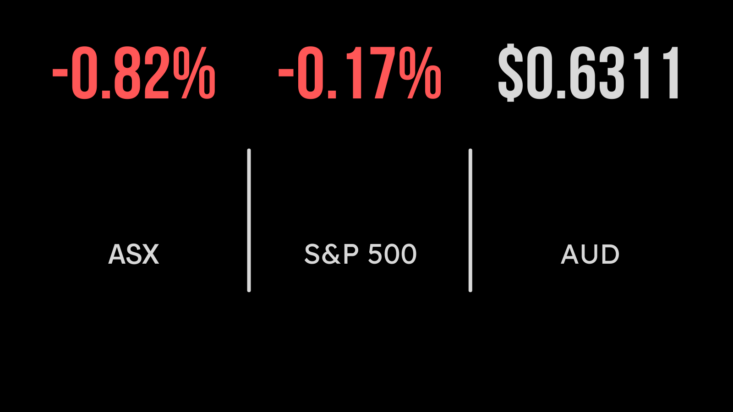

The Australian stock market has given up all of the gains that it had made in 2023, with the benchmark S&P/ASX 200 losing 56.6 points, or 0.8 per cent, on Monday to 6,844.1, with resources weakness the major culprit. That puts the index in the red by 2.8 per cent for the year. The broader All Ordinaries index sank 59.7 points, also 0.8 per cent, to 7,030.0.

Australia’s 10-year government bond yield climbed to 4.81 per cent, matching Friday’s high, and the highest level since 2011 on expectations that interest rates would stay high for longer. Traders are waiting for Wednesday, when the Australia Bureau of Statistics (ABS) will release third-quarter consumer price index (CPI) data that is expected to be critical in deciding whether the Reserve Bank lifts interest rates next month.

Nine out of the 11 sectors went backward, with materials and energy leading losses.

Resources were under pressure across the board, with BHP down $1.07, or 2.4 per cent, to $43.36; Rio Tinto losing $2.77, also 2.4 per cent, to $111.85; and Fortescue Mining closing 58 cents, or 2.7 per cent, to $20.81.

Lithium, coal turn downward

Lithium producer Pilbara Minerals suffered a 28-cent, or 7.3 per cent, fall to $3.58; and fellow producer Allkem eased 32 cents, or 3 per cent, to $10.36. Mineral Resources, which produces iron ore as well as lithium, lost $3.11, or 5.2 per cent, to $56.44, and IGO, which mines nickel and lithium, also gave up 5.2 per cent, down 58 cents at $10.58.

In coal, New Hope Corporation sank 55 cents, or 8.5 per cent, to $5.92, as it traded ex-dividend, with the final dividend of 21 cents a share and a special dividend of 9 cents a share both coming out of the share price. Whitehaven Coal slid 4 cents, or 0.5 per cent, to $7.50; Yancoal Australia lost 9 cents, or 1.8 per cent, to $4.98; Coronado Global Resources gave up 7.5 cents, or 4.5 per cent, to $1.61; and Stanmore Resources shed 2 cents, or 0.6 per cent, to $3.63.

South32 retreated 10 cents, or 3 per cent, to $3.27 after telling the market of a 33 per cent drop in coal production this quarter, in a business update.

Woodside Energy dropped $1.17, or 3.2 per cent, to $35.19, while Santos lost 20 cents, or 2.5 per cent, to $7.80.

The major banks were all lower, with Westpac easing 2 cents to $20.84, ANZ down 5 cents at $25.22, National Australia Bank shedding 9 cents to $28.56, and Commonwealth Bank the biggest loser, walking back 93 cents, or 0.9 per cent, to $97.82.

Biotech heavyweight CSL added $3.71, or 1.6 per cent, to $26.80. Drug developer Immutep jumped 5.5 cents, or 20 per cent, to 33 cents, after reporting positive clinical trial results for its lung cancer treatment, efti.

Telstra was down 2 cents, at $3.79.

Tech index anticipates strong earnings

In the US, the major indices were mixed, as US bond yields retreated significantly, with the 10-year yield back to 4.85 per cent, from levels above 5 per cent a few days ago. The Nasdaq Composite moved higher on Monday as traders looked ahead to the release of corporate earnings from tech industry giants: the tech-heavy gauge snapped a four-day losing streak, adding 34.52 points, or 0.3 per cent, to 13,018.33.

It was not such a positive day for the 30-stock Dow Jones Industrial Average, which slipped 190.87 points, or 0.6 per cent, to close at 32,936.41; or the broader S&P 500 index, which shed 7.12 points, or 0.2 per cent, to 4,217.04.

The US reporting season gets into full swing tonight with Microsoft, Alphabet, Visa, Coca Cola and GE among the big names reporting.

The US 2-year Treasury yield gave back 5.1 basis points, to 5.058 per cent.

Gold gained US$1.72, to US$1,972.85 an ounce, while on the oil markets, the global benchmark Brent crude grade lost US$1.59, or 1.7 per cent, to US$90.57 a barrel, and West Texas Intermediate crude retreated US$2.59, or 2.9 per cent, to US$85.49 a barrel.

The Australian dollar is buying 63.36 US cents, up from 63.13 US cents at the ASX close on Monday.