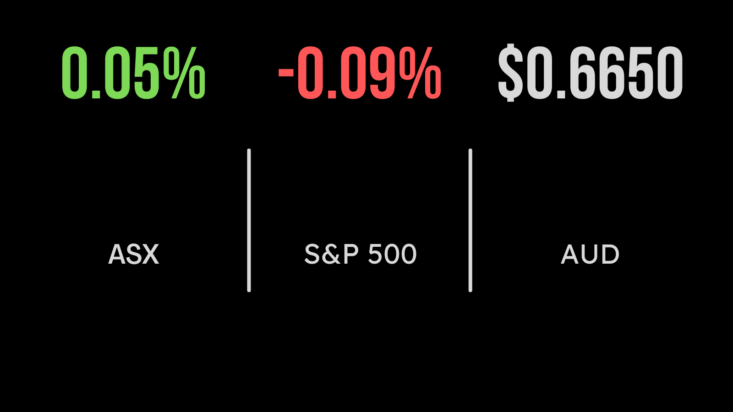

ASX lifts & headline inflation falls

The S&P/ASX 200 concluded the day up 0.3 per cent, led by interest rate-sensitive real estate, technology, and consumer discretionary sectors, all closing over 1 per cent higher. This surge came after the Australian Bureau of Statistics reported a drop in annual inflation from 5.6 per cent in September to 4.9 per cent in October. These figures indicate a gradual decline in inflation, potentially aligning with the Reserve Bank’s target over a reasonable timeframe. Within the market, Scentre Group led the property stocks with a 2.3 per cent increase. In the tech sector, WiseTech rose by 2 per, while IDP education surged by 4.7 per cent, boosting the consumer discretionary stocks. Among materials stocks, gold miners shone bright as the precious metal hit a six-month high. Newmont rose by 5.4 per cent, Northern Star by 4.3 per cent, and Perseus Mining by 6.7 per cent. However, energy stocks faced a downturn, dropping by 0.8 per cent, attributed to anticipation surrounding an upcoming meeting of OPEC+ members.

Australian company news

In terms of specific company updates, Healius surged by 6 per cent following increased stakes from Australian Retirement Trust and Host Super. Meanwhile, Fisher & Paykel Healthcare reported positive revenue and profit growth, propelling its shares by 7.9 per cent. Conversely, EML Payments plummeted by 29.7 per cent after revealing its profit and revenue forecasts for the year, amidst pressure from Texas-based Alta Fox Capital seeking changes in the prepaid cards business. Harvey Norman recorded a 4.2 per cent gain despite a recent 7.8 per cent sales drop over five months. Link Administration emerged as the top performer on the benchmark, rallying by 8.5 per cent following Macquarie’s neutral rating after resuming coverage on the share registry company. Transurban, a major toll roads company listed on the ASX, was notably absent from the bidding process for a 55.45 per cent ownership stake in Melbourne’s EastLink toll road. However, it’s too early to completely remove Transurban from bidding for the 300 million a year toll road project.

The US economy grinds higher, showing broad-based gains

The US economy grinds higher on Wednesday with the cyclical Dow up 0.1 per cent, whilst the S&P500 fell 0.1 per cent and Nasdaq fell 0.2 per cent. Interestingly the Russel 2000 index also managed to lift on Wednesday highlighting the broad-based gain across US equities, outside the Magnificent Seven. In company news, General Motors Co.’s stock surged by 9.4 per cent following the car manufacturer’s announcement to generously reward its shareholders now that labour strikes have been resolved. Conversely, Petco Health & Wellness Co. Inc. witnessed a steep decline of 28.9 per cent in its shares on Wednesday after the pet care-products retailer reported an unexpected fiscal third-quarter loss and significantly reduced its full-year forecast. Meanwhile, Foot Locker Inc. experienced a notable 16.1 per cent increase in its shares after the athletic-footwear retailer delivered impressive earnings results and offered an optimistic sales projection. Additionally, GameStop Corp. saw a 20.5 per cent rise in its shares on Wednesday as individual investors surged into speculative call options for the videogame retailer, reigniting an upward momentum in its stock price.