ASX grinds out another gain, materials surge on supply uncertainty, Zip buys Sezzle

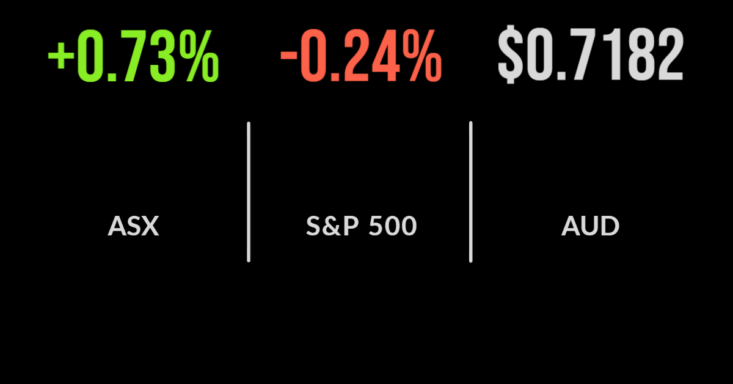

Rumours that Russia and Ukraine were being encouraged to come to the table for peace discussions supported the market on Monday, with the S&P/ASX200 gaining 0.7 per cent.

Mining, materials and energy remain the biggest contributors as the conflict raises questions around supply chains, with the former adding 3.0 per cent and the latter 1.4 per cent.

BHP (ASX: BHP) and Rio Tinto (ASX: RIO) were central to the rally, gaining 4.4 and 3.2 per cent respectively after the iron ore price reached US$140 per tonne once again.

Both Russia and Ukraine are material producers of iron ore, albeit not to the scale of Australia and Brazil, so it has been more about the buyers of this ore changing their source.

The technology sector was the biggest detractor, falling 0.6 per cent, as family tracking app Life360 (ASX: 360) continued to struggle, falling 8.9 per cent in the session.

Zip Co (ASX: Z1P) entered a trading halt to announce a $200 million capital raising that will be used to fund the acquisition of smaller BNPL player Sezzle (ASX: SZL).

The shares price has fallen close to 70 per cent in recent months, but the deal is set to see the business grow active users by more than 30 per cent and shift transaction volume to over $10 billion.

Graincorp gains on pricing, investment recovery spurs Invocare, Sandfire cuts dividend

Shares in Graincorp (ASX: GNC) were among the top-performing for the day, with the company gaining 5 per cent on the expectation that a shutdown in the supply of wheat from Ukraine will benefit alternative producers like Australia.

Funeral provider Invocare (ASX: IVC) gained another 4.5 per cent after the company moved from an $11 million loss to an $80 million profit.

Revenue rose 11 per cent to $532 million, however, it was the performance of the investments in which prepaid funeral expenses are held which drove performance following a difficult 2020 and 2021.

This reiterated that IVC is akin to an insurance or investment company.

Copper producer Sandfire (ASX: SFR) reported a 22 per cent increase in revenue, and a 24 per cent jump in profit, with production in line with expectations.

A surging copper price has been central to the recovery but wasn’t enough to offset a significant cut in the dividend.

Finally, US gambling hopeful Pointsbet (ASX: PBH) appears to have slowed the bleeding, falling 1.1 per cent, despite last week reporting that accumulated losses in its pursuit of the lucrative online gaming market in the US now exceed $427 million.

Global markets digest expanding sanctions, Russia hikes rates, trade deficit surges

The market direction remains dominated by the events in Ukraine, with little in the way of company-specific news.

The weekend saw an aggressive expansion in sanctions against Russia, including banning the country from using the global SWIFT payments system.

The result has been a rumoured run-on Russian banks with balances deemed all but useless.

The central bank has sought to protect the tumbling currency by hiking interest rates from 9.5 to 20 per cent in hopes this will attract bond buyers, whilst the sharemarket has been halted after the likes of Sberbank fell 75 per cent in UK trading.

Over 90 per cent of S&P500 companies fell on Monday, with beaten-down Teladoc (NASDAQ: TDOC) adding 6 per cent after announcing a tie-up with Amazon (NYSE: AMZN) for their e-health delivery.

The Dow Jones finished down 0.5 per cent, the S&P500 0.2 and the Nasdaq gained 0.4.

The US trade deficit also hit a record high, up 7.1 per cent to US$107 billion as imports continue to outweigh exports.

Oil major BP (LON: BP) also announced they would exit their US$25 billion investment in Rosneft, the Russian oil company that represents half of their oil and gas reserves.