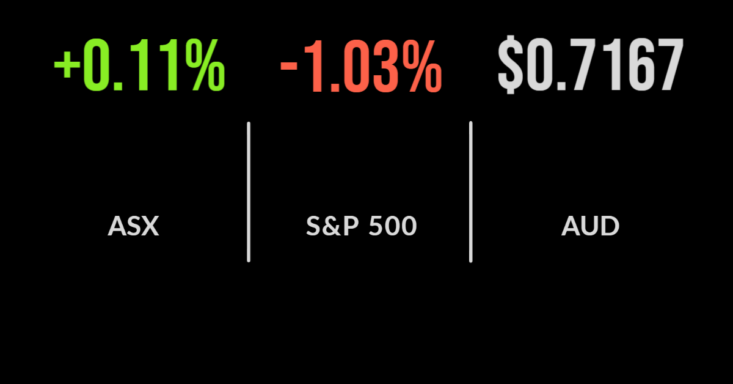

ASX closes up 0.11%, Afterpay share price plummets

Rates send markets lower, Magellan loses ‘material’ client, gold miners shine

The local market benefitted from a strong overseas lead but managed to deliver a gain of just 0.1 per cent on Friday.

The technology sector continues to be the largest drag, falling 3.9 per cent for the day and 4.5 per cent for the week, with energy and materials both gaining over 1 per cent.

Afterpay (ASX: APT) and Zip Co (ASX: Z1P) were among the biggest detractors falling 7.6 and 6.1 per cent respectively after the US government announced a review of the fast-growing BNPL loan sector.

The materials sector gained 2.3 per cent across the week with gold miners topping the leader board as the threat of rate hikes sends investors back into the traditional volatility and inflation hedge; Northern Star (ASX: NST) gained 5.6 per cent, Evolution (ASX: EVN) gained 4.2 per cent.

Magellan (ASX: MFG) shares were 1.7 per cent higher before entering a trading halt with management indicated they had lost a ‘material contract’.

Rumours are swirling that they may have lost the St James Place contract of UK financial advisory firm, which is said to represent as much as 18 per cent of their assets under management.

This comes after a 40 per cent fall in the share price on rising uncertainty.

Rollercoaster week, yield curves flatten, quadruple witching

Experts have blamed another ‘quadruple witching’ event on the volatility that gripped US markets this week.

The Dow Jones finished 1.5 per cent lower, the S&P500 1 and the Nasdaq just 0.1 per cent as a series of option contract expirations coincided with what may well be the last trading day of the year with significant volume to allow investors to rebalance.

Omicron is surging around the world with New York reporting record case numbers and investors once again growing concerned about potential restrictions.

The value rotation has continued, with the likes of Amazon (NYSE: AMZN), Apple (NYSE: AAPL) and Tesla (NYSE: TSLA) losing out in favour of the banking and energy sectors.

Shares in courier business FedEx gained 5 per cent after raising their outlook and confirming they expect a profit margin of 10 per cent in the next two quarters as labour shortages subside.

The company remains well positioned to benefit from the surge in e-commerce as the leader in US package deliveries.

Over the week the technology sector couldn’t overcome the move higher in interest rates, the Nasdaq sinking 3 per cent, with the S&P500 and Dow falling 1.9 and 1.7 per cent respectively.

Rate hikes begin, new highs but more losers, BNPL faces regulatory challenge

The UK central bank this week became the first to move interest rates higher among G7 nations, with little reaction in most markets.

The so-called hawkish chancellor views the inflation surge, primarily driven by energy and labour shortages, as enough to warrant the move.

The question, however, is what impact this has on the economy, with many concerned early rate hikes may send the economy into a recession.

New record highs have become common place in 2021, but it isn’t all smooth sailing below the surface.

The Russell 2000 is now in a technical correction, having fallen 10 per cent from recent highs.

Whilst the index is still higher over the year, the median stock has fallen by more than 20 per cent.

Similarly, recent IPOs are down by an average of 20 per cent and a group of profitless tech names has fallen 30 per cent in a few short weeks.

It looks like the BNPL sector is bearing the brunt of pent-up regulatory power in the US, with Friday’s announcement of an investigation into potentially predatory loans sending the sector into a tailspin.