ASX (ASX:XAO) down on banks, AMP hit by class action, China economic data underwhelms

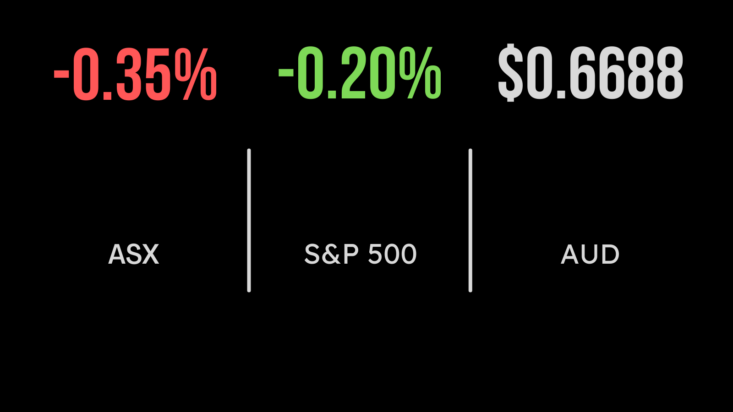

The Australian sharemarket broke its FY24 winning streak on Wednesday, with the All Ordinaries (ASX:XAO) dropping 0.3 and the S&P/ASX200 (ASX:XJO) down 0.4 per cent as the healthcare and financial sectors dragged the market lower. Embattled wealth manager AMP (ASX:AMP) was the biggest detractor, with shares falling 6.1 per cent after the Federal Court ruled against the company in the beginning of a class action case related to the Buyer of Last Resort program it had in place for financial advisers relating to the resale of their businesses. The claim related to a reduced valuation paid by AMP, with the company noting that the impact for other class action group members would now need to be quantified. While not a sign of weakness, the latest manufacturing data out of China showed a weaker than expected PMI result, of 53.9 vs. 56.2 points that many expected, suggesting the economy will grow strongly, but not as rapidly as first thought.

Johns Lyng expands, platforms down on flow pressure, Treasury cuts production

Shares in the major superannuation and wealth platforms, Hub 24 (ASX:HUB) and Netwealth (ASX:NWL) were both hit by a broker report suggesting margins may be under pressure in the coming year. Citi has suggested rising term deposit rates may impact on inflows onto both platforms, with the group reducing earnings growth forecasts as a result. Shares in winemaker Treasury Wines (ASX:TWE) were unmoved by news that the company had mothballed one of its smaller vineyards outside of Mildura. Karadoc will be shut down after 50 years as the demand for low cost wine reduces. Shares in Johns Lyng (ASX:JLG) were flat after the company entered a trading halt in an effort to raise capital for two new acquisitions. The new businesses will expand the maintenance and repairs groups divisions, adding Smoke Alarms Australia and Link Fire Holdings to the stable. In a positive sign for the energy sector, AGL Energy (ASX:AGL) also reached a new 52 week high after gaining 2.4 per cent on surging global energy prices.

Markets weaken in Fed minutes, Rivian jumps autonomous trucks, goods orders rise

All three US benchmarks weakened slightly as the market reopened following the 4th of July holiday. The Dow Jones fell 0.4, the S&P500 0.2 and the Nasdaq 0.1 per cent. The negativity came from the release of the Fed minutes which showed intentions for further rate hikes this year, while on the positive side manufacturing orders rose 0.3 per cent in May. Shares in electric vehicles maker Rivian (NYSE:RIVN) gained more than 4 per cent after Amazon (NYSE:AMZN) confirmed it had begun rolling out the first round of electric delivery vans produced by the company. United Parcel Service (NYSE:UPS) fell by 2 per cent after news spread that the company had walked away from union negotiations representing 340,000 employees. It was a similar story for Nikola (NYSE:NKLA) with the company gaining 4 per cent after confirming the delivery of 111 battery-electric trucks to market as production continues to grow.