A new supercycle?

The huge movement in commodity prices in the past year cannot have escaped any investor’s attention. Should there be new allocations to commodities and resource stocks on the basis we are in a prolonged period of price rises?

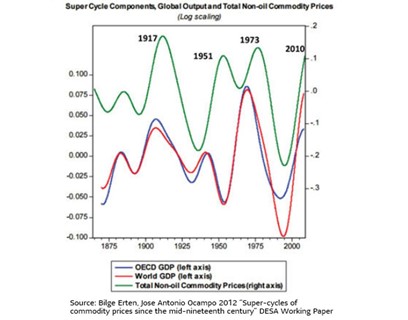

Over the past 150 years there have been only four major commodity cycles that have lasted for a prolonged period. The first was supported by the rapid development of the US in the early 1900’s, the second came after WW2, the third was mostly energy related as nationalistic restraints drove up prices and finally, the most recent of 2000-2010 was underpinned by China’s rise as a global manufacturing nation.

The fundamental support for a new cycle is complex. Oil and energy resources are unlikely given rapid transition to renewables. Iron ore is linked to large scale infrastructure. The programme proposed in the US, yet to pass the Senate, is skewed to assets that are low consumers of steel. Marginal products that have recently been in the news such as lumber are already turning down, as is the same with some agricultural products. These are, in any event, highly unlikely to represent a supercycle.

The clear potential lies with the likes of copper, lithium, nickel sulfate and a few others. That will not represent the traditional approach. The S&P Commodity Index may well evolve to include renewable energy sources rather than fossil fuel, yet the price of renewables is heading down rather than up.

Historic lessons from commodity cycles may need tweaking. This one does not necessarily mean USD weakness, or at least the correlation is suspect. The trade weighted dollar is rather subject to the lack of carry given low rates in the US and large debt issuance. Nor is an index a great idea given the weight in fossil fuels. Most observers are of the view many industrial commodity prices, including oil, still have upside in the coming year, but that this is not the makings of a sustainable pattern.

Resource funds with an eye on the few commodities that look like long term winners could be a good satellite position. The problem is often the lack of investable options. New copper mines are rare, many prospects have marginal grades and complex mining, or are in regions that are considered unreliable. Nonetheless the absence of commodity stocks in most broad cap funds suggests a bespoke allocation may be useful.

The few dedicated resource funds have sufficient diversity in approach to distinguish them for different portfolios. Some take a broader view of what are resources by including renewable energy, packaging companies and food processors. Others offer a long short style. The majority though have high volatility and gappy drawdowns that may not suit anxious investors. ESG is another tough debatable overlay.

Yet the segment deserves renewed attention rather than just hoping the current commodity price cycle abates to justify its lack of position in portfolios.