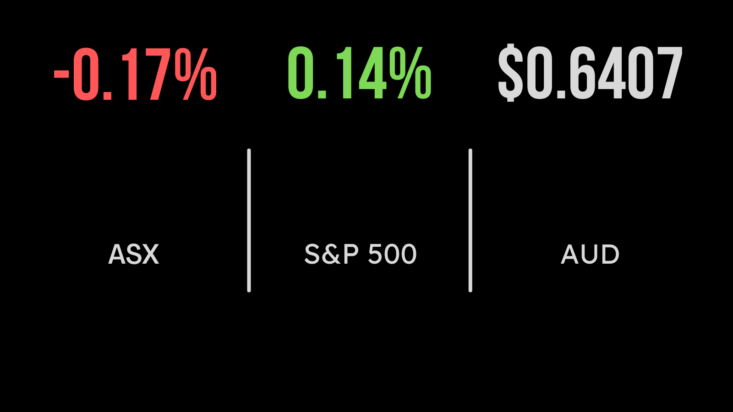

Iron ore hits market (ASX:XJO), AMA tumbles on raising, Platinum remains under pressure

Both benchmarks weakened into the close, as both the S&P/ASX200 (ASX:XJO) and All Ordinaries (ASX:XAO) fell 0.2 per cent on Friday. The weakness was driven by the materials sector, which fell 1 per cent, driven lower by BHP (ASX:BHP) and Fortescue (ASX:FMG), down 1.2 and 2.4 per cent. The highlight was the utilities sector which gained 1.1 per cent. Iron ore remains under pressure as weakness in the Chinese economy continues. Smash repairer AMA Group (ASX:AMA) fell 50 per cent after the company resumed trading following a $55 million equity raising, with pressure continuing to grow. It was a similar story for Platinum Asset Management (ASX:PTM) as shares fell 4.4 per cent following a report from broker Barrenjoey that suggested the business would face continued competitive pressure. Across the weak both benchmarks fell 1.7 per cent, with energy the only positive contributor, up 0.6 per cent. The materials sector fell 3 per cent, despite Liontown (ASX:LTR) topping the market up 16.4 per cent. US markets gain on Apple, DocuSign improves, ARM IPO nears All three US benchmarks finished the week lower, with the Dow Jones down 0.7, the S&P500 1.3 and the Nasdaq 1.9 per cent. This was despite a positive end to the week, in which the Dow Jones added a 0.2 per cent gain on Friday. Among the key drivers was some settling in Apple (NYSE:AAPL) shares, which gained 0.4 per cent after a week of sustained losses. The rally came after NY Fed President delivered an address suggesting he was comfortable with the current level of interest rates. Shares in digital document platform DocuSign (NYSE:DOCU) fell more than 3 per cent despite the company topping earnings expectations and increasing guidance for the year ahead. There was positive news for Australian grocers after Kroger (NYSE:KR) added 3.1 per cent, despite a downbeat report. The ARM IPO is nearing settlement, with management now expecting an 11 per cent revenue growth in the year ahead. Oil the unexpected drag, GDP slows but recession averted, raising, acquisitions return News that both Russia and Saudi Arabia would be cutting production and thus sending oil prices higher stands out as an unexpected drag on an economy that appeared resilient in the face of aggressive rate hikes. As inflation recedes, the threat of oil putting a handbrake on growth is becoming a heightened concern. The weakness in China and the impact of rates was evidenced by the slowing domestic economic growth rate, which fell to 2.1 per cent despite being supported by an incredible surge in inflation. Consumer spending is buckling in the face of impact of cost of living increases. This week was all about capital raisings, with the likes of Orora raising capital for aggressive acquisitions, AMA simply to boost operations and finally the growin energy in the lithium and materials sector.