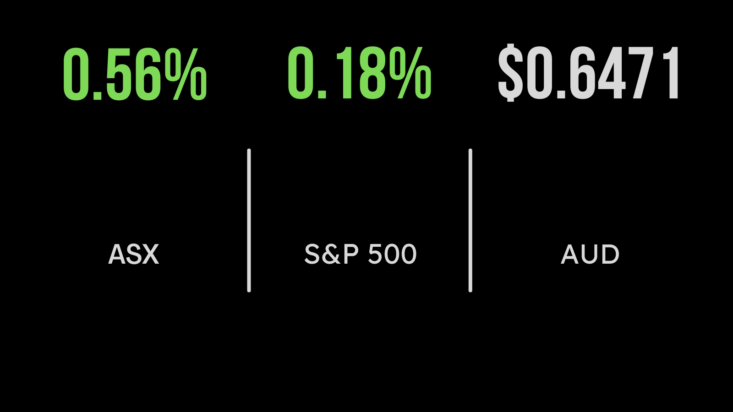

Market (ASX:XJO) hit on Qantas, Fortescue woes, China stimulus boosts sentiment

Both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) fell 0.4 per cent on Friday, but still managed to deliver a 2.3 per cent gain for the week. The mining and retailing sectors remain under significant pressure, despite news of stimulus from the Chinese banking sector. Shares in Fortescue (ASX:FMG) fell another 5.3 per cent after news that board member Guy Debelle would also be departing the embattled company just days after the companies’ CFO announced her intention to step down. This was enough to offset the positive sentiment that the Chinese government and central banks would be cutting interest rates and lowering the capital margin in an effort to stimulate growth. On the positive side, was the energy sector, with Whitehaven (ASX:WHC) gaining 4 per cent and Boral (ASX:BLD) 2.1 after the Stokes family confirmed they had no intention to sell down their holding further. Over the week, every sector finished higher, led by retail, which added 3.4 and financials 2.6 per cent on signs of an improving property sector. Harvey Norman (ASX:HVN) managed a 9.6 per cent gain. Dow surges to best weekly gain since June, unemployment jumps, Dell, Lulu deliver The Dow Jones managed to post its strongest weekly gain since June, gaining 0.3 per cent on Friday and taking the market to a 1.4 per cent gain across the five days. It was a similar story for the Nasdaq and S&P500, with both posting back to back weekly gains, up 2.5 and 3.2 per cent, despite finishing 0.2 per cent higher and down 0.02 per cent on Friday. Among the strongest performers were Dell (NYSE:DELL) which gained more than 21 per cent after the company reporting strong growth in its software storage solution and AI-powered services. Earnings were down on the prior quarter but forecasts were better than expected. Athleisure wear producer Lululemon (NYSE:LULU) gained more than 6 per cent after the company reported an 18 per cent increase in sales, spurred on by discounting and the strong brand. Same store sales were 11 per cent higher, reflecting strength across the world for the global brand. Unemployment in the US increased to 3.8 per cent, after a significant slowdown in jobs growth was evidenced by just 187k new jobs gains in the month. China stimulus returns, property resilience grows, Future fund returns 6 per cent It has taken a little longer than expected, but the Chinese government appears to step into the fold and support the now sputtering economy. News this week that the reserve requirement would be dropped from 6 to 4 per cent, while a number of banks cut deposit rates in order to protect profitability were seen as a positive step to stimulate growth. Rate cuts are important given the massive increase in savings post the pandemic, and seeks to stimulate consumption. This comes after the PMI results show the manufacturing sector returns to expansionary phase in July. News this week that Sydney house prices had recovered another 1.1 per cent in August has spurred hopes of a 10 per cent gain for the year, as a shortage of property offsets the increasing cost of interest. Finally, the Future Fund released performance data for the financial year, posting a return of 6 per cent, which is at the lower end of most similar institutional investors. The reason being a decision to reduce risk in light of growing uncertainty and volatility.