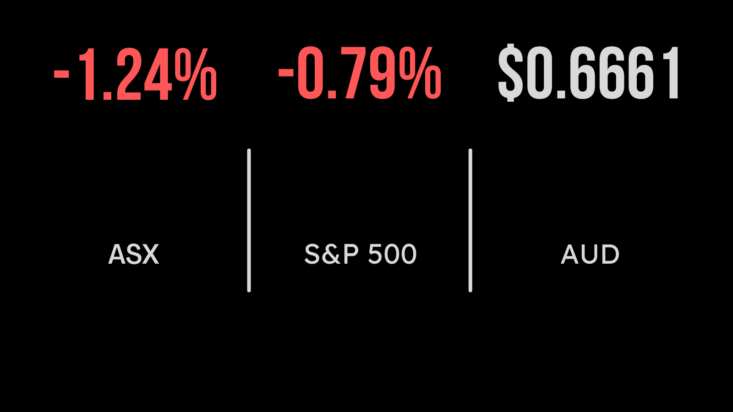

Market (ASX:XJO) on US rate concerns, Star sinks, Magellan outflows grow

The local share market was dragged lower by concerns of further rate hikes in the US, with both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) falling by 1.2 per cent with just the technology sector finishing higher, gaining 0.1 per cent. The materials and retail sectors were the biggest laggards both falling 1.9 per cent, led by Star Entertainment (ASX:SGR) which fell 8.7 per cent on growing debt concerns. It was a similar case for Magellan (ASX:MFG) with the embattled fund manager and activist target dropping 8.3 per cent on another round of outflows. The group saw another $2.1 billion in outflows, taking funds under management to $39.7 billion, despite finally showing signs of outperformance. Johns Lyng (ASX:JLG) also confirmed the successful raise of $65 million to fund the prior announced acquisitions.

Bubs release strategic review, Pinnacle’s flag performance fees, oil price settles on inventories

Infant milk producer Bub’s (ASX:BUB released the details of its strategic review, sending the share price more than 2 per cent lower. The key takeaways were confirmation of a strategic reset in China, more pressure on operating capacity at existing assets and most importantly a $10 million cut to monthly operating expenses, as well as a halving of cash burn. Cath Whitaker has stepped down as CEO of Self Wealth (ASX:SWL), with shares dropping 3.2 per cent on the news. The energy sector also benefitted from news that inventories had grown in the US, offsetting the recent rally on the back of announced production cuts. Australia’s trade surplus jumped to $11.8 billion in May, gaining on another surge in commodity prices. The NBN announced its intention to compete with the new Telstra-Starlink partnership, as it seeks to expand services into regional areas.

Strong jobs market pulls Dow Jones lower, bond yields jump, Meta releases Twitter killer

Much stronger expected jobs data in the US, which saw 497,000 jobs created in June, triggered a selloff in equity markets, as bond yields surged once again. This comes after the Fed suggested another few rate hikes may be required to cool such a robust economy. It was a similar story in the services sector, with the PMI reading coming out at 53.9, well above the prior level of 51.3 and suggesting consumers are not slowing down. The result was a 1.1 per cent fall in the Dow Jones, 0.7 per cent loss for the S&P500 and 0.8 per cent for the Nasdaq. Shares in Meta Platforms (NYSE:META) fell slightly after the company brought forward the release of its Threads platform on Facebook, an alternative to Elon Musk’s Twitter. Oil producer Exxon Mobil (NYSE:XOM) also fell by close to 4 per cent after the company warned of lower profits as oil and gas prices fall.