Market mulls strong jobs, retail sales numbers

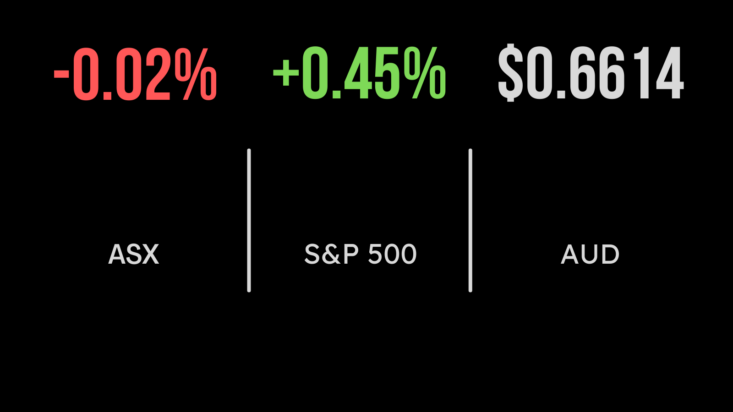

The major Australian induces were becalmed on Thursday as stronger-than-expected retail sales and jobs data suggested the Reserve Bank might need to lift interest rates again next week, in an attempt to slow a still-strong economy.

Data from the Australian Bureau of Statistics showed that Australia’s jobs market remains resilient despite the Reserve Bank’s historic pace of interest rate increases over the past year. Job vacancies showed just 1.2 people looking for a job for each vacancy.

And retail sales in May increased 0.7 per cent seasonally adjusted, beating forecasts of 0.1 per cent growth, and following a flat result in April.

The benchmark S&P/ASX 200 was down on the day, but only by 1.6 points to 7194.9 points, although that small loss did represent its first down day in three. The broader All Ordinaries index advanced 5.5 points, to 7,389.6.

Of the big banks, Commonwealth Bank advanced 53 cents, or 0.5 per cent, to $100.07; ANZ gained 28 cents, or 1.2 per cent, to $23.71; National Australia Bank lifted 10 cents, or 0.4 per cent, to $26.35; and Westpac closed 2 cents higher, at $21.42. Global investment bank and wealth manager Macquarie Group was up $1.30, or 0.7 per cent, to $176.27; and “mini-major” Bendigo Bank appreciated 3 cents, or 0.3 per cent, to $8.58.

Among the technology cohort, cloud accounting software business Xero lifted $2.59, or 2.3 per cent; to $117.28, logistics software leader WiseTech added $1.69, or 2.2 per cent, to $79.35; data centre operator NextDC gained 20 cents, or 1.6 per cent, to $12.49; and enterprise software group Technology One jumped 25 cents, or 1.6 per cent, to $15.69.

Real estate advertiser Domain was up 18 cents, or 5.1 per cent, to $3.71, while healthcare giant CSL was down 5 cents to $278.30.

Mixed messages from mining

Among the bulk miners, BHP lost 47 cents, or 1 per cent, to $44.95; Rio Tinto drifted $1.33, or 1.1 per cent, lower to $114.46; while Fortescue Metals added 10 cents, or 0.4 per cent, to $22.11.

In gold, Evolution Mining slipped 7 cents, or 2.1 per cent, to $3.23; Northern Star lost 21 cents, or 1.7 per cent, to $12.12; Gold Road Resources was down 4.5 cents, or 2.9 per cent; Silver Lake Resources gave up 1.5 cents, or 1.5 per cent, to 97.5 cents; and Regis Resources was off 2.5 cents, or 1.3 per cent, to $1.835; but Bellevue Gold accrued 1.5 cents, or 1.2 per cent, to $1.265.

On planet lithium, producer Allkem eased 13 cents, or 0.8 per cent, to $15.99; fellow producer Pilbara Minerals was unchanged at $4.83; IGO, which mines nickel as well as lithium, shed 6 cents, or 0.4 per cent, to $15.02; but Mineral Resources, which produces iron ore as well as lithium, rose 35 cents, or 0.5 per cent, to $71.20.

In coal, Whitehaven Coal gained 8 cents, or 1.2 per cent, to $6.80; New Hope Corporation strengthened 5 cents, or 1 per cent, to $4.85; Coronado Global Resources walked back 1.5 cents, or 1 per cent, to $1.525; and Yancoal Australia lifted 4 cents, or 0.9 per cent, to $4.50.

Namibia-based uranium miner Paladin moved 3 cents, or 4.3 per cent, higher to 73 cents, after telling the market on Wednesday that it is exploring plans to raise capital. Copper leader Sandfire eased 2 cents, or 0.3 per cent, to $5.93, and rare earths producer Lynas dropped 13 cents, or 1.9 per cent, to $6.82.

US economy surprises on the upside

In the US, the final reading of first-quarter GDP was revised higher to show the economy expanded at 2 per cent annualised rate, up from 1.3. per cent previously. The revision was driven by exports and consumer spending, which lifted 7.8 per cent and 4.2 per cent respectively. The numbers imply that the Fed’s tightening cycle is not crimping the economy to the extent that many thought.

The 30-stock Dow Jones Industrial Average rose 296.76 points, or 0.8 per cent, to 34,122.42, while the broader S&P 500 index gained 19.58 points, or 0.4 per cent, to 4,396.44, and the tech-heavy Nasdaq Composite index retreated a barely noticeable 0.4 of one point, to 13,591.33.

The top two stocks in the S&P 500 (Apple and Microsoft) now represent a combined 14.4 per cent of the index, the highest weighting for any two companies with data going back to 1980.

On the bond market, the US 10-year yield advanced 13.4 basis points, to 3.846 per cent, while the 2-year yield was up 15 basis points, to 4.866 per cent.

Gold lost 86 cents overnight, to US$1,908.82 an ounce; the global benchmark Brent crude oil grade firmed 31 cents, or 0.4 per cent, to US$74.34 a barrel; and US West Texas Intermediate crude retreated 7 cents, to US$69.79 a barrel.