Less millionaires, more money as $5M to $10M investible asset cohort grows

There are slightly fewer high-net-worth (HNW) investors controlling slightly more investable assets this year than in 2021, and these investors are increasingly focussing on defensive assets and intergenerational wealth preservation as they face a potential market downturn, new research from Investment Trends shows.

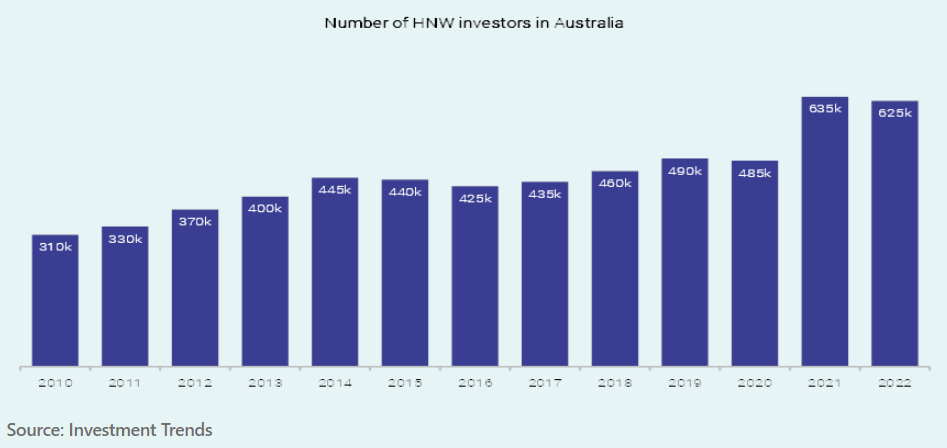

After surging to 635,000 last year from 485,000 in 2020, the population of those controlling more than $1 million in investable assets dipped to 625,000 in the research company’s recent 2022 High Net Worth Investor Report. The group’s total investable assets ticked up to $2.82 trillion from $2.72 trillion in 2021.

The change in the average demographic profile of the HNW population was small compared with the significant jump recorded last year, Irene Guiamatsia, head of research at Investment Trends, tells The Inside Investor. She adds that the 120,000 new millionaires added to the population last year brought down the average age of the HNW cohort to about 60.

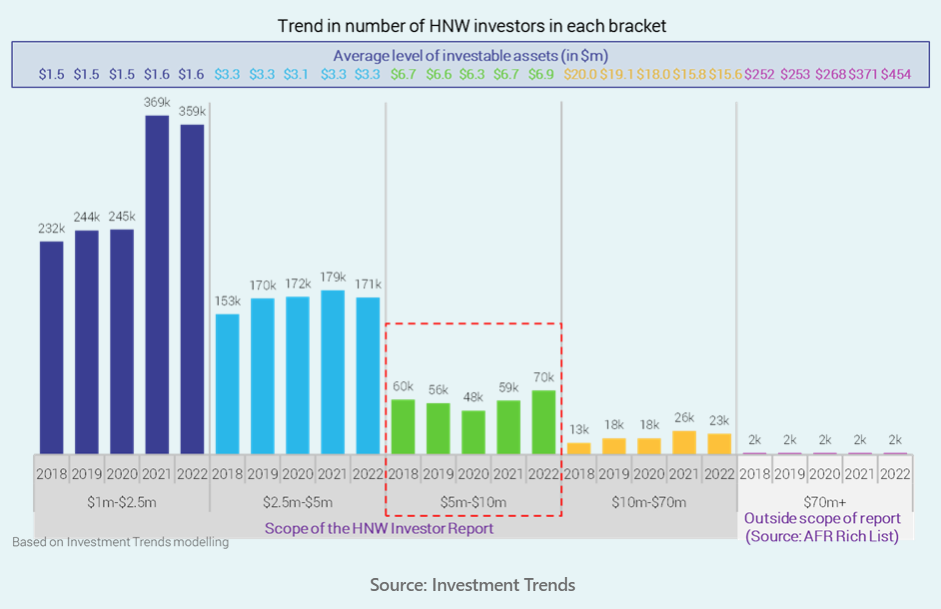

“The key change of note this year was the fact that the $5 million-$10 million segment continued to grow even as the others contracted,” Guiamatsia says. “Drilling down, it transpired this group has a higher propensity to have generated their wealth from the proceeds of the sale of a business.”

The report, which aims to provide an in-depth look at Australian HNW investing behaviour and investors’ product and advice needs, “highlights that as we come out of a period of unprecedented asset value growth” reflected in the lower overall HNW population, “the total level of investable assets held steady”, Investment Trends notes. This investor class is also showing to be reactive to the changing macroeconomic outlook, which may underpin its resilience.

According to Guiamatsia, the fact that the level of wealth is continuing to increase reflects that property prices held up relatively well during the reporting period, as did certain equity sectors, such as resources and commodities, which include blue-chip stocks that are typically found in HNW portfolios.

Just under two in five HNW investors (37 per cent) reported making substantial asset allocation changes to their portfolio in the year through June 30, down from 41 per cent in 2021 and 50 percent in 2020, which was a record high, according to Investment Trends.

The report also revealed an increased focus on defensive assets and intergenerational wealth preservation, although Guiamatsia noted that while investors are recalibrating their objectives in response to the macroeconomic environment, the overall trend this year is a return to “normal”.

“Capital protection usually features as the top investment objective for about 15 per cent of HNWI, and the 2021 ‘everything bubble’ drove many HNWs to temporarily emphasise their focus on capital growth,” she says.

“Fixed-income funds are a natural go-to to gain exposure to the asset class, but investors also consider equities for both capital growth and yield,” Guiamatsia says of the report’s findings that HNW investors have recalibrated their investment goals for a subdued outlook for the next year and are looking more to protect their assets against a market downturn. “And when it comes to listed products, those with the highest latent demand among HNWs (existing demand that is not satisfied) are global equities and ETFs.”

And HNW investors plan to pass down nearly $2 trillion in assets to the next generation, or around 70 per cent of their total assets. When they discuss intergenerational planning, they largely consult financial advisers, and they seek advice particularly on tax optimisation and wealth preservation, the report states.

The report, issued annually, “always explores in a great deal of detail how product issuers, advise providers and technology providers can best support high-net-worth investors,” according to Guiamatsia. “This year’s report shines a light on the sharper focus HNW families are placing on wealth preservation across generations.”