Market up ahead of likely rate rise

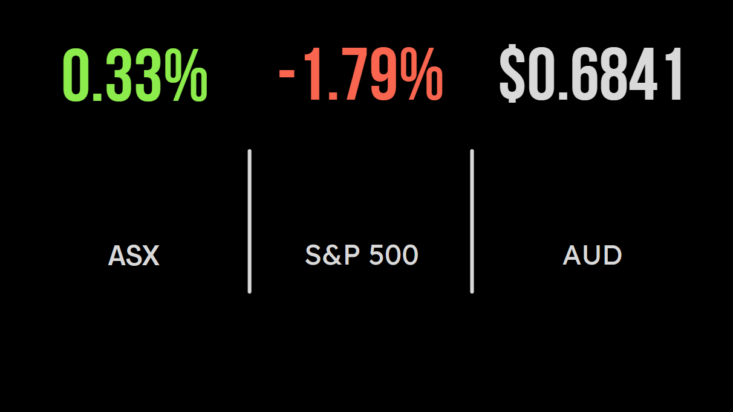

Despite plenty of uncertainty around what the Reserve Bank will announce with the cash rate this morning – although consensus expects that the central bank will lift the cash rate by another 25 basis points, to 3.15 per cent – there was a reasonably positive mood afoot on the local stock market on Monday, with the benchmark S&P/ASX 200 index adding 24.1 points, or 0.3 per cent, to 7325.6 points, nearing a six-month high reached last week. The broader All Ordinaries index gained 24.3 points, also 0.3 per cent, to 7527.8.

The energy and mining sectors led the rise, gaining 1.5 and 1.4 per cent, respectively, with the miners buoyed by the improving iron ore price. Iron ore specialist Fortescue Metals gained $1.35, or 6.9 per cent to a nearly six-month high of $21.03, while BHP was up $1.05, or 2.3 per cent, to $46.81, while Rio Tinto surged $4.19, or 3.7 per cent, to $116.13.

Diversified miner South32 advanced 15 cents, or 3.6 per cent, to $4.34; Mineral Resources, which mines iron ore and lithium, gained 81 cents, or 0.9 per cent, to $90.64; but IGO, which produces nickel as well as lithium, lost 80 cents, or 4.9 per cent, to $15.54. Copper producer Sandfire Resources put on 17 cents, or 3.2 per cent, to $5.42. In gold, Northern Star eased 16 cents, or 1.4 per cent, to $10.92, while Gold Road Resources shed 6.5 cents, or 3.5 per cent, to $1.77

Resources tough outside iron ore

Rare earths heavyweight Lynas Rare Earths retreated 38 cents, or 4.2 per cent, to $8.64, while project developer Arafura Rare Earths was also lower, down 2.5 cents, or 5.7 per cent, to 42 cents. Mineral sands and rare earths producer Iluka gained 11 cents, or 1.1 per cent, to $10.45.

Coal was on the back foot, with Whitehaven Coal easing 19 cents, or 2 per cent, to $9.55;

New Hope Corporation losing 9 cents, or 1.6 per cent, to $5.65; Stanmore Resources dropping 9 cents, or 3.4 per cent, to $2.56; and Yancoal Australia down 32 cents, or 5.6 per cent, to $5.35.

In lithium, producer Allkem lost 28 cents, or 1.9 per cent, to $14.11; fellow producer Pilbara Minerals gave up 25 cents, or 5.1 per cent, to $4.61; Lake Resources shed 3 cents, or 2.9 per cent, to $1.00; Liontown Resources was down 5 cents, or 2.4 per cent, to $2.03; and Core Lithium dropped 6 cents, or 4.4 per cent, to $1.31; although Piedmont Lithium, which has offtake agreements with Tesla for its US lithium project, went against the trend, gaining 5 cents, or 6.1 per cent, to 87 cents.

In energy, oil and gas producer Beach Energy gained 9.5 cents, or 5.3 per cent, to a six-month high of $1.90; Santos moved 19 cents, or 2.7 per cent, higher to $7.34; and Woodside Energy rose 70 cents, or 2 per cent, to $36.41.

Among the big banks, National Australia Bank retreated 12 cents, or 0.4 per cent, to $31.26; ANZ was down 8 cents, or 0.3 per cent, to $24.57; Westpac eased 4 cents, or 0.2 per cent, to $23.72; and Commonwealth Bank gave up 1 cent, to $106.94.

Resilient US economy fuels rate fears

On Wall Street, the broad S&P 500 shed 72.9 points, or 1.8 per cent, to 3,998.8, while the 30-stock Dow Jones Industrial Average shed 482.8 points, or 1.4 per cent, to 33,947.1 and the technology-focused Nasdaq Composite Index was off 221.6 points, or 1.9 per cent, to 11,239.9.

US readings on service-sector activity and factory output indicated that the economy remains robust, raising concerns that the US Federal Reserve will have to keep lifting rates to slow growth – possibly above 5 per cent in 2023 after a 50 basis point increase this month.

US 10-year bond yields rose to 3.60 per cent and the more economically sensitive two-year yield jumped to 4.4 per cent.

Oil prices fell as the $US60 per barrel cap on Russian crude kicked in and as China’s easing of some COVID restrictions flowed through to forecasts of increasing demand. The global benchmark Brent crude oil traded US$2.60, or 3.4 per cent, lower at $US82.68 a barrel, while US West Texas Intermediate shed US$3.05, or 3.8 per cent, to $US76.93 per barrel.

The gold futures price fell 1.6 per cent to $US1781.30 an ounce, while iron ore futures rose 0.2 per cent to $US107.68 per tonne. The Australian dollar is buying 66.97 US cents this morning.