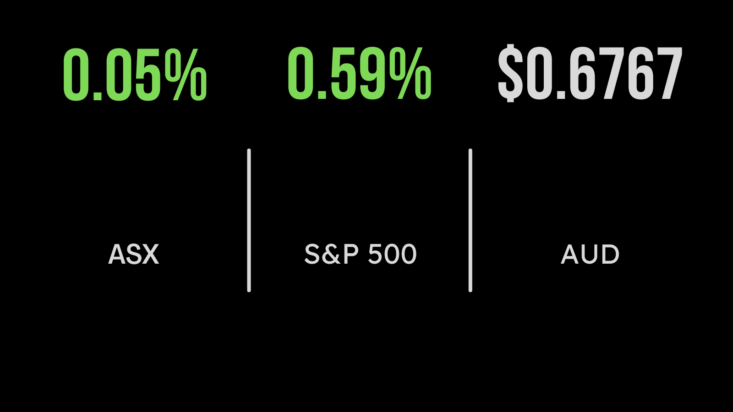

ASX strength continues, energy sinks on coal sales, Harvey Norman, Nick Scali shine

Performance across the key sectors of the S&P/ASX200 continues to diverge with a weak day for energy, down 1.8 per cent, offset by gains in the technology and real estate sectors, which both added 1.2 per cent.

Vicinity Centres (ASX:VCX) was a highlight, adding 4.1 per cent following the departure of its CEO, while Whitehaven (ASX:WHC) tanked by more than 6 per cent after its own CEO declared the sale of some $8 million in shares of the company.

Gold miners were also a standout as hopes of a slowdown in rate hikes benefitted the price of bullion with St Barbara (ASX:SBM) jumping 9.1 per cent.

Shares in struggling e-commerce retailer Kogan (ASX:KGN) gained close to 8 per cent after the company delivered another weak sales result, albeit an improvement on expectations.

Earnings fell to a small loss, with sales down 38 per cent compared to the prior year but management are confident that excess inventory has nearly been cleared, allowing a return to prior growth levels.

Harvey Norman’s surprise sales jump, Scali keeps delivering

Old-fashioned retailer Harvey Norman (ASX:HVN) is showing few signs of a slowdown in the economy or consumer spending with the company surprising the market when delivering a 6.9 per cent increase in global sales for the four months to October 31.

Same stores sales were up 6.3 per cent across the various brands. It was a similarly positive store for the franchised stores, which reported 8.8 per cent sales growth while management now expect to open 50 stores in Malaysia over the next six years. Shares were down 1.4 per cent.

Furniture retailer delivered a similar surprise, describing financial year performance as ‘robust’ with sales increasing 55 per cent on the prior year, and profit margin hitting 61 per cent.

The result was an increase in profit expectations to $59 to $59 million or more than 50 per cent on the prior year; shares gained 9.5 per cent.

US markets closed for Thanksgiving