Bitcoin builds credibility for a new asset class

The recent surge in the market value of Bitcoin (BTC) has made headlines this holiday season as the underlying structure of the market continues to attract more institutional investors.

Recent announcements from global leading fund managers, corporations and insurance companies have highlighted a seismic shift in an investor base focused on Bitcoin’s value proposition of scarcity and “store of value.”

The continual employment of unconventional global central bank policy of maximum liquidity and central bank balance sheet expansion, coupled with fiscal stimulus of previously unimaginable largesse, has raised the alarm over the long-term impact on the value of fiat money.

Understandably, protecting wealth and purchasing power has become a major theme for investors. Tech billionaire and founder of Nasdaq listed Microstrategy Inc. (MSTR), Michael Saylor, has recently made solid arguments for Bitcoin relative to other potential hedges against this currency debasement – arguments that have been backed-up by his significant investment, valued at more than US$3 billion (buying BTC at $35,000) through MSTR and various entities.

For Saylor, “Bitcoin represents an infinitely hard asset, whereas gold “can be produced by humans given the right incentive,” he says. “If you double the price of gold, you’re going to double the incentive for miners to produce gold, and if gold goes up by a factor of ten, human beings have a way of putting capital into mining and ingenuity and they’ll invent better ways to mine it, and at some point they’ll melt down their jewellery or find other gold.”

But if Bitcoin rises in price by a factor of ten, Saylor points out, no amount of investment in Bitcoin mining can produce more Bitcoin. “If I put $100 billion into gold mining, I will produce more gold. … If I put $100 billion into Bitcoin mining, I will produce no more Bitcoin, I will just produce more security.”

As of January 7, Bitcoin’s one-year performance (in A$) of +325% is naturally dominating media headlines and content. While the “store of value” attribute is the major narrative of Bitcoin, the combination of a permissionless, censorship-resistant and trust-minimising (as in, there is no need to have to trust anybody, or take any risk in trusting anybody) platform(s) for innovation is arguably the bigger story, which can be overlooked when focusing on the price action in BTC alone.

More importantly, increased adoption from institutional investors will add more credibility and growth to the entire digital-currency (crypto) asset class. As more investment professionals and their gatekeepers become technically fluent in the underlying technology, the realisation of broader digital asset-class potential should come into focus.

While Bitcoin was the first of its kind, and its growth in market value has been historic, significant progress has been made within other projects. This was most evident within the Decentralized Finance (DeFi) categories of crypto earlier this year as BTC and other crypto assets were appreciating. DeFi is the ecosystem of financial applications being built with blockchain technology to remove the need for using third-party intermediaries.

While Bitcoin may be viewed more as digital gold with a growing use case as collateral, many DeFi projects are more akin to fintech and venture capital, albeit with daily liquidity. The second-largest base layer blockchain by market capitalisation is Ethereum (ETH), a global, open-source platform for decentralised applications. Both ETH and middle-ware applications within the Ethereum ecosystem have seen massive appreciation in 2020 and the most recent market advance. As an example, while Bitcoin’s one-year A$ performance had returned over +325% as of Jan 7, ETH in A$ terms returned +655 % over the same period.

Melbourne-based Apollo Capital’s multi-strategy crypto fund has held major themes in BTC, ETH and DeFi since inception in 2018, helping Apollo gain global award recognition.

Apollo’s CIO Henrik Anderssen highlights the fact that crypto assets “leverage the technological possibilities of the digital age” to create decentralised applications that aim to empower the individual and take away control from third party intermediaries.

“DeFi represents the first time in human history that we have open and permissionless innovation in finance on a global scale,” says Anderssen. “Over the coming years, blockchain developers will continue to build a more efficient, fair and open financial system. We believe that there will be many opportunities to participate in projects that will be the first of their kind and shape the future financial system. Bitcoin will act as a pillar of value to this new and modern financial system, which is fundamentally superior to the slower-moving legacy financial system.”

Apollo’s flagship fund has recently been made available for wholesale investors on the Netwealth administration platform, indicating the growing appetite of investors and their advisers within the asset class.

Institutional Flow Changes Everything

Significant developments in 2020, including global institutional custody and administration services coupled with US federally regulated exchange-traded futures and options markets on CME/Bakkt (Intercontinental Exchange) for Bitcoin and Ethereum, has given institutional investors the ability to participate in this new area of growth.

Leading global macro managers and tech industry heavyweights have officially announced their positive views and, more importantly, many now hold “skin in the game,” adding credibility for others to follow.

Additional adoption from a diverse list of institutions including PayPal and US-based life insurance heavyweight MassMutual signal a maturing view of Bitcoin, with expectations of commercial transaction growth backed by digital assets and investment by “real money” asset owners, respectively.

With institutional ownership on the rise, investment committees and their consultants will increase their analysis of not only BTC but the broader technology and opportunities across digital assets. The asymmetric return opportunity within the asset class is simply too large to ignore. For example, a 1% portfolio allocation to BTC in 2020, would have added more than 300 basis points in performance to the anaemic returns provided by most balanced funds.

Currently, a small number of Australian superannuation funds hold non-direct exposure to crypto. For example, through global macro/managed futures strategies or tech venture capital (VC) funds. Other institutional organisations have been investigating the inclusion of BTC within their basket of foreign currency holdings, in conjunction with (or replacement of) physical gold holdings.

At Fundlab, we have held educational sessions for investment committees as their desire to investigate the opportunity set becomes more pressing. As expected, with BTC’s recent performance and credibility gained through growing institutional holdings, interest from local groups is growing. For some teams, the interest may be on general understanding of the asset class; for others the initial focus is on the potential disruption risks to their traditional financial assets, while others further along the curve are focused upon operational risks to investing.

Portfolio Construction Impact

From a portfolio construction standpoint, over longer periods crypto assets have held minimal correlation with traditional assets. However, BTC and the broader asset class has suffered in systemic stress periods like March 2020. For BTC, its promise of a potential hedge against currency debasement coupled with high asymmetric growth potential is attractive for any portfolio. However, while BTC growth is not tied to GDP growth, BTC should not be viewed as a hedge for negative equity environments.

Further, the price volatility of BTC and other crypto assets has kept many from participating in the asset class. However, that logic would have precluded many from being early investors in other technology investments like Apple and Netflix, where high volatility is common in new technology and microcap investments. For others, volatility is simply addressed by limiting the allocation size. As in broader fintech or microcap equity categories, there are clear risks including volatility and project failure.

Additional risks including regulatory concerns should not be taken lightly. However, as Bitcoin continues to build institutional consensus, it is more likely that smarter government policy will seek to support the digital asset ecosystem. Policies could be made to speed growth and add investor protection which would be both welcomed and self-reinforcing.

Like the IPO mania of the internet boom, there will be many worthless projects and opportunities to lose 100% of your investment within individual digital assets. Critically, active investment management with a focus on coin/token economics and avoiding over-concentration within any theme can help provide better risk-adjusted returns.

As with VC, leading crypto funds are sought by new project developers not only for their capital, but for the credibility, advice, and networking that such a fund’s participation may grant. Established crypto fund managers with global networks can gain early access to projects at pre-public pricing.

Assets with high asymmetric return profiles and low correlation with traditional assets can make a substantial improvement to portfolio returns. The magnitude of volatility can make a material benefit with a relatively small portfolio allocation.

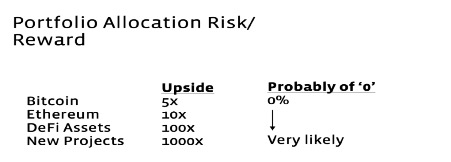

For Apollo’s Andersson, this asymmetry can be outlined with the simple illustrative comparison of the asymmetric relationship available for different-stage investments.

As BTC has moved along its “S” curve of growth over the past ten years, the upside in BTC – while still extremely attractive – will be a fraction of the growth of successful new projects. However, risk and reward are always intertwined, and new projects on average will always have a higher probability of failure.

Diversification and sizing smaller allocations to higher-risk assets, whether BTC in a traditional portfolio or new projects within a digital asset portfolio, is practical.

New Era

Importantly, the initial view of BTC as a mere speculative asset is being supplanted with BTC’s potential as a store of value, one with a potentially high growth rate. Most notably, the open-source blockchain architecture for the next generation of “use-case” innovations are well underway. The industry will continue to see exponential growth in innovation and applications beyond Bitcoin.

With each passing day, BTC’s entrenchment within the financial industry will reduce the risk of failure and will be additive for the entire industry’s growth. The potential for Bitcoin to be developed into a more reserve asset and global form of collateral promises to be its next step along its curve. As ETH and other blockchain ecosystems develop, 2020’s growth in areas such as earning yield and staking credit from digital asset holdings will mature as innovation and continual improvements compound growth by design.

To be sure, volatility and risk of failure are always present when seeking high returns. However, in a traditional investment world likely faced with low rates of growth, the potential of digital assets should be welcomed. Size appropriately!

Disclaimer

This material has been intended for educational purposes and to provide background information only and does not purport to make any recommendation upon which you may reasonably rely without further and more specific advice. Past performance (whether actual or simulated) is not a reliable indicator of future performance, and no representation or warranty, express or implied, is made regarding future performance.

Michael Armitage CAIA- (ma@fundlab.com.au) has over 30 years of experience across capital markets, hedge fund strategy research and portfolio management, asset consulting, and product development in the Australian market.. Michael advises several asset management companies, HNW advisery practices and institutions.

Fundlab Strategic Consulting P/L provide information consultation on digital assets for various investor groups. Michael Armitage is a renumerated adviser to Apollo Capital.