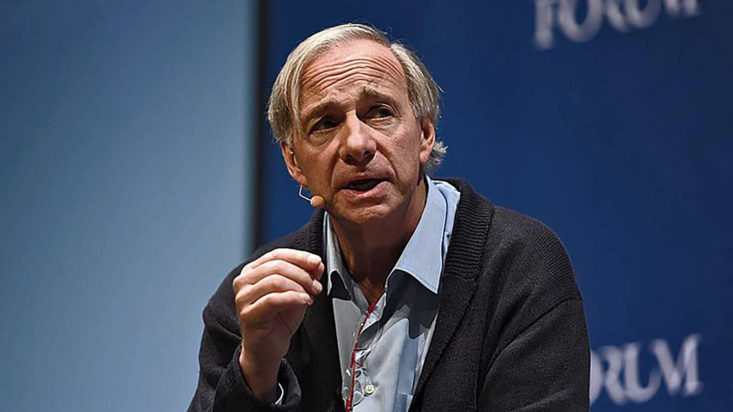

Ray Dalio: “Reducing Inflation Will Come at a Great Cost”

Legendary investor Ray Dalio has warned against believing all will be well if central banks simply increase interest rates to get inflation under control.

In a public Linkedin post, the founder and Co-Chief Investment Officer of Bridgewater Associates believes the US economy is heading toward a stagflationary environment of high inflation, high unemployment and low economic growth.

“For me, hearing supposed “experts” talk about what’s now happening in the markets and economy is like listening to nails scratch against a chalkboard because they are typically saying incorrect things in an erudite rather than commonsense way”.

He believes any action central banks take to lower inflation will be offset by creating weakness in the economy.

Raising rates reduces buying power as it increases interest payments, therefore, taking away from income previously spent on spending. It also lowers the value of investment assets such as shares and bonds due to the present value of cash flows falling.

“It just shifts some of the squeezing of people via inflation to squeezing them via giving them less buying power”.

“The only way to raise living standards over the long term is to raise productivity and central banks don’t do that”.

As central banks increased and withdrew demand over the years, stimulus typically outweighed the tightening resulting in more ups than downs until the debt load became unsustainable.

“Whenever these depressing periods of paying back become too depressing, central banks typically provide another and even bigger dose of stimulation”.

Since 1980, debt relative income has grown while interest rates have declined until hitting zero in 2020.

Dalio criticises recent action by the Federal Reserve. Specifically, it’s buying and selling of debt in addition to letting government deficits get too large. As a result, the central bank’s ability to push interest rates high to compensate debtors for inflation has been constrained.

“If the holders of debt don’t get adequate returns they will sell them…”

He advises central banks should move more smoothly rather than wild swings in each direction and resist the temptation to allow debt assets and liabilities to get too large.

Judging by Dalio’s rhetoric, central banks have cornered themselves into a lose-lose situation.

Either a reduction in credit leads to a weakening economy or the central bank needs to print more money and creates further inflation.

Subsequently, Dalio is bearish on the outlook for the US economy with the Fed charting “a middle course that will take the form of stagflation”.