Local market gains, energy falls on oil price correction, ANZ to buy MYOB

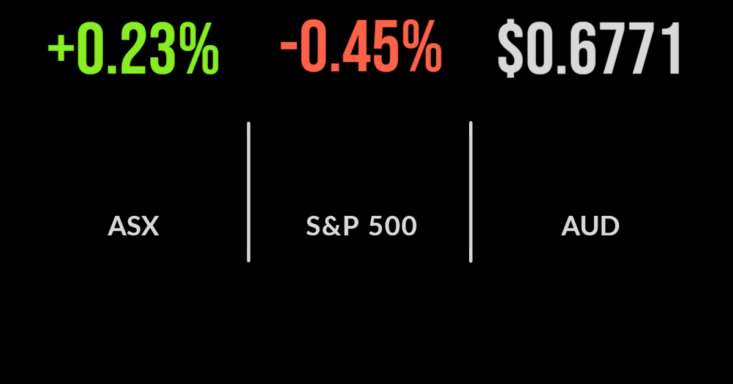

It was another positive, but mixed, day for the local market with seven of the 11 sectors finishing higher and contributing to a 0.2 per cent gain.

The dispersion between the winners and losers is beginning to narrow after an incredibly volatile period.

On the positive side were the consumer and technology sectors, which gained 1.2 per cent each, buoyed by the likes of Megaport (ASX: MP1) which jumped 7.3 per cent on little news.

The energy sector continues to reverse recent gains, falling 1.8 per cent after the oil price fell 8 per cent to below US$100 per barrel for the first time in weeks; Woodside (ASX: WDS) led the losses falling 2.9 per cent.

Shares in ANZ Bank (ASX: ANZ) fell 1.2 per cent after the company confirmed they were considering a bid for a private equity-owned accounting platform MYOB, which is valued at as much as $4 billion.

The company would be a natural integration for the group’s business banking division. In an unsurprising call, the Reserve Bank of New Zealand continued to increase rates, moving 50 basis points higher again, despite signs of growing stress in the property market.

KMD flags slowing growth, Platinum outflows continue, ETFs beating active funds

Shares in KMD Brands (ASX: KMD) which owns the likes of Kathmandu and Rip Curl, finished 0.5 per cent higher after forecasting total revenue of $965 to $995 million for the financial year.

This is stronger than 2021 and comes off the back of a “record winter promotional period” as shoppers flocked for winter gear in Australia.

Earnings is expected to fall as staffing and supply chain issues hit the profit line. Platinum Asset Management (ASX: PTM) reported another $304 million in outflows in June, continuing a trend of outflows in every month of the quarter.

Assets under management have fallen to just $18.2 billion despite the recent value recovery offering some short-term outperformance; shares fell 2.3 per cent.

It seems the ETF sector has been the winner with Vanguard reporting that while assets fell to $119 billion, the sector broadly received $3.1 billion in inflows in the June quarter.

Inflation hits 41 year high, Netflix partners with Microsoft, Twitter surges News that inflation had reached a 41 year high, breaching 9.1 per cent in June and up 1.3 per cent on the month prior had surprisingly less impact on the market than many expected.

The result remains almost entirely driven by fuel price increases which President Biden was quick to highlight had begun to reverse in late June.

The result was marketed rallying into the close but ultimately finishing down, with the Nasdaq outperforming, falling 0.2 per cent.

The S&P500 and Dow Jones fell 0.6 and 0.7 per cent respectively.

Twitter (NYSE: TWTR) was a rare winner after the board began legal action against Elon Musk after he pulled out of their deal; shares gained 7 per cent on the news.

Netflix (NYSE: NFLX) also gained after the company announced it would be partnering with Microsoft (NYSE: MSFT) for the build of their long-awaited ad-supported platform.

Delta Airlines (NYSE: DAL) has struggled to keep up with the boom in travel, with oil prices continuing to bite, a halving of profit for the quarter to USD$735 million sent shares 5 per cent lower.