‘Wash and clean’ equity portfolios as valuations spike

The now not-so-new ETFs that follow well-known indices have been a hugely welcome introduction. One does not have to debate the inexplicable underperformance of the majority of active managers, the sometimes usurious fees, the change in teams, and other influences that take up time and effort.

The pressure is to explain what they really mean and why they are selected.

In regional allocations, many asset allocators currently prefer Europe, Japan and Emerging Markets based on valuation, while the outcome can be skewed by a relatively narrow handful of stocks.

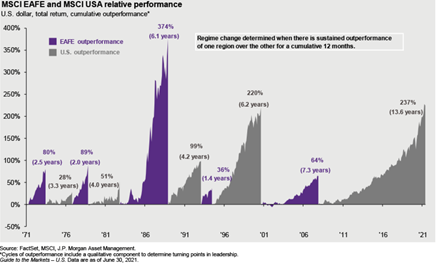

Even the S&P500 has been the winner based on the entrenched tech stocks that have come to dominate this index. Yet there was a long period, from circa 1980 to 2010, when total returns from Europe and the US were almost identical; with the last decade having spoilt the parity.

Most active managers now include unique stocks from outside the US. Europe has a leading edge in luxury consumer goods, some consumer staples and even healthcare, but that has not been enough for ETFs.

Europe (that is, the Stoxx 600 index) has plenty of issues, lousy banks, weight to resources and lack of diversity in tech. The biggest differential is that European value stocks trade at a huge discount to US value stocks.

It may well be that Europe has too many dead entities with no hope of useful earnings, while in the US these are sustained by wishful possibilities, take-outs through private equity or, most likely, are caught up in the swarm of US allocations through ETFs relative to Europe. After all, riding the S&P500 in an index and then being highly selective in non-US holdings has been a near-perfect option.

What might break this cycle?

- If value does take hold, a shift in flows out of the US to Europe is inevitable.

- Tax and policy issues hit the US tech/internet stocks harder than other jurisdictions.

- European costs (via Producer Price Index) may lag the US and sustain profit margins as US companies face a cost squeeze or rising consumer prices.

- Income is in short supply and European yields are relatively attractive

- Europe has an advantage in clean energy

None of these is entirely compelling in its own right and European champions have been caught wrong-footed before. But complacency towards a domination of US equity deserves a ‘wash and clean’ on a regular basis. Those investors who are long in the tooth will recall when Japan was considered an invincible market deserving a huge valuation premium. Well, that did not last long.