SMSF numbers jump, top industry fund growth in 2022

The lockdowns of 2021 and a trend for younger people to set up a self-managed superannuation funds (SMSFs) have driven a sharp growth in the number of funds being established in Australia with assets their assets under management (AUM) now approaching $1 trillion, and accounting for around one-quarter of all Australian superannuation assets.

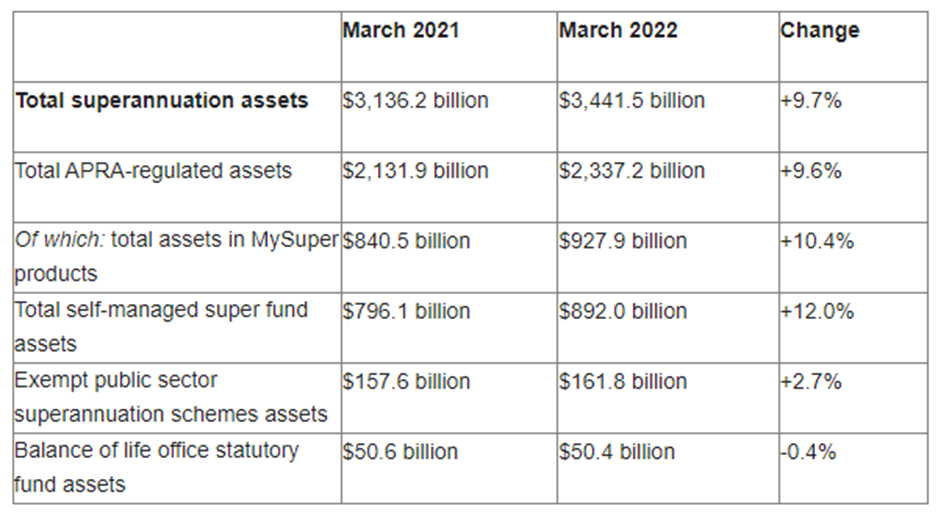

The Australian Prudential Regulation Authority (APRA)’s Quarterly Superannuation Performance publication and Quarterly MySuper Statistics report reveals SMSF assets jumped 12 per cent to $892.0 billion at the end of the March 2022 quarter, up from $796.1 billion a year earlier. That exceeded the growth in MySuper products which rose to $927.9 billion, up 10.4 per cent from $840.5 billion.

Superannuation assets totalled over $3.4 trillion, increasing 9.7 per cent over the past year, reflecting strong investment performance and positive contributions growth due to COVID-19 fiscal stimulus.

Contributions totalled $141.6 billion, a jump of 16.9 per cent for the year. Employer contributions rose 6.6 per cent totalling $104.2 billion, of which Superannuation Guarantee contributions rose 5.3 per cent to $77.3 billion. Member contributions totalled $37.4 billion, rising 60 per cent over the year, of which personal contributions jumped 61.7 per cent to $34.9 billion, largely due to the jump in household savings during the COVID-19 pandemic, according to APRA.

Younger investors drive growth of SMSFs

ATO statistics for 2020-21 reveal the largest increase in the number of SMSF being established since 2017-18 with 25,312 new funds. On average, this equated to 2100 new funds being established every month in this period, according to John Maroney, CEO, SMSF Association. Much of the growth has come from the 35 to 44 years age group, with this age group comprising around one-third of all new establishments. That rises to nearly 45 per cent once you include those aged between 25 and 34, says Maroney.

“This trend for younger people to set up an SMSF, evident for more than a decade, is in stark contrast to the earlier practice where people waited until they were in their 50s and retirement was on the horizon before switching from an APRA-regulated fund to an SMSF,” says Maroney.

“It also suggests that, as in the GFC, in times of uncertainty and market volatility, individuals want to take more control over their finances and bring things closer to home. With superannuation, SMSFs provide the ultimate in terms of flexibility and control – as well as far greater responsibility.”

“That people had more time during lockdowns to reflect and review their finances could also be a factor,” says Maroney. The emergence of the SMSF specialist adviser means consumers have greater access to better advice about their funds, Maroney said.

Maroney says cost is also less prohibitive than once though. He cites research from the University of Adelaide International Centre for Financial Services published earlier this year which shows that based on 318,000 SMSFs, the investment performance of a typical DIY fund improves as the fund balance approaches $200,000, and that once this threshold is reached, the fund achieves comparable investment returns with APRA-regulated funds.

That conflicts with the current guidance from the Australian Securities and Investments Commission (ASIC) that “on average, SMSFs with balances below $500,000 have lower returns after expenses and tax than funds regulated by APRA”.

“It is time for ASIC to review this guidance, based on the increasing body of evidence that a $200,000 threshold provides a more appropriate level beyond which SMSFs can be competitive with larger funds – both on investment performance and operating costs,” says Maroney.

Local bias in assets held by SMSFs

Some SMSFs have too much of their money invested into just a few asset classes and are not as diversified as they could be, Australian Taxation Office (ATO) data reveals.

According to the most recent data from the ATO, SMSFs held just over one quarter of assets in Australian shares, or $241.3 billion as at 31 December 2021 while $147.8 billion or around 17 per cent was held in cash and term deposits out of total assets then worth $876.7 billion. Just $12.7 billion was invested in overseas shares, which represents only 1.5 per cent of SMSF total assets. Cryptocurrency is gaining in popularity, and SMSFs held $227 million in digital coins, up from zero holdings in 2018, but down from $232 million in the year earlier period.