Defence overtakes offence as portfolio managers seek shelter with recession likely

Against the background of rising interest rates, slowing economic activity and falling commodity prices, earnings growth for companies could slow markedly, though companies with defensive earnings could outperform those companies with earnings more closely linked with economic activity.

Australia’s risk of an economic downturn jumped to the highest level since the pandemic, a Bloomberg survey showed this month, with the likelihood of a recession in the next 12 months climbing to 50 per cent, up from 35 per cent in May. Many economists still expect the Reserve Bank of Australia to raise interest rates again to try to curb inflation.

“The four-percentage point increase in interest rates since May 2022 means it is becoming much harder for the economy to remain on an ‘even keel’ as the RBA and most are forecasting and runs the real risk of tipping the economy into a recession, which we assign a 50 per cent risk to in the next 12 months,” said Diana Mousina, deputy chief economist at AMP Capital Markets.

“There are already increasing signs that the economy is weakening – retail sales has slowed, the unemployment rate is rising, building construction is collapsing, and this is all occurring at a time that the inflation indicators are pointing down,” Mousina adds.

Analysts say that very few sectors would be immune from a recession. However, companies with defensive earnings characteristics could be better positioned for any economic downturn. According to global index provider MSCI, defensive sectors include healthcare companies, consumer staples, energy and utilities; these have been shown to outperform during an economic slowdown while cyclical sector indexes typically outperform in a growing or expanding economy.

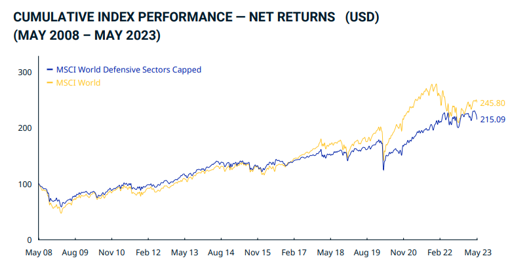

MSCI has developed share market indices which reflect the performance of defensive companies, and they only include consumer staples, energy, healthcare and utilities businesses. Reflecting their outperformance in volatile markets in recent years, the MSCI All Country World Index (ACWI) Defensive Sectors Index (USD) has returned 11.6 per cent over the three years to May 31, 2023, compared to the MSCI ACWI, MSCI’s flagship global equity index, which has returned 11.0 per cent.

During the global financial crisis (GFC), the MSCI ACWI Defensive Sectors Index fell 31.5 per cent in 2008 compared to 42.19 per cent for the MSCI ACWI. The chart below shows its outperformance during the GFC.

Source: MSCI to May 31, 2023

Some experts position for downturn

Senior financial planner Scott Keeley of Wakefield Partners is positioning for a share market downturn with defensive stocks. “It might be kind of boring, but defensive stocks make up the majority of our portfolios to start with,” he says.

“Recession-proof sectors such as consumer staples are a core of our portfolios, as is infrastructure. Major supermarkets such as Coles and Woolworths tend to remain profitable during all parts of market cycles, and most infrastructure companies have the ability to link contract pricing to CPI. Energy exposure and healthcare also add defensive core exposure to our portfolios,” Keeley says.

Indeed, Coles and Woolworths are commonly cited as defensive stocks as we consumers need to buy food, irrespective of how the economy is doing. Other defensive Australian companies include telecommunications companies like Telstra and Bunnings owner Wesfarmers, as their values typically don’t fall as much as more growth companies during an economic downturn because they provide staple rather than discretionary goods and services.

But be careful here; Morningstar analyst Johannes Faul believes these shares are overvalued. Faul has a fair value on Woolworths of $27.00 compared to its market price around $39 as at 14 June. On Coles, he has a fair value of $14 compared to its market price around $18.

Faul believes shares in Woolworths and Coles are materially overvalued. “Perhaps the market is less concerned about near term earnings headwinds and is willing to accept a lower equity risk premium than us,” says Faul. However, given recent monetary policy tightening, Faul thinks prices for Coles and Woolworths are too high and their earnings will come under pressure and share prices for both will fall as consumer spending moderates.

Shane Hurst (pictured), a portfolio manager with ClearBridge Investments, says investors should be thinking about infrastructure companies, such as electricity and gas utilities, airports and toll roads, as consumers will continue to use their goods and services even if economies fall into recession.

“We believe infrastructure’s focus on cash flows and underlying earnings make it a prudent investment as economic conditions deteriorate and a recession looms,” says Hurst.

“Infrastructure companies’ cash flows tend to be durable due to the essential nature of infrastructure assets, demand is relatively stable, providing lower volatility than traditional equities and resiliency of infrastructure revenue through the business cycle. Even in times of economic weakness, consumers continue to use water, electricity and gas, drive cars on toll roads and use other essential infrastructure services.”

Unlike most fixed income, the dividends from infrastructure assets act as a hedge against inflation as fees are often regulated and linked to the consumer price index (CPI). This often applies to both utilities and user-pays assets such as toll roads or rail. “Infrastructure’s pricing power gives it true inflation protection, in our view.”

This story was first published in The Inside Investor.