-

Sort By

-

Newest

-

Newest

-

Oldest

As widely expected, the RBA raised the cash rate by 0.5 percentage points yesterday, taking it to 1.35%, as widely expected. This is the fastest back-to-back increase in rates since increases of 0.75% and 1% in November and December 1994 respectively. But the RBA remains upbeat on the economy and employment, despite remaining concerned about…

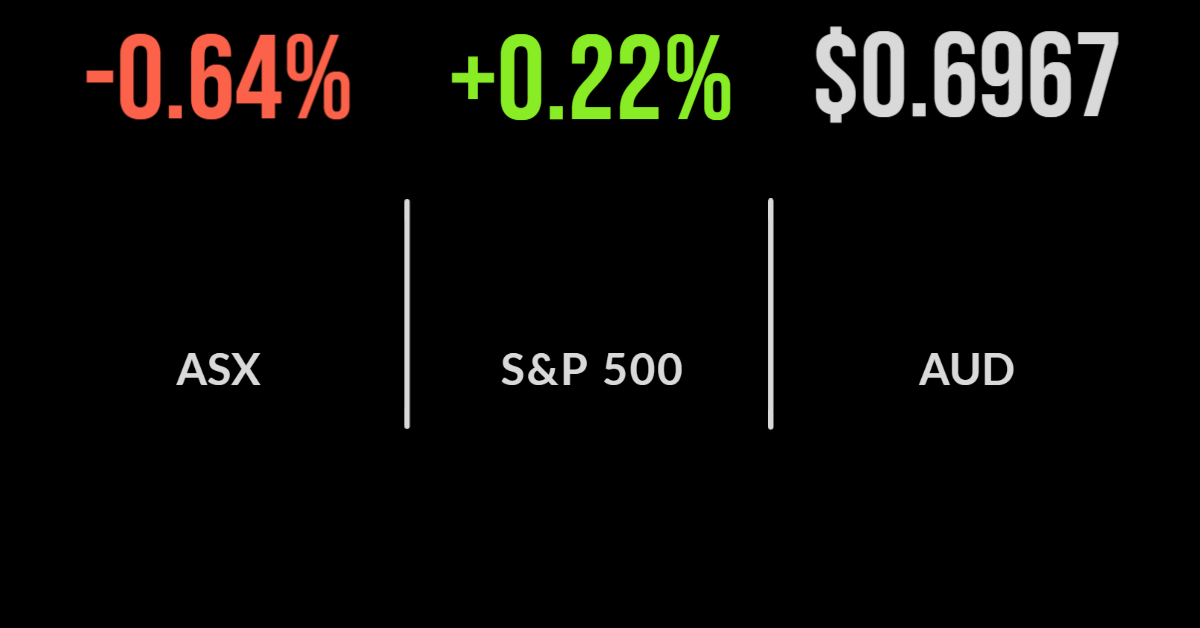

The Australian share market ended in the green on Monday, despite investor skittishness ahead of today’s Reserve Bank board meeting. The central bank is widely predicted to lift its cash rate by another 50 basis points today, which would take it to 1.35 per cent, in the intensifying effort to rein in surging inflation, which…

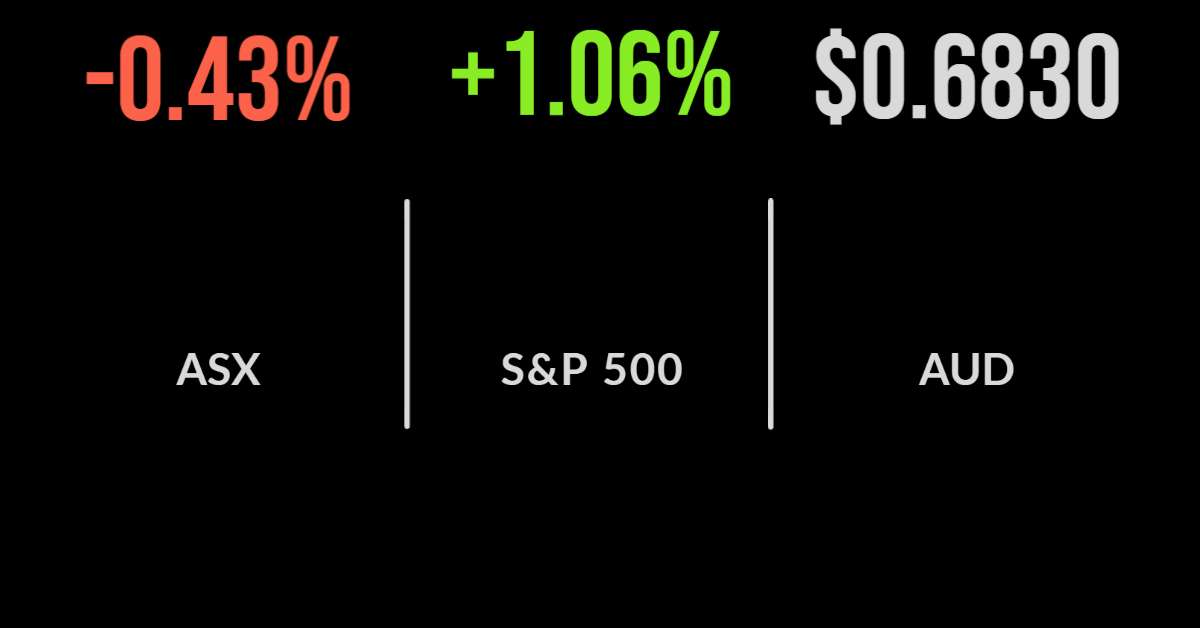

The Australian market started the session on a positive note, moving as much as 1 per cent higher on the first day of the new financial year but ultimately sank to a 0.4 per cent loss. The realisation that an interest rate-driven slowdown in the global economy may hit commodity demand saw both energy and…

The local market managed to deliver another strong day, the S&P/ASX200 finishing 0.9 per cent higher. Five sectors were lower, albeit only slightly, with consumer discretionary the biggest detractor on concerns that higher interest rates will cut disposable incomes. This sent the likes of JB Hi-Fi (ASX: JBH) and Zip Co (ASX: ZIP) down 3.9 and…

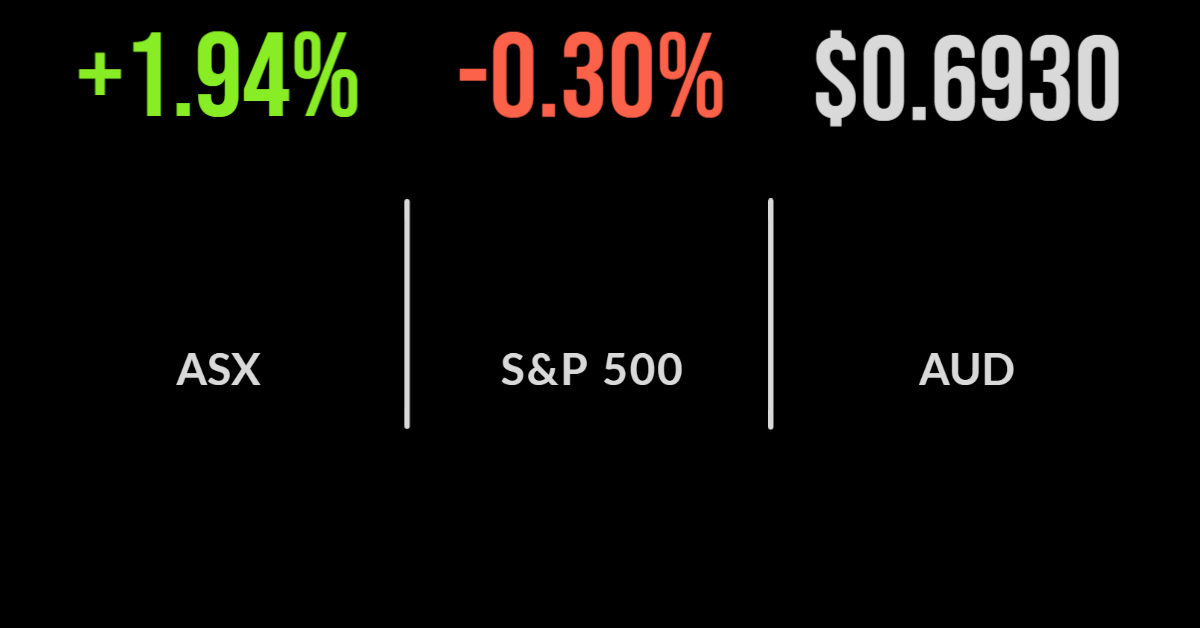

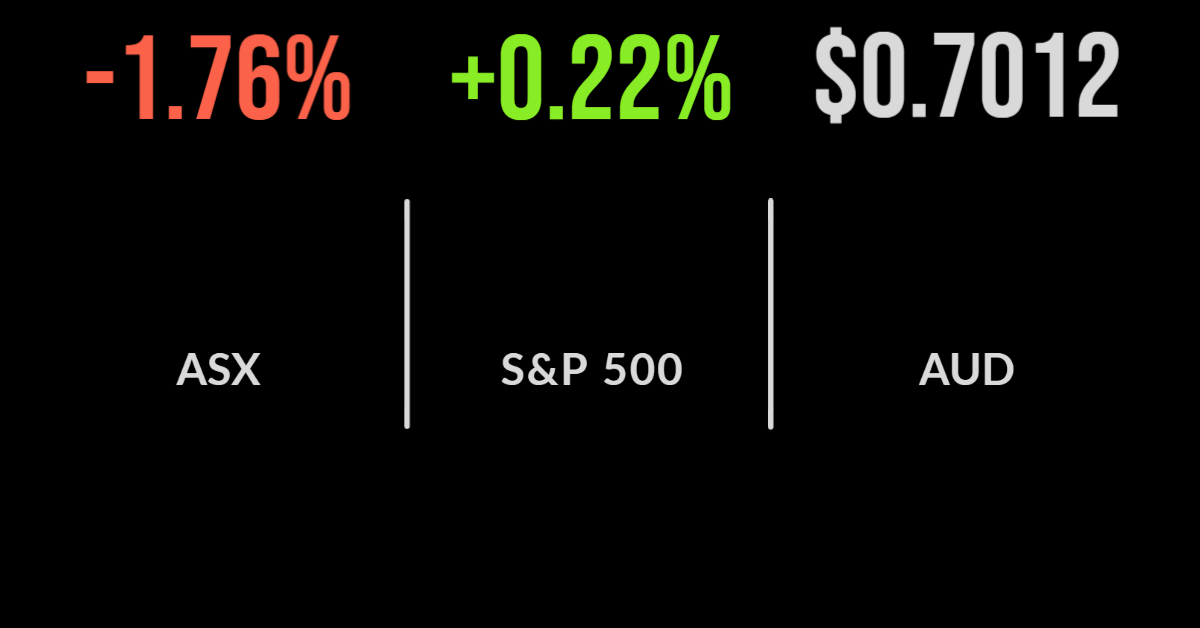

A positive lead from Wall Street, in which bad news on the economy became good news for stocks, resulted in the ASX gaining 1.9 per cent to begin the week. Every sector was higher, with energy and financials gaining 2.6 per cent each, buoyed by hopes that rate hikes may not be as aggressive as…

The local market has reversed two straight weeks of losses, posting a 0.8 per cent gain on Friday which took the S&P/ASX200 to a weekly gain of 1.6 per cent. The rally was powered by the unloved sectors in technology, property and retailers which were up 6, 2.5 and 2.2 per cent respectively as lower…

The selloff in lithium stocks has returned once again, with the likes of Pilbara (ASX: PLS) and Liontown (ASX: LTR) pushing the commodities sector to a 1.5 per cent loss. Along with the energy sector which fell 2.1 per cent is now officially in a bear market, these were the only two sectors to post…

The positive sentiment couldn’t be maintained on Wednesday with weakness in the technology and financial sectors sending a 0.5 per cent gain to a 0.2 per cent loss. Energy and utilities remain in focus, gaining 1.5 and 2.1 per cent with NZ energy provider Mercury (ASX: MCY) and fuel refiner Ampol (ASX: ALD) gaining 4…

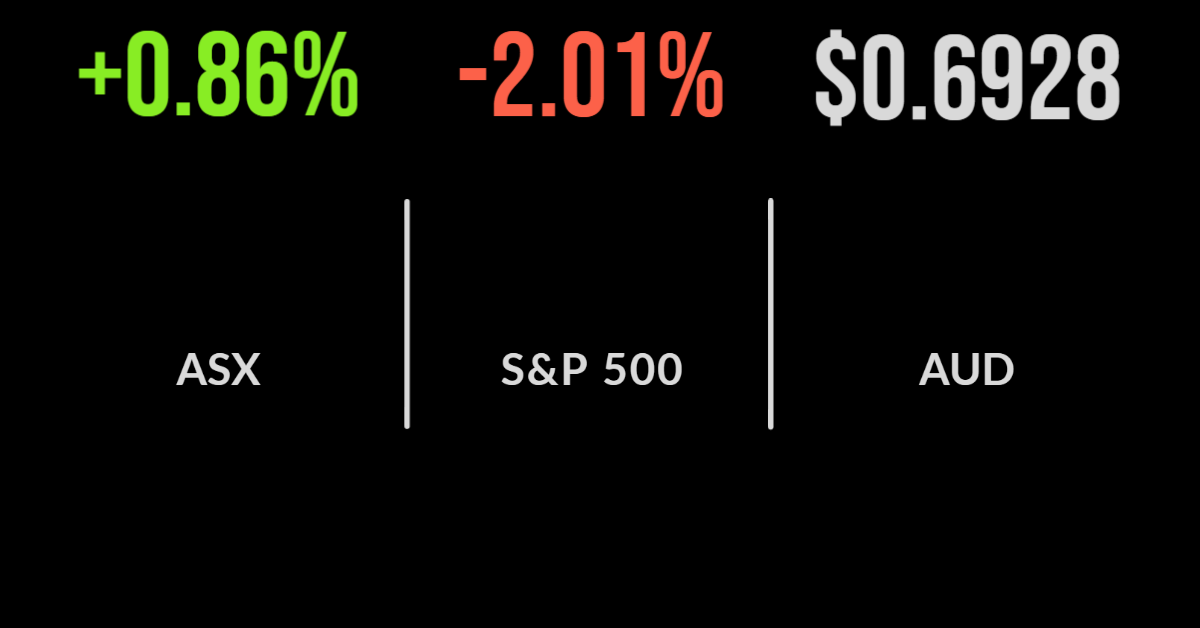

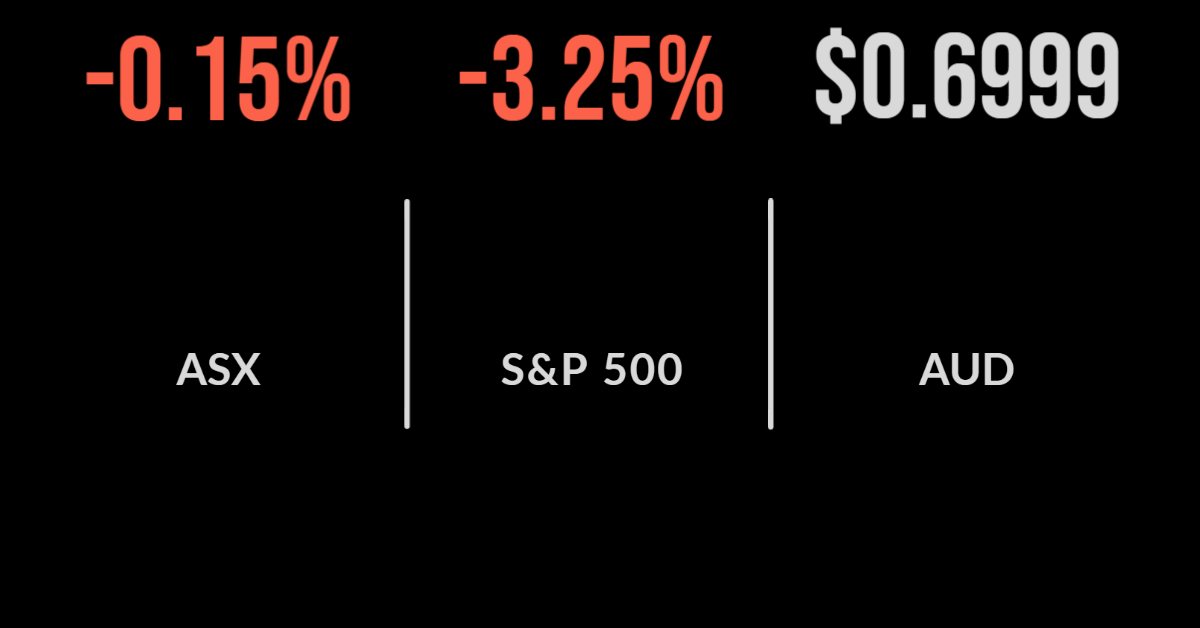

The local market open on an unexpectedly positive tone but ultimately finished 0.6 per cent lower as commodity and energy prices fell across the board. The selloff in energy and materials finished at 5.1 and 4.6 per cent respectively, amid growing concerns about the outlook for the global economy. Uranium miner Paladin (ASX: PDN) was…

The local market capped its worst week since March 2020 falling 1.8 per cent on Friday and dragging the S&P/ASX200 down 6.6 per cent for the week. This followed a 4.2 per cent drop in the prior week which now has the index nearing a bear market. Comments from the RBA Governor this week heightened…

Australian shares were as much as 1.1 per cent higher during Thursday’s session following the Federal Reserve decision to hike interest rates by 0.75 per cent, but ultimately finished 0.1 per cent lower. The major detractors were the consumer staples and utilities sectors, falling 1 and 1.6 per cent with the latter hit by the…

Anyone keeping up with the news overnight is aware of the headlines. $88 billion lost in a single day, market crumbles, stocks tank; there will be no lack of hyperbole following the worst day for the S&P/ASX200 since March 2020. The market fell by close to 5 per cent during the session, following a rough…