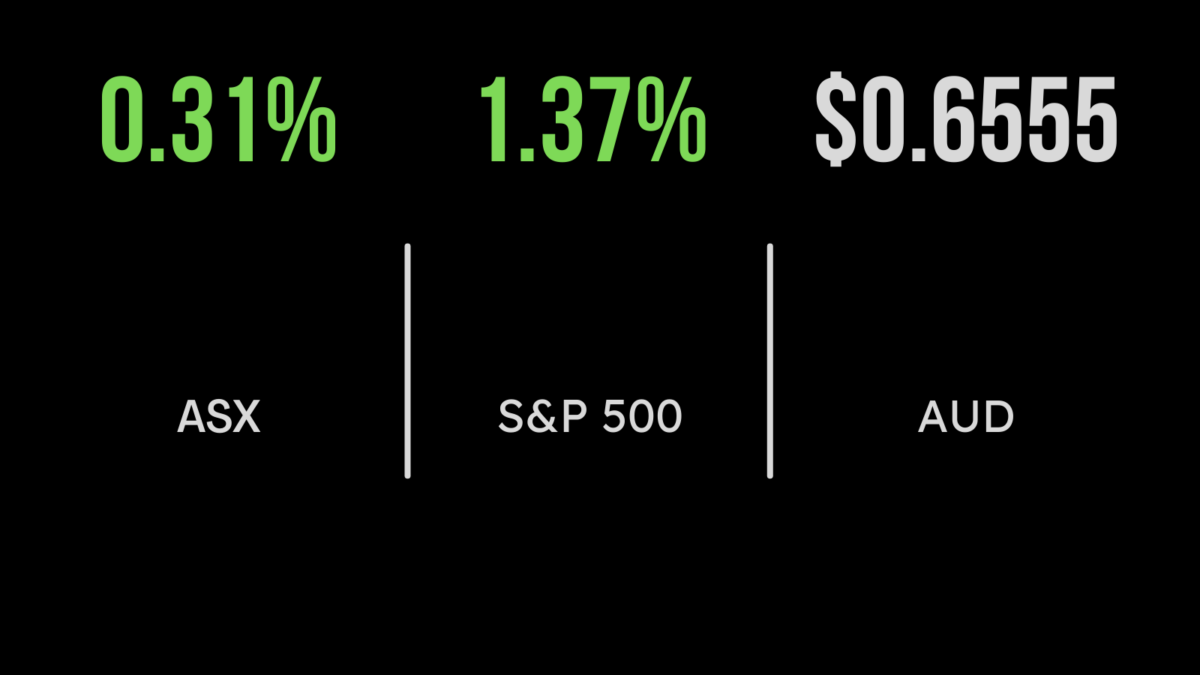

Australia’s sharemarket pushed higher on Wednesday, as the big miners tracked iron ore prices higher. At the close the S&P/ASX 200 was up 23.8 points, or 0.3 per cent, to 7,259.1 points, while the broader All Ordinaries index gained 22.7 points, also 0.3 per cent, to 7,469.1. On the industrial side, the highlight of the…

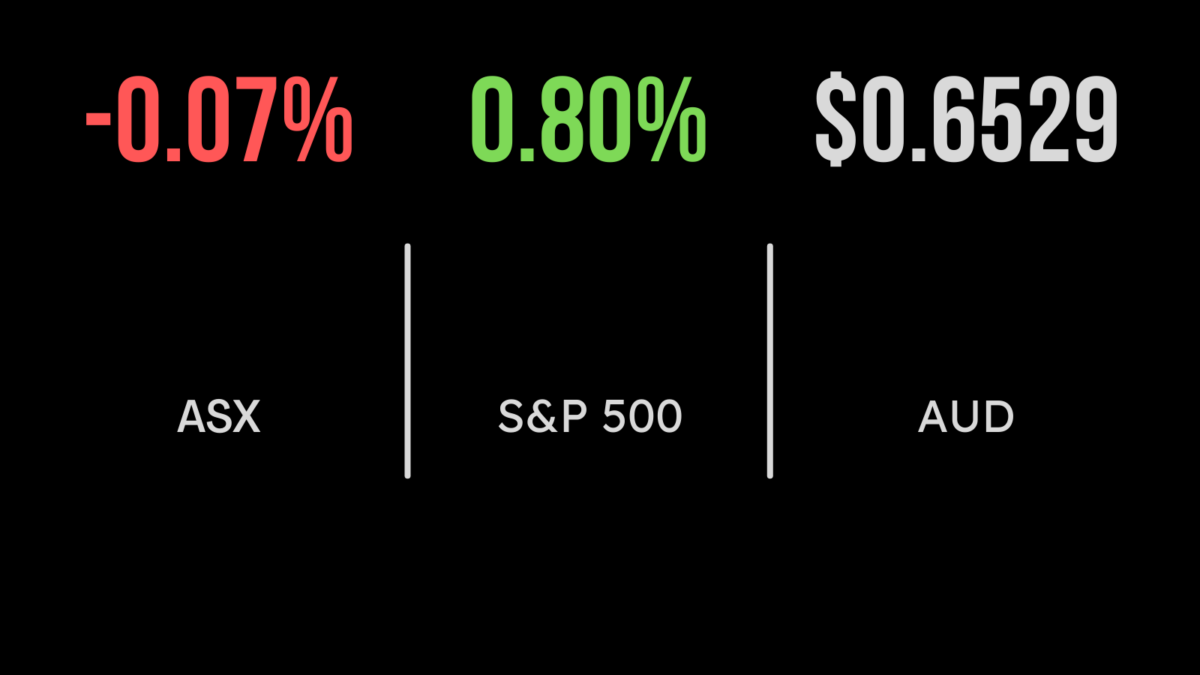

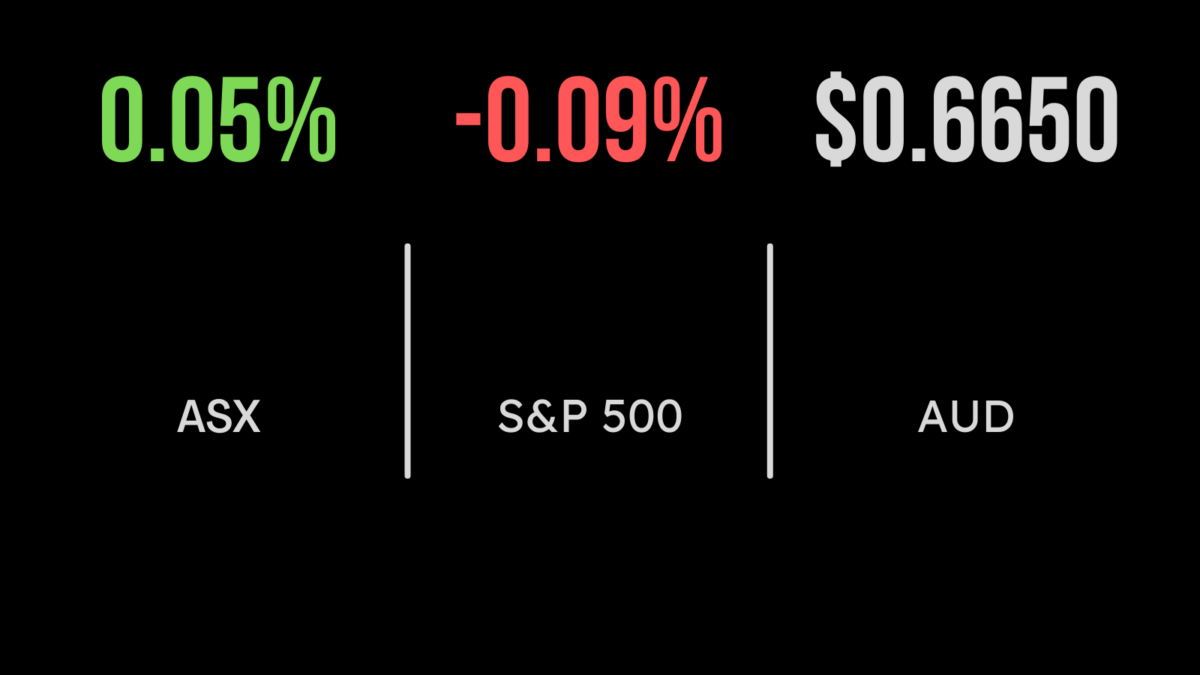

The Australian market retreated on Thursday, but in a barely noticeable manner; the benchmark S&P/ASX 200 slipped 5.1 points to 7,173, while the broader All Ordinaries index lost 2 points, to 7,384. Financial services house Perpetual jumped $1.59, or 6.7 per cent, to $25.35 after the firm formally rejected a $3 billion buyout proposal from investment…

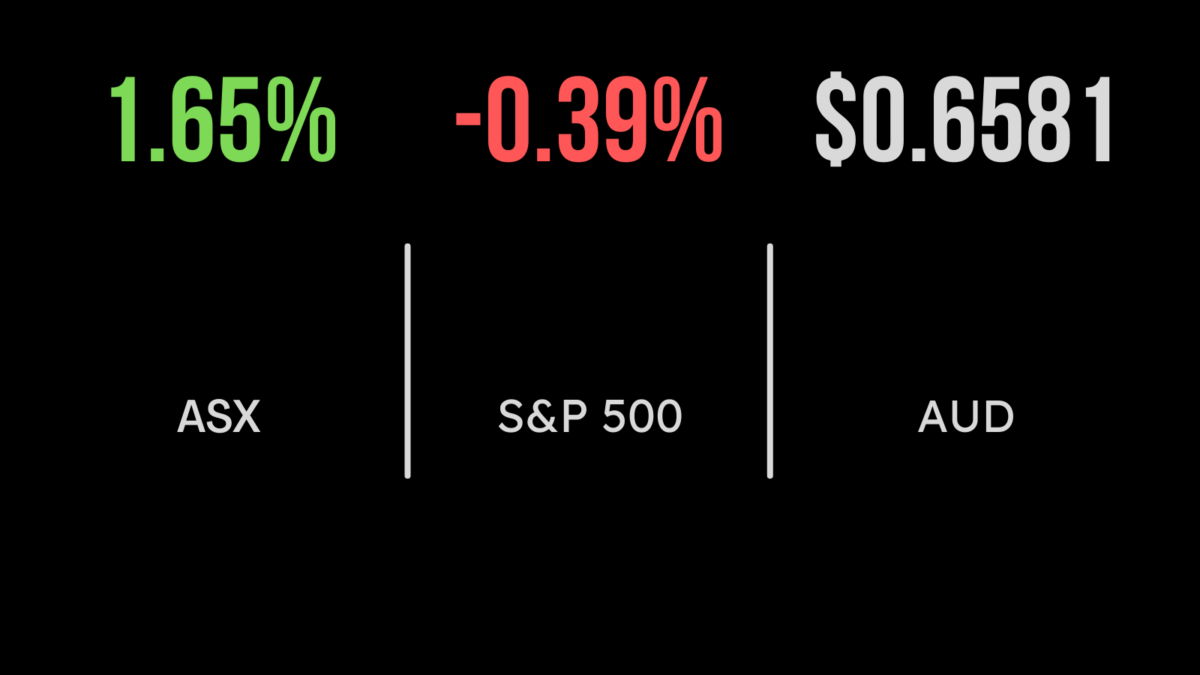

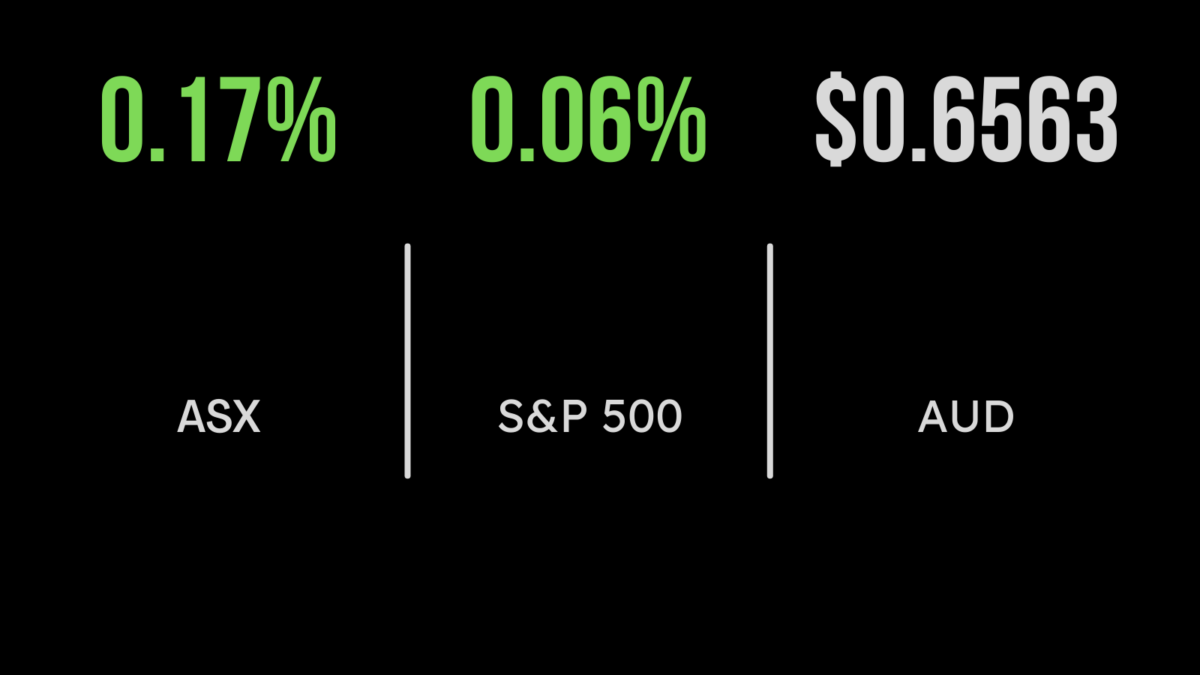

The Australian sharemarket had its biggest one-day rally in more than a year on Wednesday as traders raised their bets on the Reserve Bank cutting interest rates. Weaker-than-expected GDP for third quarter boosted speculation the central bank could start lowering rates again in 2024. Australia’s economy grew just 0.2 per cent in the September quarter,…

Australian shares slipped back on Tuesday, led by a sell-off in commodity stocks, on a day when – as widely predicted – the Reserve Bank left the cash rate at 4.35 per cent at its final meeting of the year. The S&P/ASX 200 closed 63.1 points, or 0.9 per cent, lower at 7061.6, while the…

“Volatility is the most persistent diversifier,” says Atlantic House Australian head Andrew Lakeman. “People are starting to realise that, as well as realising that diversity of assets in a portfolio – with different names – does not necessarily mean that you are diversified.”

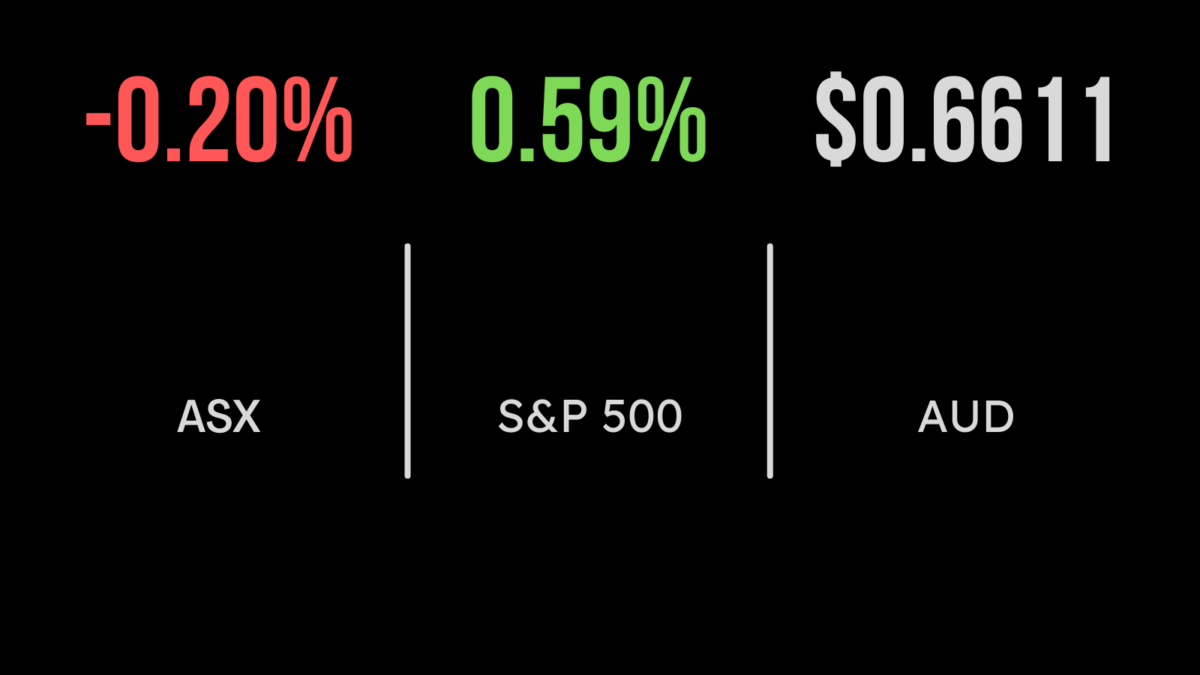

A rough finish to the week wasn’t enough to reverse a strong finish to November, with both the All Ordinaries and S&P/ASX200 (ASX:XJO) falling 0.2 per cent on Friday. The energy sector was a rare winner, adding 0.1 per cent, benefitting from a quick reversal of supply cuts agreed at the latest OPEC+ meeting. Both…

The S&P/ASX 200 concluded the day up 0.3 per cent, led by interest rate-sensitive real estate, technology, and consumer discretionary sectors, all closing over 1 per cent higher. This surge came after the Australian Bureau of Statistics reported a drop in annual inflation from 5.6 per cent in September to 4.9 per cent in October….

The Australian share market saw a decline driven by a slump in mining stocks, notably affected by a drop in iron ore value amid concerns about potential intervention by Beijing to stabilise prices. This decline resulted in the benchmark S&P/ASX 200 index dropping by 0.8 per cent, driven primarily by the materials sector’s poor performance,…

The Australian share market finished the week on a positive note, gaining 0.1 per cent, once again on the back of a rally in the energy and utilities sectors, which gained 1.3 and 1.6 per cent. The standout was Origin Energy (ASX:ORG) which added 2.8 per cent as the market continues to digest the likelihood…

You can’t judge a book by its cover in the far north of Australia, says adviser Anthony Menico. Sometimes it’s the most unassuming clients that have the most complex financial advice needs.