Local market fights commodity jitters

A tech rebound – possibly a dead-cat bounce – tried to drive the Australian market higher on Wednesday, but the concerns on commodity prices more than outweighed this.

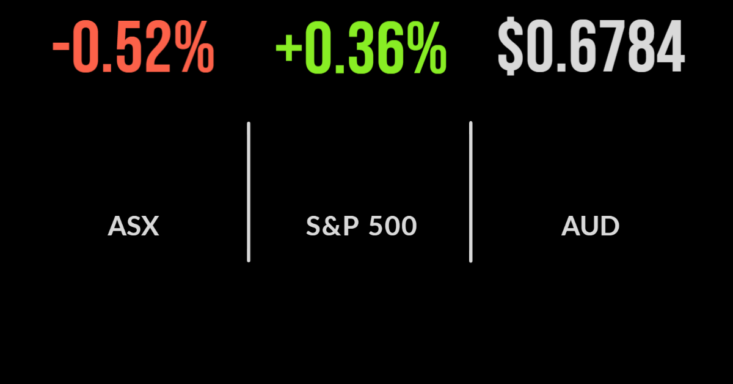

By the close, the benchmark S&P/ASX 200 had shed 34.8 points, or 0.52 per cent, to 6,594.5, while the broader All Ordinaries surrendered 33.8 points, or 0.5 per cent, to 6,784.3.

Energy and resources were hammered, on the back of lower commodity prices, and fears of recession.

For the oil and gas pumpers, oil back around US$100 a barrel was not what investors wanted to see.

Woodside fell $2.24, or 6.9 per cent, to $30.20; Santos dropped 46 cents, or 6.2 per cent, to $7.02; Beach Energy gave up 14 cents, or 8 per cent, to $1.61; and Karoon Energy plunged 18 cents, or 11 per cent, to $1.50.

Among the big iron ore producers, fears of a further Chinese slowdown trumped an overnight rise in the price; which slipped during the Asian trading day.

BHP lost $2.24, or 5.6 per cent, to $37.76; Rio Tinto dropped $7.41, or 7.4 per cent, to $93.37; and Fortescue Metals closed 84 cents down at $16.48, a loss of 4.9 per cent.

Both Rio Tinto and Fortescue are trading at six-month lows, while BHP is the lowest the stock has been for eight months.

Gold dropped below $US1,800 an ounce for the first time since February, and the falling gold price cut a swathe through the gold miners, with Newcrest down $1.39, or 6.6 per cent, to $19.60; Northern Star off 30 cents, or 4.2 per cent, at $6.91; Evolution down 10 cents, or 4 per cent, to $2.41; St Barbara losing 8.5 cents, or 9.5 per cent, to 81 cents; Regis Resources down 11 cents, or 6.9 per cent, to $1.50.

Tech tries to turn the tide

But tech stocks continued their recovery, on the back of renewed demand for their US-based counterparts, evidenced in the rising Nasdaq.

Small business accounting software leader Xero jumped $5.36, or 6.7 per cent, to $86; logistics software business WiseTech Global gained $1.49, or 3.7 per cent, to $42.19; electronics design software company Altium rose $1.14, or 4.1 per cent, to $28.67.

Afterpay’s owner Block added $4.22, or 4.5 per cent, to 58 cents; fellow buy-now-pay-later player Zip was up 6.5 cents, or 12.8 per cent, to 58 cents; and EML Payments surged 13 cents, or 10.5 per cent, to $1.42, after a big deal with the Spanish post office.

Who let the Fed hawks out?

Stateside overnight, the market mounted its third straight day of gains, after the release of the Federal Reserve’s June meeting minutes.

The minutes were considered hawkish, with the market now considering a likely increase of 50 or 75 basis points at the Fed meeting later this month as baked-in.

The S&P 500 index gained 13.7 points, or 0.4 per cent, to 3,845.1, while the 30-stock Dow Jones Industrial Average added 193.3 points, or 1.6 per cent, to 12,594.5, and the tech-laden Nasdaq Composite Index was up 39.6 points, or 0.3 per cent, to 11,361.8

European markets were stronger, with the STOXX 600 up 6.7 points, or 1.7 per cent, to 407.3 and London’s FTSE-100 up 82.3 points, or 1.2 per cent, to 7,107.8.

Oil slid 2 per cent to three-month lows on fears of global recession: the Brent price fell $2.08, or 2 per cent, to US$100.69 a barrel, while West Texas Intermediate shed 97 cents, or 1 per cent, to settle at US$98.5.

Gold extended its sell-off, losing 1.4 per cent to US$1,738.99 an ounce, a nine-month low, hurt by a stronger dollar.

The US dollar index, which measures the greenback against a basket of six peers, hit a 20-year high, with the Benjamins emerging as the preferred refuge for global investors looking to hedge growing recession fears.

In this context, the Australian dollar has slipped further and is buying 67.8 US cents this morning.