Market flat as commodities fall, Ramsay’s massive payday, Santos announces buyback

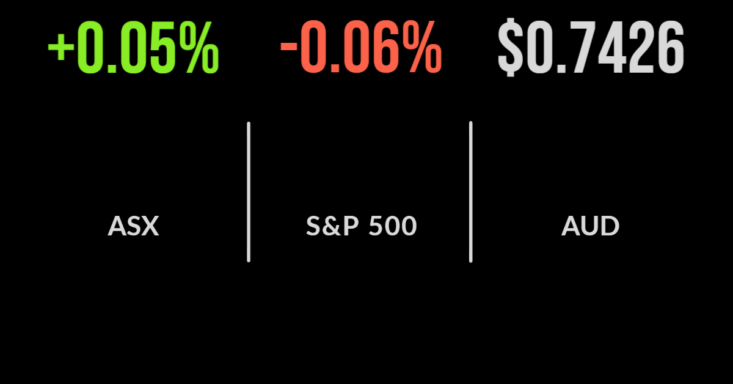

It was a flat day for the local bourse, with the S&P/ASX200 managing to deliver a gain of just four points or 0.05 per cent as the dualling pull of falling commodity prices and a surge in healthcare offset each other.

The materials sector was down 1.5 per cent and energy 0.6, with every other sector finishing higher behind healthcare, which recorded a 2.6 per cent jump.

After a period of relative underperformance, the healthcare sector rebounded after private hospital operator Ramsay Healthcare (ASX: RHC) confirmed it had received a takeover bid backed by global private equity giant KKR to acquire the company.

The price was a 37 per cent premium to the last closing price, being $88 per share and valuing the company at over $20 billion.

Despite the premium, most analysts view the deal as reasonably priced with some suggesting a bidding war may be in the offing given the group’s significant property holdings; shares finished 24.2 per cent higher on the news.

Santos (ASX: STO) outperformed the broader energy sector falling just 1.1 per cent after the company announced it would be returning capital to shareholders via an on-market buyback of up to US$250 million.

Healthcare ancillary gains, AGL faults to drag, Rio underwhelms, News set to enter betting

The Ramsay tide lifted all boats in the healthcare sector with the likes of Resmed (ASX: RMD) and Sonic (ASX: SHL) also gaining more than 2 per cent each on the knowledge that private equity is clearly focused on the sector.

Shares in AGL (ASX: AGL) reversed, falling 3.2 per cent after management confirmed the struggling Loy Yang A Power Station would remain out of service until at least 1 August due to a continuing electrical fault at the plant; this will likely send energy prices higher in winter.

Iron ore miner Rio Tinto (ASX: RIO) weakened by 2.8 per cent after flagging a “challenging” first quarter of production but keeping guidance at 320 to 335 million tones despite facing labour and workplace challenges.

Shares in BNPL minnow Zebit (ASX: ZBT) are officially gone after the company announced plans to delist following a 97 per cent fall in its share price since a momentum-driven IPO in 2020.

Online gambling technology provider Betmakers (ASX: BET) backed by Matthew Tripp entered a trading halt with rumours suggesting they may have entered a partnership with News Corp (ASX: NWS) for a long-awaited foray into the lucrative sports gambling market which is only just being made legal in the US.

Nasdaq falls as Netflix craters, staples outperform, housing sales drop

US markets were mixed overnight with the Dow Jones gaining 0.7 per cent as old fashioned defensive companies delivered whilst the S&P500 was flat and the Nasdaq fell by 1.2 per cent.

The biggest driver was a cratering in Netflix (NYSE: NFLX) shares which dropped more than 36 per cent in a single session following a disappointing earnings update.

The group announced that subscribers had fallen by 200,000 the first fall in a decade, whilst also planning a crackdown on password sharing.

The selloff reverberated around the market with other streaming services including Disney (NYSE: DIS) and Warner Bros (NYSE: WBD) both down more than 5 per cent.

US home sales fell by 2.7 per cent in March as new borrowing costs and inflation hits consumer pockets.

Proctor & Gamble (NYSE: PG) and IBM (NYSE: IBM) were standouts with the Dow stalwarts delivering better than expected updates.

PG’s profit was only slightly higher but they raises sales expectations to 4 to 5 per cent in 2023 as demand for healthcare products remains strong.

IBM delivered a similar result with revenue up slightly, earnings down but strong improvement in their software revenue, up 12 per cent, and consulting revenue, 13 per cent, following their focus on cloud computing and data centres.