RBA ‘losing patience’, market pulls back from all-time high, iron ore surge

Tuesday was a similarly strong day for the Australian market, with the S&P/ASX200 moving within 1 per cent of an all-time high; despite the incredibly difficult geopolitical backdrop.

That was until the Reserve Bank of Australia delivered its latest board meeting result and associated explanation.

Whilst rates remained on hold at 0.1 per cent, analysts were focused on the removal of the word ‘patience’ from their commentary around inflation and rate hikes, suggesting an increase was imminent.

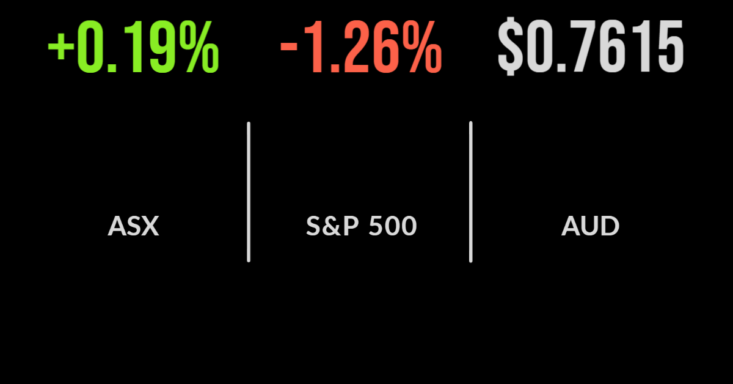

Despite this, the market managed to finish 0.2 per cent higher with seven of the 11 sectors rallying.

The highlights were once again the energy and technology sectors, up 2.2 and 3.0 per cent, an intriguing combination given the vastly different growth profiles.

Among the highlights was Mineral Resources (ASX: MIN) with the iron ore and lithium miner gaining 5.7 per cent after announcing ‘unprecedented demand’ for lithium and a potential doubling of their production facility in WA.

Other highlights were Block (ASX: SQ2) and accounting platform Xero (ASX: XRO) which gained 6.2 and 4.5 per cent.

Energy and utilities gain, IGO takeover under pressure, Qantas flag removed

The energy and related utility sectors continue to drive the market higher, likely due to the potential for further sanctions on Russia and further complications around oil and gas supplies.

Origin Energy (ASX: ORG) and AGL Energy (ASX: AGL) were local beneficiaries, gaining 3.1 and 2.6 per cent each.

The three-year probe into Qantas (ASX: QAN) regarding the competitive threat of their 19.9 per cent investment in Alliance Aviation (ASX: AQZ) was dropped without any action taken against the company; shares were flat on the news.

IGO Group (ASX: IGO) formerly Independence Group is facing a hurdle in their proposed acquisition of nickel miner Western Areas (ASX: WSA) with shares falling more than 2 per cent after the target company received an independent valuation suggesting the deal was significantly undervaluing it.

This comes after an incredible surge in the price of nickel due to the events in Ukraine.

Shares in the major iron ore miners reversed recent gains, even though a continued surge and higher prices for Chinese steel have seen the iron ore price bid up beyond US$160 once again.

US weakens as balance sheet reduction begins, Musk takes board seem, Exxon’s bumper profit

The Nasdaq delivered its worst session in several weeks falling 2.3 per cent on Tuesday as selling pressure swept the market.

The key driver was an announcement by one of the Federal Reserve’s members that they would begin to shrink their balance sheet.

That means, the Fed which has been buying US Government bonds of various terms, would stop doing so and start letting some mature without reinvesting. This is seen as another step towards higher rates.

The S&P500 and Dow Jones outperformed, down 1.3 and 0.8 per cent with Twitter (NYSE: TWTR) gaining another 2 per cent following conformation that Elon Musk would gain a board seat.

The trade deficit fell after hitting a record amid a surge in imports, down to $89.2 billion.

Oil company Exxon Mobil (NYSE: XOM) indicated they will likely deliver a bumper quarterly profit of US$9 billion in the first quarter following a jump in the oil price, but that Russia related writedowns may hit earnings.