ASX gains for third week, energy weakens, BHP, lithium stocks drive market

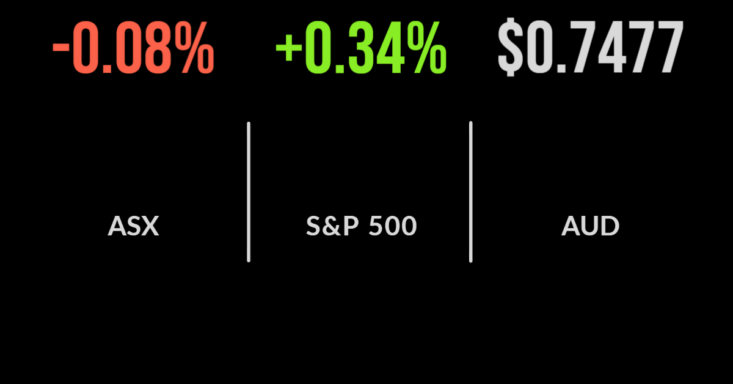

The Australian market continues to defy weakening market sentiment, falling less than 0.1 per cent on Friday with the S&P/ASX200 ultimately gaining 1.2 per cent and delivering a third straight week of gains.

On Friday, energy and materials came roaring back with BHP (ASX: BHP) the primary contributor, but broad-based gains in lithium stocks also supporting the market.

The driver was comments from Allkem (ASX: AKE) which reported another 10 per cent increase in lithium prices received and supported gains of 8.5 per cent for the stock, 7.2 per cent for Pilbara (ASX: PLS) and 3.6 per cent for Mineral Resources (ASX: MIN).

Macquarie (ASX: MQG) remains busy, confirming the sale of their 2,000 communication towers held by Axicom, to Australian Super and Singtel in a $3.5 billion deal.

Domain Group (ASX: DHG) also announced a capital raise to fund the $180 million purchase of Realbase, a real estate agent campaign platform.

Across the week most sectors were higher but materials were the standout gaining 3.7 per cent, as Allkem and Mineral Resources both gained more than 12 per cent.

Energy weakened after the US government announced the release of stockpiles, whilst healthcare and technology continued to struggle.

US markets finish higher, cap worst quarter in two years, China stocks surge

A late frenzy of buying turned another losing week into a small gain for the S&P500 and Nasdaq, which were 0.3 per cent higher on Friday but 0.1 and 0.7 per cent stronger over the week.

The Dow Jones outperformed, gaining 0.4 per cent, but fell 0.1 per cent across the week following stronger unemployment results.

Some 431,000 jobs were gained during the month sending the unemployment rate down to 3.6 per cent.

At the same time hourly pay rose to the highest level since the ’80s, moving 5.6 per cent higher.

On the negative side, manufacturing indicators are suggesting a slowdown in activity would may well be a sign that an improvement in supply is keeping up with outsized demand.

The highlight, however, was the Chinese technology and related sectors with the likes of Alibaba (NYSE: BABA), Pinduoduo (NYSE: PDD) and DiDi Global (NYSE: DIDI) all gaining after the Chinese Government indicated that would be willing to release the full audit reports of Chinese companies to US regulators in an effort to ensure they remain listed on US exchanges.

Yield curve says recession, property prices fall, quarterly performance results

The yield curve, which charts the current available interest rates on government bonds ranging from the very short-term to 30 years this week inverted for a short period of time.

Traditionally, an upward sloping curve suggests a strong outlook for the economy and the likelihood of higher interest rates, with the inversion suggesting the opposite.

In fact, many experts believe it highlights the impending risk of recession. Either way, it is another unique event that only contributes to the growing uncertainty.

One of the asset classes most connected to interest rates is property, particularly in Australia which relies heavily on variable rate mortgages.

The month saw price falls, albeit only tiny, in Australia and Sydney as the availability of credit and a surge in supply hit the market.

The strong link between mortgages and the cash rate suggests the RBA will remain much slower to raise rates than the US Federal Reserve.

March 2022 was a rare quarter in which the Australian sharemarket easily outperformed the US.

The Dow Jones fell 4.6 per cent, S&P500 4.9 and the Nasdaq 9.1 per cent with the latter representing some US$2 trillion in lost value.

Australia was significantly stronger, with the market slightly positive at 0.7 per cent driven by a 25 per cent jump in the energy sector and 12 per cent in utilities and materials once again showing how different our market can be.