Strong reports overcome Russia concerns, IT, comms send market higher, Woolies cuts dividend

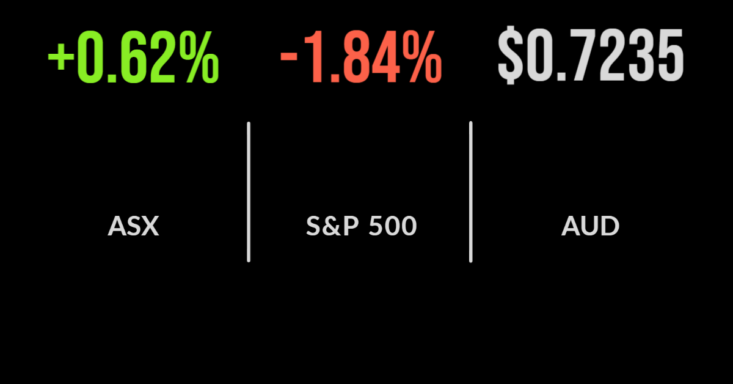

The Australian market overcame increasingly weak global sentiment to post a gain of 0.6 per cent on Wednesday.

Whilst the events in Ukraine and associated impacts on the price of energy remain a major concern, another bumper day for reporting season pushed the market higher, with the technology and communication sectors faring best.

WiseTech (ASX: WTC) was a major highlight, gaining 4 per cent after the company declared the biggest dividend on record.

This was triggered by another 18 per cent jump in revenue and an associated 74 per cent improvement in profit after the company hiked pricing of their key tracking products.

Woolworths (ASX: WOW) delivered its first post Endeavour report which saw an unexpected 8 per cent improvement in sales, to $31.9 billion, but an 11 per cent fall in their profit margin.

The Omicron outbreak was the key influence, driving higher demand but also sending staffing and labour costs higher whilst putting pressure on the supply of key items.

The dividend was cut, albeit only slightly to 39 cents, down from 40 per cent when the impact of Endeavour Drinks was included.

Profit tripled but was skewed by a circa $6 billion sales of the Dan Murphy’s owners; shares gained 1.4 per cent.

Wage growth below RBA target, Domino’s warning, Accent sales struggle

Concerns about Australia seeing a similar surge in wage inflation like the US were allayed today, with the annual rate for 2021 coming in at just 2.3 per cent and likely skewed by late year bonuses or job changes.

The quarterly increase was 0.7, both in line with consensus, but unlikely to be enough to force the RBA’s hand as many are predicting.

Shares in Dominos (ASX: DMP) fell heavily, finishing down 14 per cent after management warned about the more challenging trading conditions ahead.

The company confirmed that the first six weeks of trading in 2022 are just 6 per cent ahead of the previous year, with same-store sales growth of just 1.7 per cent.

Analysts were clearly concerned about this, and the ability to maintain any growth in the year ahead with just 23 new store openings.

Revenue increased 10 per cent, with the company seeking to pass on inflation in both labour and food inputs by bundling up multiple offers to customers.

Shares in footwear retailer Accent (ASX: AX1) gained 7.8 per cent despite the company delivering a 72 per cent fall in profit to just $14 million and decline to provide any guidance for FY22.

Sales increased 12 per cent in the half-year despite significant store closures impacting foot traffic to their stores.

Same-store sales in the first eight weeks of the second half are already down double digits on strong 2021 comparables.

Russia sends S&P500 into correction, Lowe’s smashes expectations

The S&P500 has officially entered its first ‘technical’ correction, or 10 per cent fall, in close to two years as sanctions against Russia and growing uncertainty continue to bite.

After Putin sent troops over the border, the US and most major governments announced a wide range of travel, business and capital sanctions aimed at placing pressure on both Russia and its most powerful allies to reverse course.

The local market and currency continue to weaken, with the Nord Stream 2 pipeline a major focus and likely cause for diversification away from Russian gas in the future.

The Dow Jones fell 1.4 per cent, the S&P500 1.8 and the Nasdaq 2.6 per cent, with DIY and home improvement store Lowe’s (NYSE: LOW) the key report of note, gaining 0.3 per cent after reporting a 30 per cent increase in profit.

The company is benefitting from a similar theme as Bunnings in Australia, with sales growing 4.8 per cent as locked down consumers turned to improve their homes.